Traders bet prices rebound

Data shows that Bitcoin option 25 Delta Skew sees a bullish flip, suggesting that traders may expect price discounts.

Bitcoin Option 25 Delta skew indicates traders are positioning

As the Analytics Corporate Glass Festival points out in a new post on X, Delta Skew recently observed a reversal of Bitcoin to the positive level. “25 Delta Skew” is an indicator related to the BTC options market, basically telling us the sentiment that exists in traders.

This indicator is done by comparing the implied volatility (IV) of bearish positions (PUTS) and bullish positions (calls). Here, IV is a measure of how traders can fluctuate their assets in the future.

The 25 delta skews specifically compare expectations for securities and telephone, i.e. the delta is 25. That is, the price change of the option contract for every 1 dollar change in the BTC spot value is USD 0.25.

Naturally, for stands, the change is the opposite of the price, as these positions bet on bearish results. This means that whenever BTC drops by $1, their price rises by $0.25. On the other hand, the increase/decrease of $0.25 occurs as the price of the spot value of the call’s asset increases/decreases by $1.

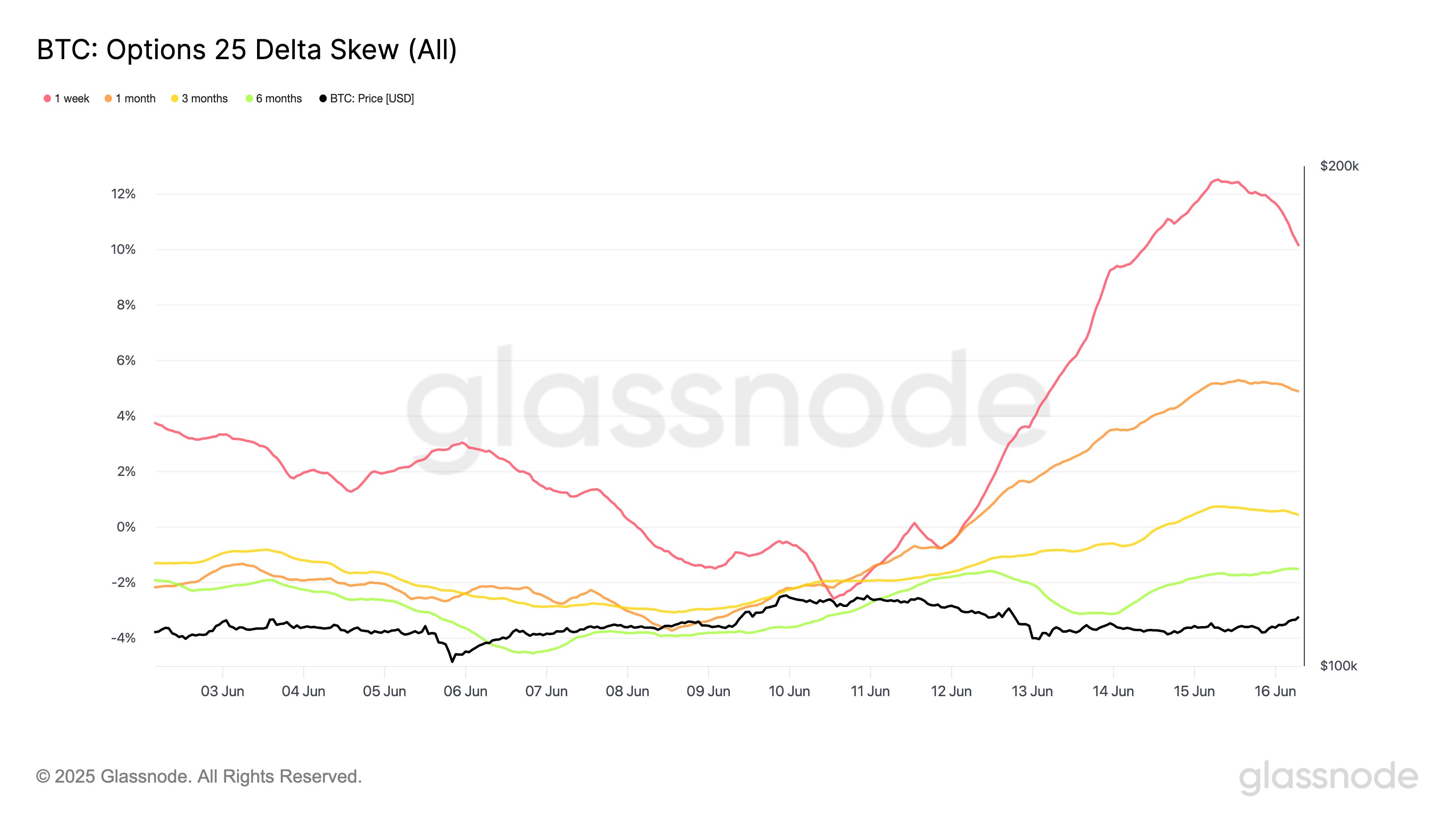

Now, here is a chart showing the trend of Bitcoin Option 25 biasing the Delta, with several different expiration deadlines over the past few weeks:

The value of the metric appears to have gone up on all of these expiration timeframes in recent days | Source: Glassnode on X

As shown in the above chart, the Bitcoin Option 25 Delta skew is below the 0% score of all these expirations earlier this month. However, in the past week, the market seems to have had a flip, with the measurement climbs reaching positive value for everyone.

This trend is particularly prominent in short-term contracts. Jobs that expire within a week have seen the metric increase from -2.6% to +10.1%. Similarly, those who expire within one month observed a reversal from -2.2% to +4.9%.

According to trends, analysts noted: “Traders are actively positioning for recent upwards or volatility.” This view of the call option market has arrived when Bitcoin faces some bearish price action. Now, it remains to be seen whether the bullish market confidence will pay off.

In some other news, the strategy has completed another Bitcoin purchase, as Chairman Michael Saylor shared in X’s post. The acquisition involved 10,100 tokens and the company lost about $1.05 billion. The company now has a total of 592,100 BTC with a cost base of $41.84 billion.

BTC price

Over the past day, the price of Bitcoin has recovered a small amount as its price has recovered to $106,600.

The trend in the BTC price over the past five days | Source: BTCUSDT on TradingView

Dall-E, Featured Images of GlassNode.com, Charts of TradingView.com

Editing process For Bitcoin experts, focus on thorough research, accurate and impartial content. We adhere to strict procurement standards and each page is diligently evaluated by our top technical experts and experienced editorial team. This process ensures the integrity, relevance and value of our content to our readers.