After 42 days of flat movement, Dogecoin Stalls: Crash is coming?

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

Morbi Pretium Leo et nisl aliquam Mollis. quisque arcu lorem, super quisque nec, ullamcorper eu odio.

esteartículo También Estádandousible enespañol.

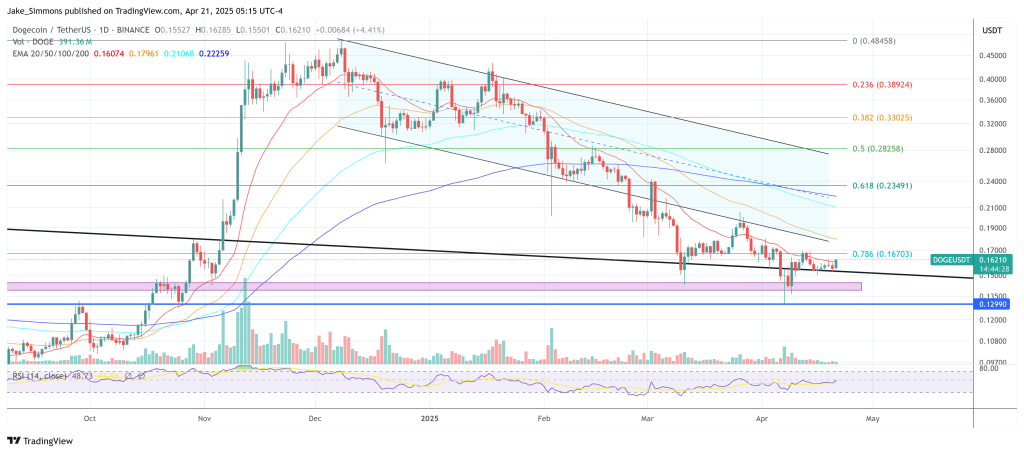

Dogecoin’s chart has become what Kevin, an independent market analyst for nearly a month and a half, said “literally doing nothing.” The senior technician said on the radio on X that the member’s final decisive move was a sharp sales more than six weeks ago. Price has since compressed into a narrow band, threatening to lose structural support that it retracted in late March.

Dogs still have weak momentum

Kevin has been monitoring the same level of “weeks”. The upper limit of the range is a racing breakout retest at around $0.156, while the Fibonacci retracement of the key is lower than $0.138, which he has been repeatedly described as “in the sand.” At that level, only one candle is below that level per week, and it will convince him that the rally that began at the end of 2023 has completely collapsed. “If Dogecoin shuts down $0.138 per week, that may have been over,” he warned.

The momentum signal does not provide early confirmation in either way. Kevin opposes social media when commenting on the highly-watched 3-day MACD, claiming that the bullish cross is already in play. “People don’t know how to read this metric correctly,” he said. “Technically, yes, by definition, it’s a cross, but it’s not a cross in reality.” […] You have to expand the moving average to confirm the cross. “He warned that without such an expansion, the freshly-started rise in the histogram could “turn over easily.”

As spot price inertia is now extended to 42 days, risk rewards are also compressed. Kevin forms the decision tree in a clear way: holding $0.156–$0.138 congestion and Dogecoin maintains its constructive mid-term structure; losing it, traders must look at the psychological $0.10 shelf. Even there, he only saw the possibility of a counter-trend bounce to $0.25-0.26.

Related Readings

The broader market background has hardly been immediately alleviated. Kevin uses Bitcoin as the main indicator to remind the audience that the entire complex is still in what he calls the “main correction phase”, which was triggered when the three-day MACD crosses over in January 2025. Historical research on Bitcoin’s macro-reclinics shows that they persist anywhere from 114 to 174 days. ”

“No matter what the economic situation is [days]. Every time it’s a bear market [or] Bull market. Bad news, good news doesn’t matter. They always last the same time. 174 days is the longest time in history, and 114 days is the average of every correct major correction period in history. ” Kevin explained.

Related Readings

He believes that if Bitcoin cannot defend $70,000, the chance of a brand new high point will be low in the short term. “If Bitcoin breaks $70,000 and goes $60,000, we’ll get a huge rebound from there. You’ll get a huge anti-reverse transcription rally. Everything will look rosy again. But it’s possible to make the new height very slim. So is Dogco Coin. Turn over and that’s the end,” Kevin said.

Therefore, for Dogecoin, the next decisive signal could be a difficult interruption of the momentum revival of the 0.156-$0.138 corridor or confirmed higher time MACD. Until then, the assets were still trapped by Kevin’s words, “We did nothing… nothing to talk about.”

At press time, Doge’s trading price was $0.1621.

Featured Images created with dall.e, Charts for TradingView.com