3 Ways to Shelve PayPal Payment

- If you have received a payment for products, services, or any other deliverable, it is important that tracking information or shipment details be added to PayPal’s order.

- If the buyer makes a refund or return request, PayPal will put your payment on hold until the dispute is resolved.

- If you have recently made large payments or transactions in a short period of time or the number of transactions is unusually fast, your PayPal funds can be put on hold due to suspicious activity.

When you receive PayPal payment, you may feel frustrated just to put it aside. Whether you are a freelancer, a small business owner, or just dealing with personal transactions, locking your funds quickly affects your day-to-day work. Thankfully, this is just a temporary ic in most cases and there are a variety of solutions that can be used to speed up. In this guide, we will discuss three simple and effective ways to put PayPal payments on hold so that you can move again.

Why do I hold my PayPal payment?

Before entering the solution, it’s nice to know why PayPal put some payments on hold. Usually, this is not a malfunction, but part of the PayPal security system that protects both buyers and sellers. Here are some common reasons why your funds may be stuck:

- New Account: If you recently opened a PayPal account, your payment may be put on hold because you don’t have a consistent history. Usually, this is not a major issue and you can expect your funds to be released within 1-2 weeks.

- Inactivity to PayPal: If you haven’t used the platform for a while, it may take PayPal to transfer funds to your bank account.

- High-risk transactions: If your PayPal account suddenly peaks in transaction volumes or unusual high volume transfers or high price transfers, this will be marked as suspicious activity.

- Refund or dispute: If the buyer makes a refund or return request, PayPal will put your payment on hold until the dispute is resolved.

PayPal can keep your payments for up to 21 days, after which funds are released in most cases. However, in some cases, the delay may be longer. Here are some fixes for the same:

1. Add tracking information and update your order

If you have received a payment for products, services, or any other deliverable, it is important that tracking information or shipment details be added to PayPal’s order. If there is no tracking information, the platform can hold your payment. You can add the necessary details:

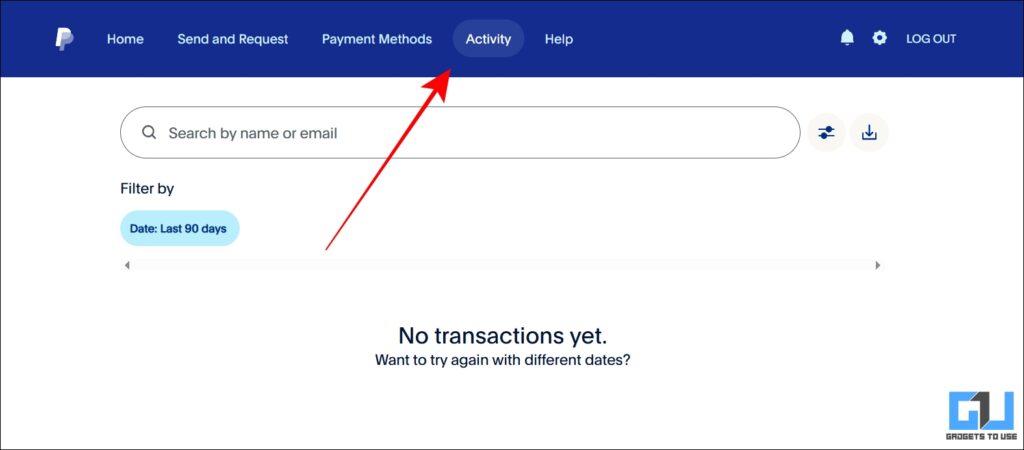

1. Open your PayPal account and go to Activity.

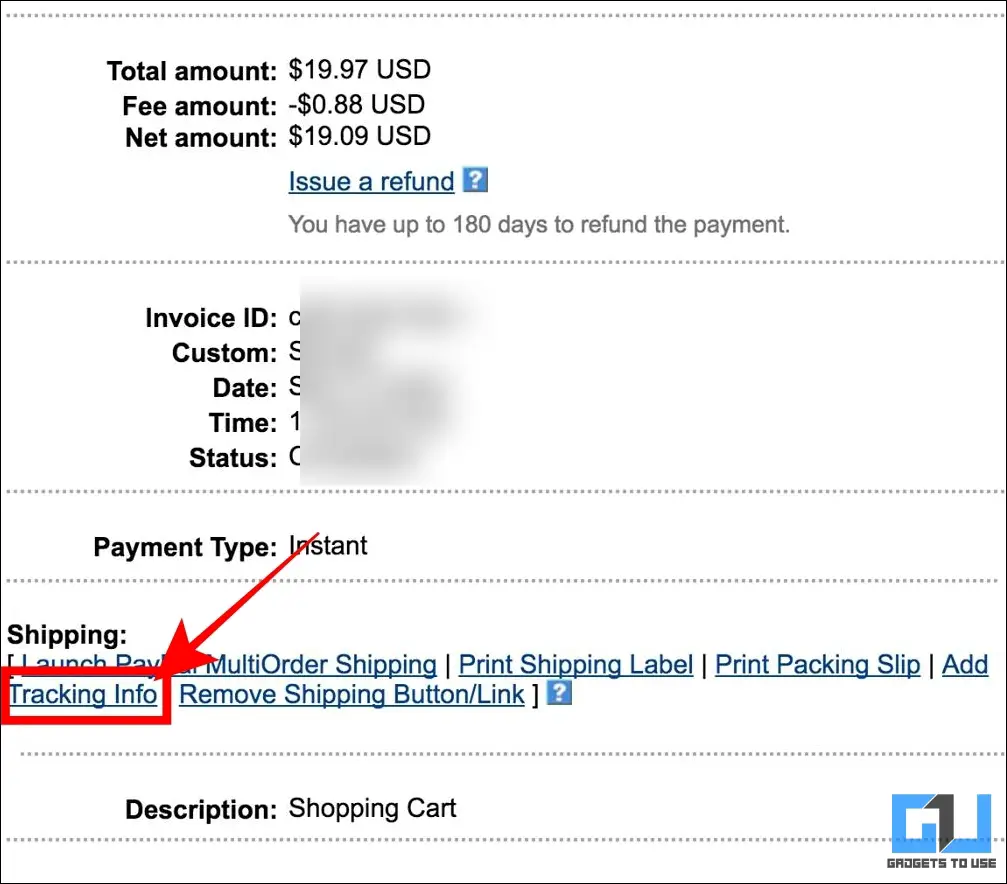

2. Find the stuck order. Make sure to update the order details to “Product” if it is a physical project, or change it to “Service or Virtual Product”.

3. choose Add tracking information Options and provide shipping details or shipping labels.

4. Save changes and update orders.

Once the correct details have been added, your payment should be posted by PayPal within 24-48 hours.

2. Check the account or policy flag

PayPal can sometimes put your funds on hold to resolve account-related issues rather than personal order issues. This can happen due to the following reasons:

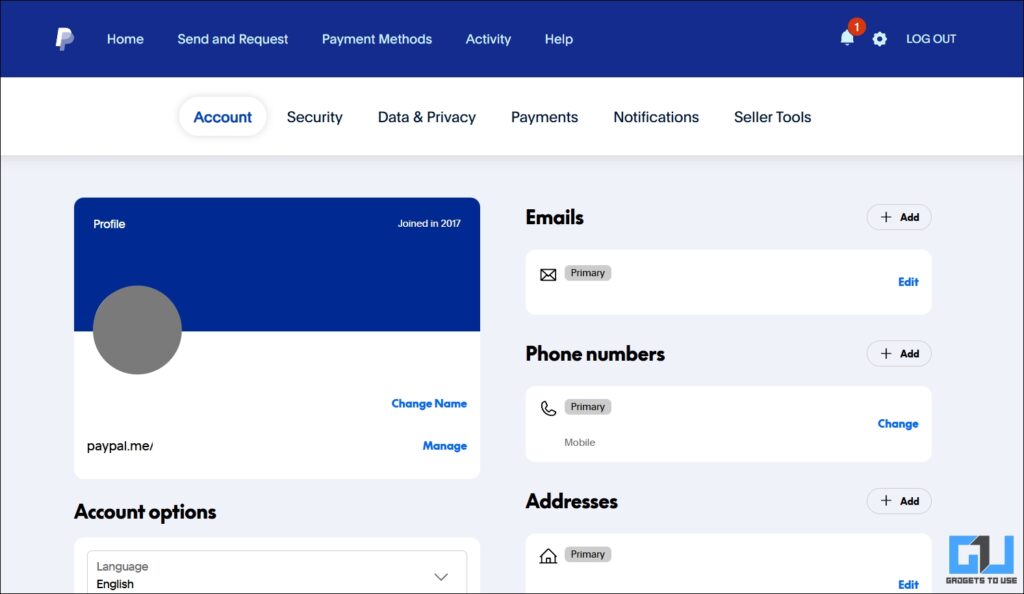

- Unverified Account: If you have not verified emails, phone numbers, bank accounts, and other details on PayPal, you can put your account on hold for manual review.

- Active disputes or claims: If a buyer makes a dispute or claims for your service order, PayPal will put your funds on hold until the issue is resolved. So check if your order is positively controversial.

- Sudden large capacity activity: If you have recently made large payments or transactions in a short period of time or the number of transactions is unusually fast, your PayPal funds can be put on hold due to suspicious activity.

In each case, you should first manually check what steps you need to take to resolve the problem in the end of your PayPal account. If the problem persists, it is best to collect all the evidence and contact PayPal customer service.

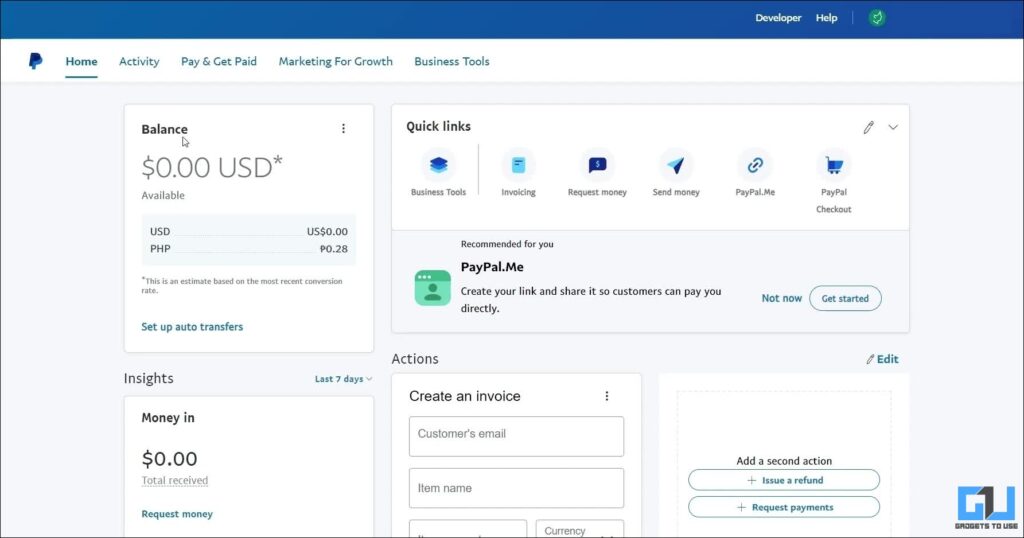

3. Maintain a good seller history

If you’re new to PayPal, or if you don’t have a long history of using the platform, the app can put your funds on hold until a reliable history is established. This is done to prevent scammers from quickly creating new PayPal accounts for financial fraud.

Assuming you are a real seller and an individual, there are some tips you should consider and you should consider building a reliable PayPal profile:

- All orders are fulfilled on time.

- Engage active communication with the buyer and provide all necessary details about order updates.

- Avoid unnecessary refund requests.

- If the buyer creates a refund request, try to resolve the dispute. Do not delay processing of refunds in real circumstances.

Although these things are easy to say, they are common challenges faced by small businesses and even freelancers. By taking these small precautions, it is ensured that they can maintain the sheer convenience of their PayPal account.

FAQ

Q: How long will PayPal payment be put on hold?

PayPal can be shelved for up to 21 days. After this time period, the platform accelerates payments to your bank account and helps you resolve pending errors or disputes.

Q: Can I call Paypal to get my money?

Yes, you can contact PayPal directly via its official email or support number and try to find out why the funds are being put on hold. However, we recommend checking the account status first, as this is what the platform recommends you to do before starting to help.

Summarize

A stuck payment is a setback for anyone. However, these are important security measures for the financial security of both buyers and sellers. As long as you are still real and don’t try to take advantage of the system, PayPal is still a seamless solution to accepting payments with proper authentication.

You may also want to read:

You can also follow us for instant tech news Google News Or comments about tips and tricks, smartphones and gadgets, please join Gadgetstouse Telegram Groupor subscribe Gadgetstouse YouTube Channel About the latest review video.

Was this article helpful?

YesNo