Bitcoin surpasses the recent buyers’ realization price – is the rally coming or double-decker?

Recent positive price action has pushed Bitcoin (BTC) to exceed the $91,000 price achieved by short-term holders. This development has prompted some crypto analysts to question whether BTC’s new strength is sustainable or just a bull trap before a major pullback.

Is Bitcoin about to rally, or will it double-top it?

U.S. President Donald Trump said tariffs on China would “much lower than the proposed 145% and could increase risky assets. Both stocks and crypto markets have responded positively, with BTC up 5.6% over the past 24 hours.

Bitcoin is currently trading for the first time since March at a price of $90,000, updating a rally that would like to be extended, which could push it up $100,000. However, crypto contributor Avocado_onchain urges caution.

In a recent crypto-fast post, the chain analyst provided insights into the behavior of the 1-3-month holder queue. The group usually enters the market during the bullish phase and tends to maintain its BTC with price corrections.

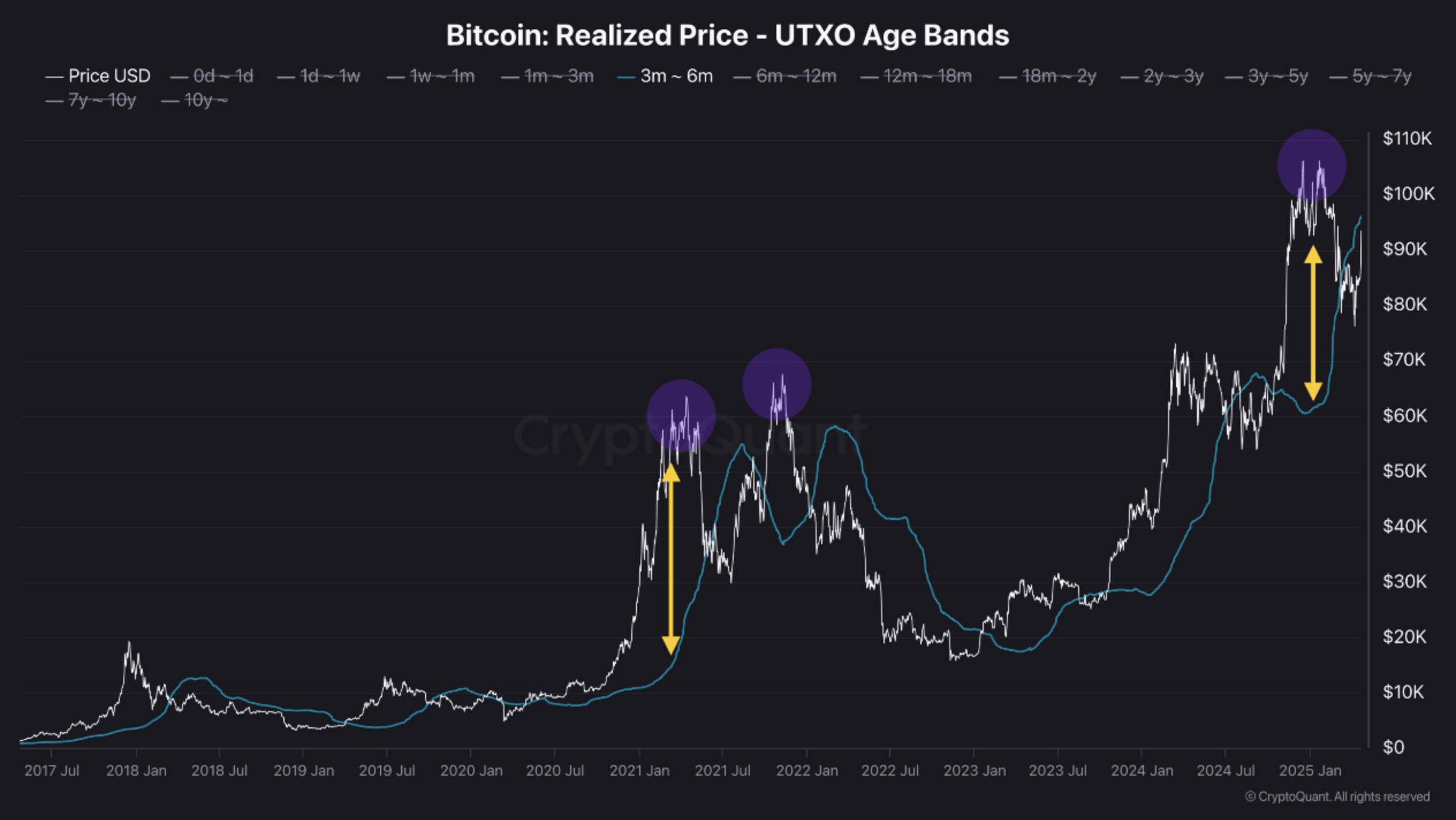

Analysts shared the following charts showing how these short-term participants often transition to a 3-6-month holding category (highlighted by yellow arrows). Instead, during strong gatherings (emphasized with green arrows), the group tends to profit by selling to new market entrants.

As the market approaches the final stage of the rally (highlighted in red circles), this queue usually grows significantly. When gradually starting, these short-term holders usually exit the market as the price approaches the cost basis of its realization.

Avocado_onchain also shared another chart showing how previous BTC peaks always exceed the average realized price for holders for 1-3 months.

Additionally, analysts warn that the current market cycle may reflect the double-story high-rise witnessed in 2021.

When Bitcoin hit its all-time high of $109,000 in January 2025, it significantly surpassed the price level of this implementation, suggesting that it could be the first top in a potential double-layer high-rise group. So it might be wise to take a more cautious approach to the current holder than to chase the rally.

Macro headwinds could derail BTC momentum

Analysts further warn that limited market liquidity and macroeconomic factors, such as the U.S.-China tariff tensions, could seriously affect risky assets such as BTC. That is, market sentiment may shift rapidly, and the entry of fresh liquidity may reignite a full-scale bull market.

Meanwhile, crypto analyst Xanrox recently warned that BTC breaking through the fallen wedge pattern could be a whale-driven trap designed to attract retail investors before landing. At press time, Bitcoin was trading at $93,754, up 5.6% in the past 24 hours.