Bitcoin retracts key levels – new ATHS may be closer than expected

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

Morbi Pretium Leo et nisl aliquam Mollis. quisque arcu lorem, super quisque nec, ullamcorper eu odio.

esteartículo También Estádandousible enespañol.

Bitcoin is trading above $90,000 and shows signs of re-strength, even as global tensions and macroeconomic uncertainty continue to stress investor sentiment. The leading cryptocurrency appears to be stabilizing after weeks of volatile volatility and bearish pressure, which some analysts believe could mark the beginning of a wider rally in the coming months.

Related Readings

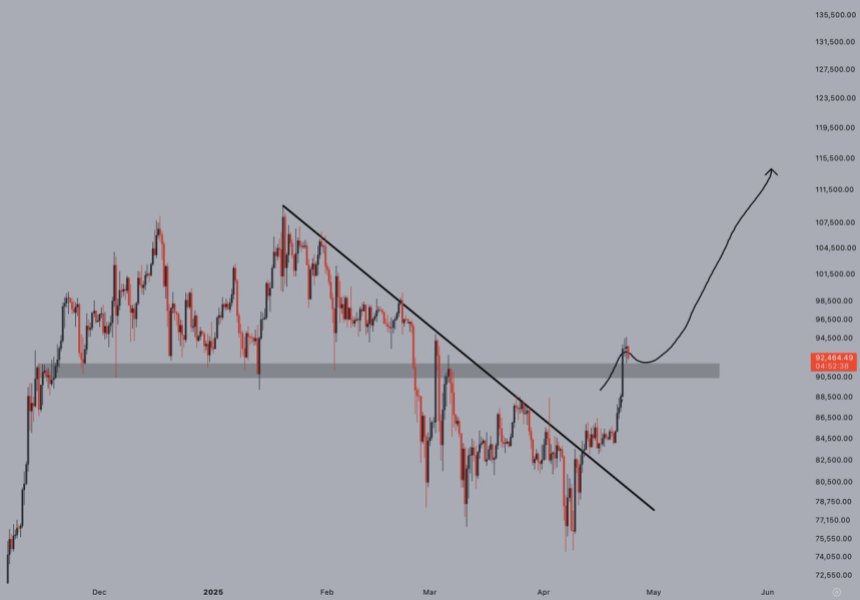

Top crypto analyst Jelle shared insights, accompanied by a price chart, highlighting a key technology development: Bitcoin has retracted its range lows and has maintained its range all the time. This type of price action often marks a healthy merger and growing buyer confidence.

Despite the continued focus on the trade war and interest rate uncertainty, Bitcoin’s resilience offers investors hope. If momentum continues to build, maintaining the current range may move towards a new all-time high. While caution remains due to external risks, many view the current setting as a potential bullish turning point that could shape the next major area of the cryptocurrency market.

Bitcoin recycling range lows, sentiment turns bullish

Bitcoin is now at a critical level after a sentiment shift that was almost overnight with a sharp market impulse shifting. For months, BTC has been in a downward trend that began in January, frustrating the Bulls and leading to calls for deeper corrections. But with the recent surge pushing BTC above $90,000, many analysts believe that this trend may eventually turn around.

But caution still dominates the wider landscape. Global uncertainty is driven by escalating trade tensions between the United States and China and unpredictable macroeconomic signals, which continue to put investor confidence in confidence. Single negative developments, such as hawkish central banks’ policies or geopolitical instability, may reintegrate the market into risk models.

Still, optimism is recovering, especially among technical analysts. Jelle shared an update that highlights Bitcoin’s retraction of range lows and holding them. “It’s what you want to see that is really bullish,” he noted, stressing that the power behind a shallow pullback is usually before further continuation.

This situation shows that the time for easy competition is behind us. If this momentum holds true, Bitcoin may be earlier than many people expected. The breakthrough has rekindled hope for the Big Bulls running, but the next few days will be key to confirming whether the move is sustainable or another brief rally.

Related Readings

BTC sells for more than $90K after retrieving the key moving average

Bitcoin traded at $92,500 after a strong relocation above the psychological $90K level, confirming bullish momentum in the short term. The breakthrough also marks a decisive close-up of over 200 Ma and Ema, both of which have been stiff resistance since January. Retrieving these technology-level signals marks a potential shift in trends after months of sales pressure and lateral action.

With the Bulls now in control, the focus shifted to the $100,000 mark, the area not only has a psychological weight, but can also serve as the next key resistance in the rally. Drivers above this level may attract new buyers and confirm a wider breakthrough, thus laying the foundation for potential historically high running.

Related Readings

But caution still needs to be taken. If Bitcoin fails to maintain momentum and drops below $88,500, it may trigger an even larger correction in the merger phase. The $88.5K region (now the main support) must stick to preserving the bullish structure. As Bitcoin hovers around these key levels, the next step may define the short-term direction of BTC and the broader crypto market.

Featured images from DALL-E, charts from TradingView