Bitcoin rally lacks chain-chain support – analysts warn of disappearing network activity

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

Morbi Pretium Leo et nisl aliquam Mollis. quisque arcu lorem, super quisque nec, ullamcorper eu odio.

esteartículo También Estádandousible enespañol.

Bitcoin has recovered $90,000, exerting new optimism across the cryptocurrency market. With emotional shifts and bullish calls returning, many investors are looking at six figures again. But not everything is like it is under the surface. Despite the impressive price increase, there are risks, especially as global tensions escalate between the United States and China. Ongoing trade wars and geopolitical frictions are injecting volatility into the market, creating a fragile backdrop for risky assets like Bitcoin.

Related Readings

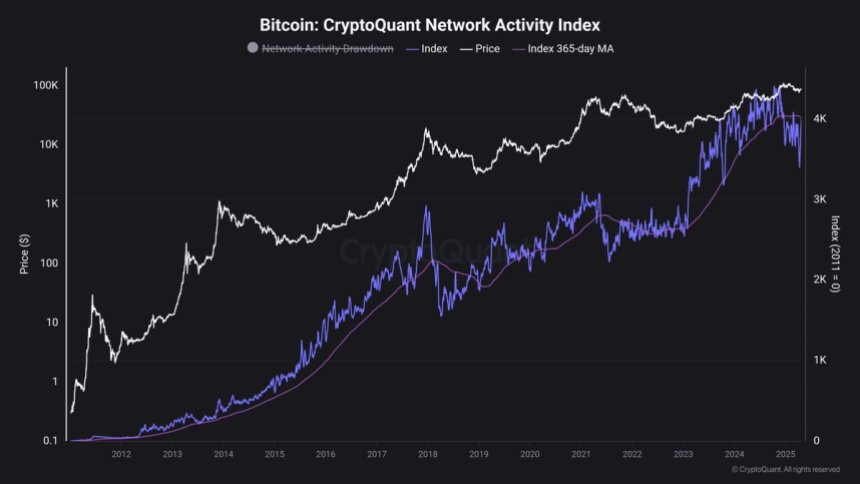

Top analyst Maartunn shares a sharp view of the current state of the Bitcoin network, revealing on-chain metrics that draw different images. According to his analysis, the higher latest moves are driven primarily by leverage and derivatives rather than strong organic demand. He noted that in his words, the Bitcoin network is a “ghost town” with little new activity or visible inflows from real users.

This disconnect between price and chain fundamentals suggests that current gatherings may lack sustainability. Therefore, investors should be cautious about the next phase of Bitcoin’s price action, especially if macroeconomic conditions worsen or derivative positions begin to relax.

Bitcoin faces resistance: Chain activity lags

Bitcoin now faces key resistance as the Bulls try to recoup the $95,000 level, and the region can define short-term momentum. The recent breakthrough in resistance of more than $88,600 marks a key shift in market sentiment, with the Bulls taking control and pushing price action to new ranges. However, to maintain this momentum, sustained demand will be essential. Analysts warn that a healthy backtrack may occur before the next area, especially given the current market conditions.

Volatility and uncertainty continue to dominate the landscape, and fear lingers despite the recent rally. Much of this prudence has stemmed from ongoing global tensions and an unstable macro environment since U.S. President Donald Trump was re-election in November 2024. With rising trade talks with China and growing tensions in trade talks, investors remain hesitant and therefore still hesitant.

Top analyst Maartunn shared a sober chain analysis on X that highlights the disconnect between Bitcoin’s price action and network activity. According to his findings, the recent surge was driven primarily by increased ETF liquidity and an increase in open interest in derivatives markets, which are often factors before reversal rather than sustainable rally. Maartunn describes the current state of the Bitcoin network as a “ghost town”, pointing to the lack of new visible chain requirements.

This difference between price and network fundamentals raises questions about the sustainability of current migrations. To make Bitcoin convincingly push $95,000 higher and set it to $100,000, stronger spot demand and rising actual user activity may be required. Until then, traders should be cautious and pay close attention to key levels of support.

Related Readings

Price action details: $95,000

After several days of bullish price action, Bitcoin was trading at $93,600, seeing a key resistance level. Price has now entered the $93,000 merger phase as the Bulls prepare for a potential breakthrough of $95,000. Continuous movement beyond the mark will open the door to push towards the highly anticipated $1 million milestone, which shows the strength of the entire cryptocurrency market.

However, the path forward is still uncertain. Although short-term sentiment seems optimistic, Bitcoin must maintain support levels above $90K to maintain a bullish structure. Failure to do so could trigger a reduction in price drop to a 200-day moving average of close to 8.8k, a level that has been a key hub for market structure over the past few months.

Related Readings

Traders and long-term holders are watching this area closely, as a breakdown below $90K could undermine the current recovery momentum. As consolidation continues, the next few sessions are crucial in determining whether BTC has sufficient strength to disrupt higher or if there is a short-term correction. Currently, all eyes are reaching $95,000, the next obstacle for Bitcoin to promote market dominance.

Featured images from DALL-E, charts from TradingView