Pro tips for maximizing MSTR returns with Bitcoin market data

Since Michael Saylor and his strategic team (formerly MicroStrategy) first invested in Bitcoin, the company has performed significantly better than Bitcoin itself. With the right data points and strategies, investors can further improve their returns. In this article, we will explore how to use various metrics to improve your MSTR investment.

Key Points

- MSTR has outperformed Bitcoin by more than 3,000% since its first investment.

- Key metrics such as MVRV Z score and active address sentiment can help invest in time.

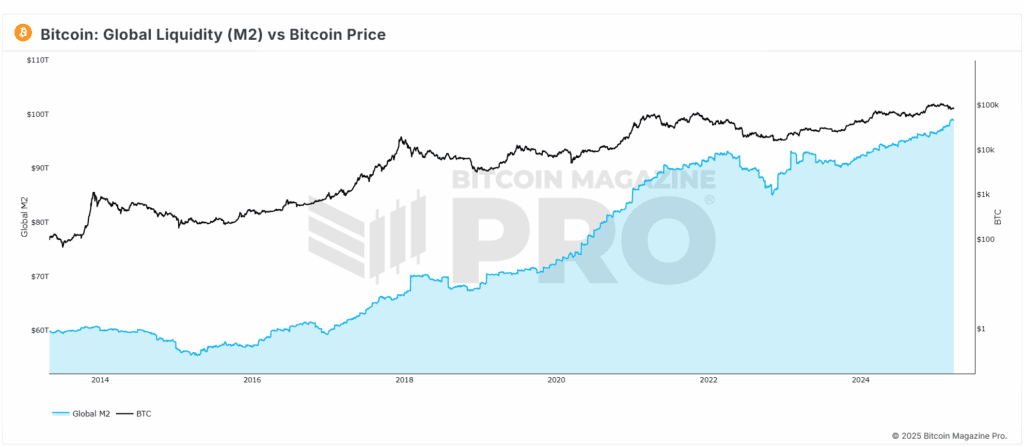

- Global liquidity trends also influence the performance of MSTR.

- Using multiple data points can simplify and enhance investment strategies.

MSTR outperforms Bitcoin

Now renamed as Strategy MicroStrategy has made headlines with Bitcoin investment. Since the company began accumulating Bitcoin, it has earned more than 3,000%, while Bitcoin itself has grown by about 700%. This sharp contrast highlights the potential of investing in companies with large amounts of Bitcoin assets.

Understand the key indicators of MSTR investment

To improve your MSTR investment strategy, various data points must be used. Here are some key indicators to consider:

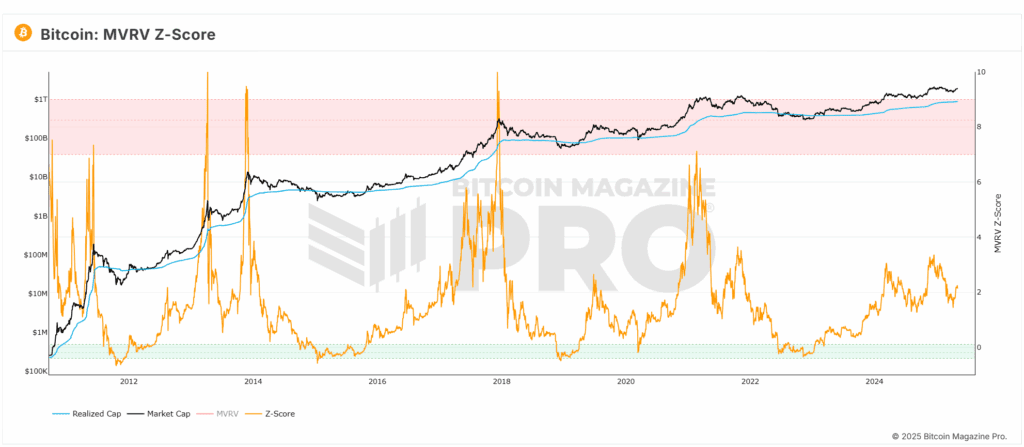

- MVRV z score: This metric helps measure whether Bitcoin is undervalued or overvalued. By analyzing the market value for the achieved cap, investors can determine the best buying and selling points.

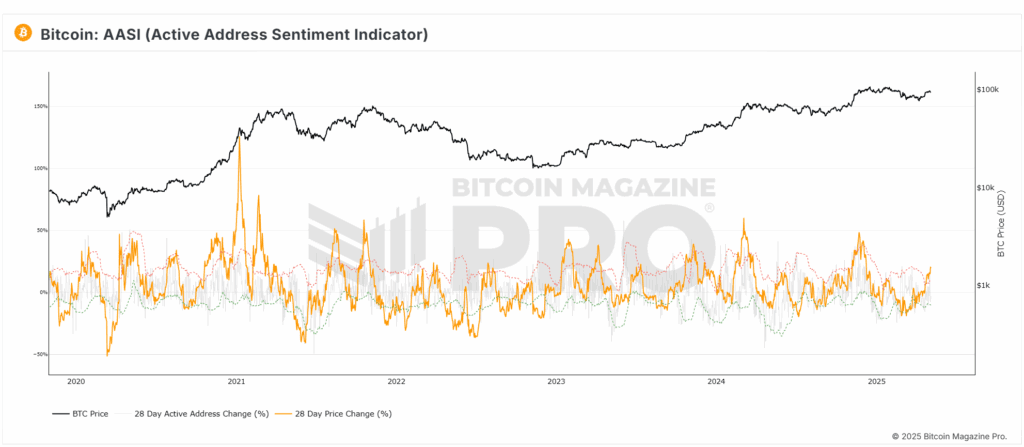

- Active address emotional indicators: This tracks network utilization and user changes, thus providing insights into market sentiment. When the price changes cross certain thresholds, it may issue when profits are made or accumulate more.

- Crosby ratio: This technical indicator helps identify potential market peaks and troughs, allowing better timing of trading.

- Global liquidity: Monitoring global liquidity trends can provide insights into wider market changes that affect MSTR stock prices.

MSTR Investing with MVRV z Score

The MVRV Z score is a powerful tool to evaluate the state of the Bitcoin market. This indicates a good time when the score drops to the green area. Instead, it might be wise to consider selling when it reaches the red zone. Given its close relationship with Bitcoin, this indicator can also be applied to MSTR.

Active address emotional indicators explained

Active address sentiment indicators track percentage changes in network users along with Bitcoin’s price action. When prices change above a certain level, it may indicate that the market is overheated. This may be a signal to lock in profits. Instead, when it goes down, it may be a good time to buy more.

The impact of global liquidity on MST

Global liquidity has a significant correlation with the performance of MSTR. By tracking liquidity trends, investors can expect potential price movements. For example, a 365-day correlation shows a strong link between global liquidity and MSTR, which can be enhanced by adjusting the analysis time frame.

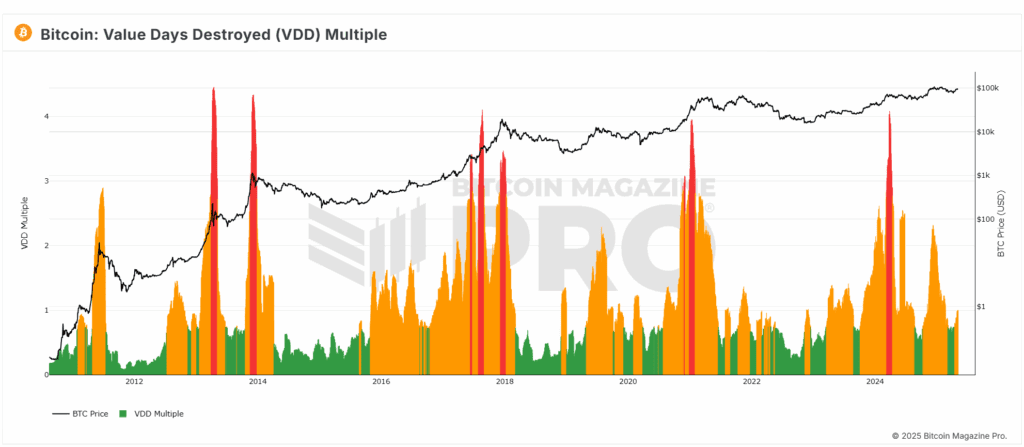

The indicator of the value day being destroyed

This indicator measures the impact of Bitcoin price action on MST. By analyzing the way in which the value day is destroyed related to the price of the MST, investors can determine the best buying and selling opportunities. The indicator has shown to be particularly effective for MST, which is probably due to its leverage on Bitcoin volatility.

Conclusion: Data-driven MSTR strategy

All in all, the close correlation between MSTR and Bitcoin means that many of the same metrics used for Bitcoin investment can also apply to MSTR. By leveraging tools such as MVRV Z scores, active address sentiment indicators, and monitoring global liquidity, investors can enhance their MST’s investment strategy.

As Michael Saylor continues to accumulate Bitcoin, MSTR’s potential for good performance remains high. By focusing on these metrics, you can simplify investment decisions and potentially increase returns.

If you find this information helpful, consider exploring more resources and analytics to learn more about Bitcoin and MST. The right data can make your investment journey different!

For more in-depth research, technical metrics, real-time market alerts, and access to the growing community of analysts, visit Bitcoinmagazinepro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Be sure to do your own research before making any investment decisions.