Bitcoin’s “key” holder moves in the right direction: santiment

Analytics firm Santiment explains how key Bitcoin holders show behavior that may prove to be bullish signals that are assets.

Bitcoin sharks and whales have been full in the past 6 weeks

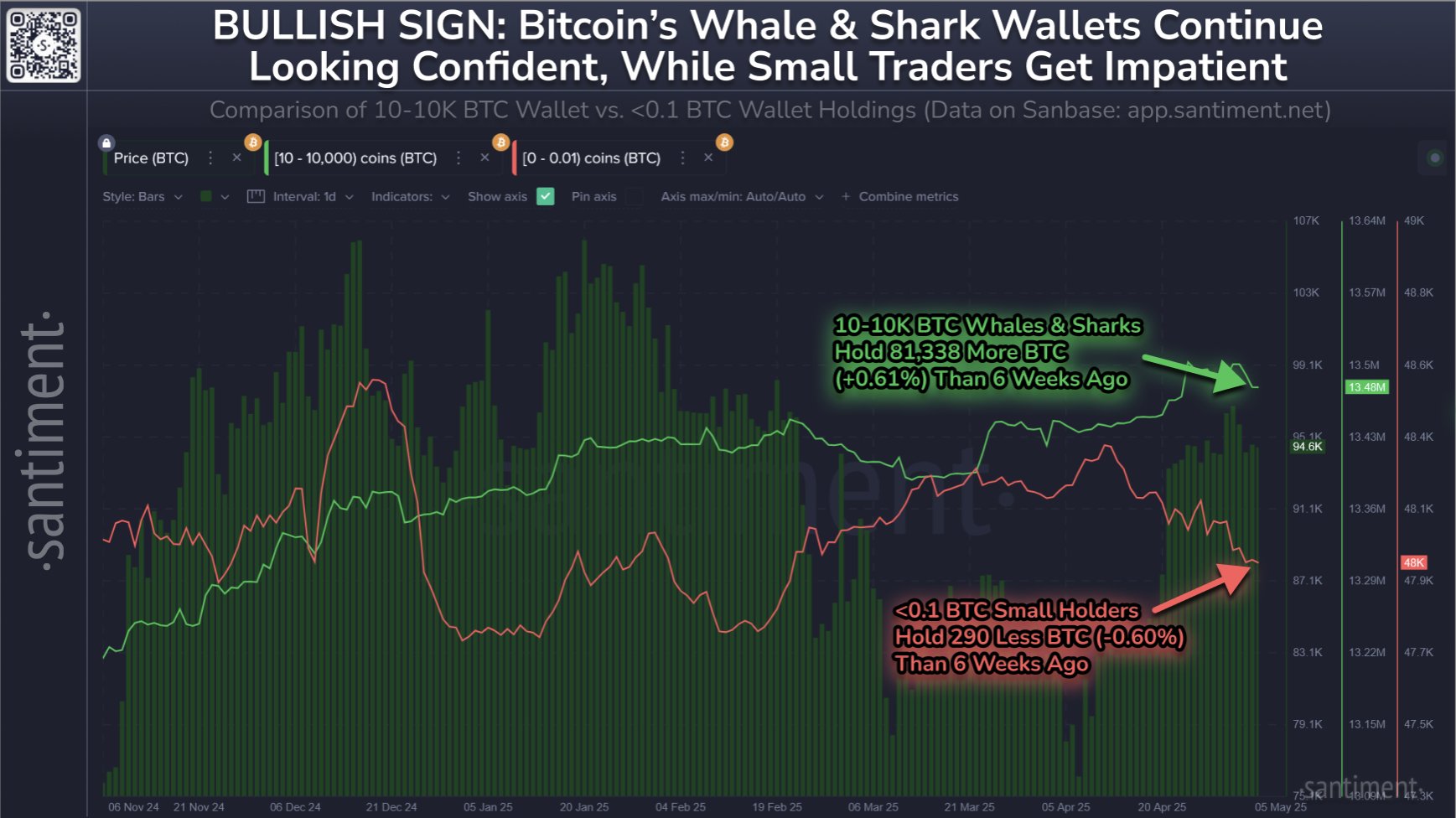

Santiment talks about the latest trends in BTC’s supply in a new post about X. The metric of correlation is “supply distribution”, which tells us the amount of Bitcoin that a given wallet group has as a whole. According to the number of coins they hold in the balance, the address or the investor are divided into these groups. For example, 1 to 10 coin groups include all holders who own assets 1 to 10 tokens.

In the context of the current topic, the range of interest is 10 to 10,000 BTC. At the current exchange rate, its lower limit is converted to around $969,000 and the upper limit is $969 million.

This extensive wallet group includes different parts of the market, including sharks and whales, which are considered important in the ecosystem due to their massive holdings.

Now, here is a graph of the supply distribution shared by companies in this holder range, showing trends in value over the past few months:

Looks like the value of the metric has observed a net increase in recent weeks | Source: Santiment on X

As shown in the above chart, 10 to 10,000 BTC holders have recently seen their supply rise. More specifically, these large investors have added 81,338 BTC to their wallets over the past six weeks.

In the same chart, Santiment also attaches data related to the supply distribution of the smallest BTC investors. It seems that these retail holders have shrunk their shares at the same time as the accumulation frenzy of sharks and whales.

“When big wallets accumulate at the same time with boring retail panic, this is often a strong long-term sign of price,” the analyst firm notes.

Although the major investors in Bitcoin have accumulated long-term trends, there have been different trends in recent perspectives. It is evident from the chart that the balance of the group has dropped in the past few days, suggesting that some of these holders have made profits from the recovery rally.

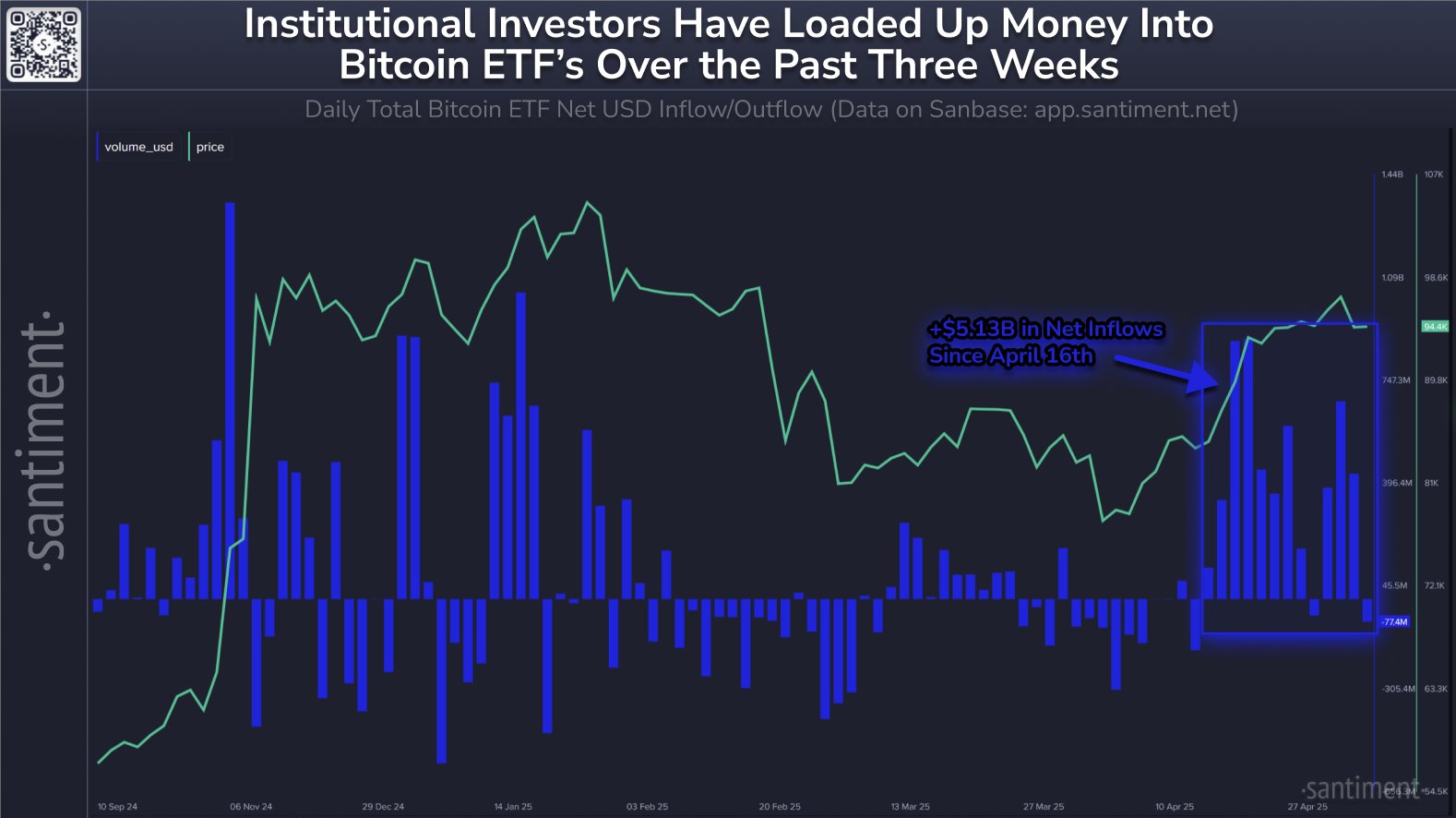

Speaking of accumulation, Bitcoin Spot Exchange Traded Funds (ETFs) have enjoyed a lot of inflows over the past few weeks, as Santiment pointed out in another X post.

The trend in the daily netflow for the BTC spot ETFs during the last few months | Source: Santiment on X

“Since April 16, $5.13B has moved to the pumping market for BTC ETFs,” the analyst firm said.

BTC price

Bitcoin has seen a bullish renewal in the past 24 hours as its price has exceeded the $97,000 level.

The price of the coin seems to have jumped over the past day | Source: BTCUSDT on TradingView

Featured images from dall-e, santiment.net, charts from tradingview.com

Editing process For Bitcoin experts, focus on thorough research, accurate and impartial content. We adhere to strict procurement standards and each page is diligently evaluated by our top technical experts and experienced editorial team. This process ensures the integrity, relevance and value of our content to our readers.