New BIS report says Bitcoin usage rate during economic stress

A new report by the Bank for International Settlement (BIS) shows that Bitcoin and other cryptocurrencies are being used more during times of economic stress. This mainly occurs in countries with high inflation rates and expensive remittances, or governments restrict how much money they can leave the country.

When their financial system stops working properly or is too expensive to use, people turn to Bitcoin and Stablecoins like USDT and USDC. This is especially true for small international payments. When people can’t rely on banks or traditional monetary systems, encryption offers people another option.

Bitcoin becomes a tool in difficult times

The report supports something that many people in the cryptocurrency space already believe (not investment anymore – in some places, it’s a real lifeline. When the value of local funds drops rapidly, or when it’s difficult or too expensive to send money across borders, people turn to Bitcoin to ensure their funds are secure and faster, cheaper and have more control.

The BIS also found that cryptocurrency usage often increases when states try to control how money comes in and out (managed through capital flows). In other words, people use bitcoin and other cryptocurrencies to solve these rules.

Cross-border crypto payments are growing

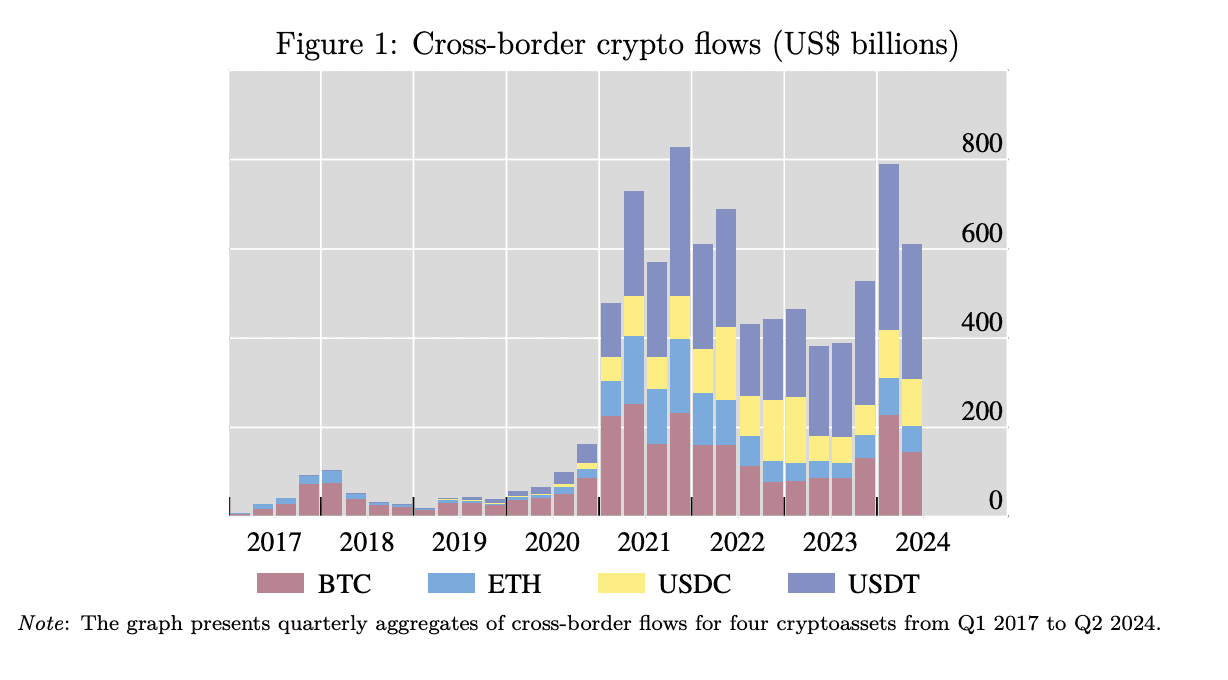

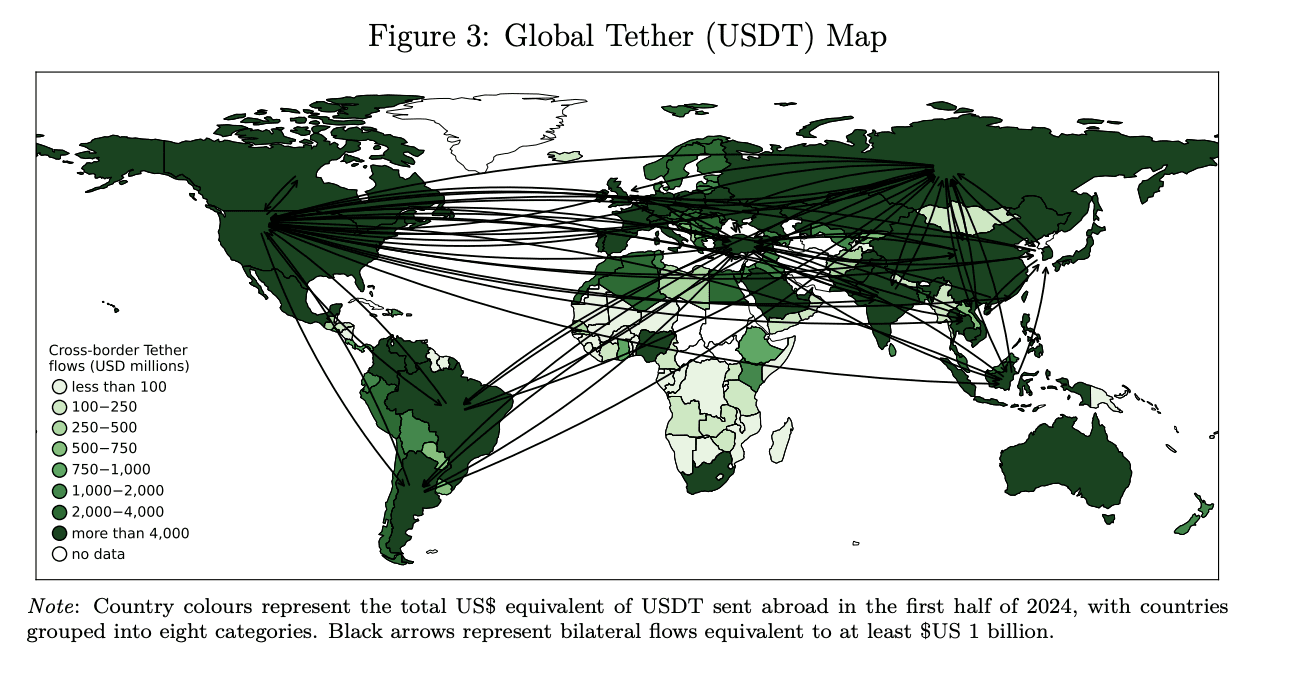

Using data from cryptocurrency exchanges and application usage patterns, BIS-map cross-border transactions of Bitcoin, Ethereum, USDT and USDC from 2017 to mid-2024. Cross-border cryptocurrencies flows soared from $7 billion in the first quarter of 2017 to $800 billion in the fourth quarter of 2021, before falling to $400 billion in 2022 during the decline in the cryptocurrency market. However, by the first quarter of 2024, they rebounded to $600 billion.

At first, Bitcoin accounts for about 80% of these payments. Now, this number is below 25%, and more people are turning to stable people. This shift does not mean that Bitcoin is not very useful, but just shows that people are choosing different tools for different needs.

The use of encryption is about what you need, not where you live

Unlike regular banks, the use of Bitcoin depends not only on where you live or what language you speak. The report says people use it when they need it, not just because it is popular. Similarly, Bitcoin usage increases when global financial stress increases (through things like VIX (Market Fear Index)). This shows that even investors and businesses use cryptocurrencies during uncertain times.