Bitcoin open interest lags despite price action exceeding $100,000 – Analytics advises caution

Bitcoin’s price action has been largely redeemed over the past week, as the Prime Minister’s cryptocurrency has placed its position above $100,000. The recent bullish momentum reflects a healthy growth sentiment among investors.

On Friday, May 15, the price of Bitcoin was as high as $103,800, the highest level since January. However, the latest chain data shows that there is no investor activity in the derivatives market, which usually occurs when the value of BTC reaches this level.

BTC Price Rally is about to hit a barrier?

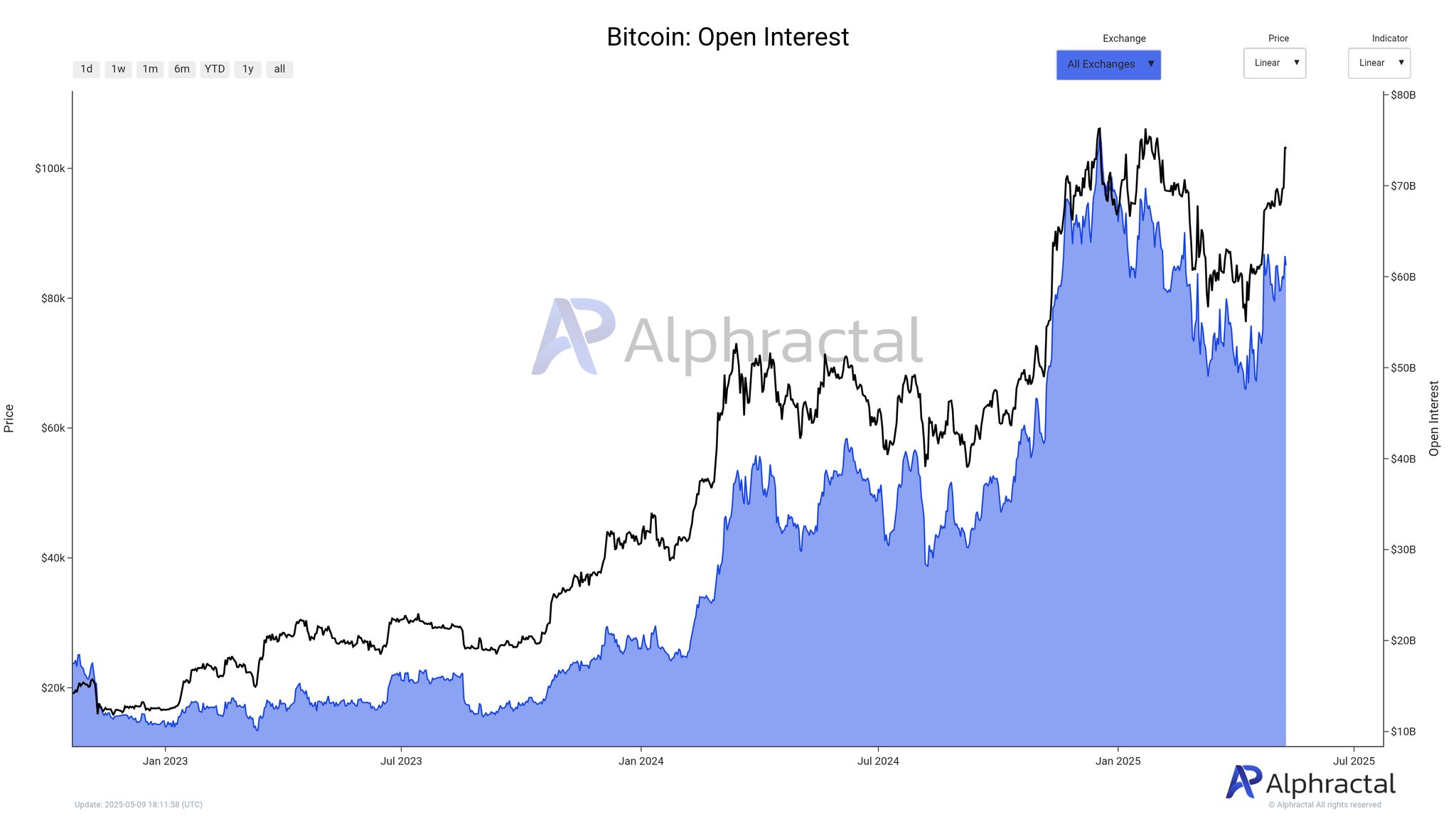

In the latest post on social media platform X, crypto analytics platform Alphractal shares that Open Interest (OI) has not been fully synchronized with Bitcoin prices in the past few days. The open interest metric measures the total amount of money flowing into BTC derivatives at any given time.

The rise in open interest is often considered a bullish signal for major cryptocurrencies, especially since it implies a new influx of capital into the market. Ultimately, this trend shows that it has boosted investor sentiment and stimulated traders’ confidence.

According to Alphractal, the current total OI (valued at approximately $103,000) of Bitcoin is $61.3 billion. BTC last sold for a huge price with public interest of more than $68 billion.

Source: @Alphractal on X

With the current Bitcoin open interest below the last price of OI at $103,000, Alphractal notes that this trend suggests a decrease in leverage and activity in the largest markets of cryptocurrencies. The analysis firm further explained that this phenomenon may be due to recent liquidation waves or location closures.

In a post on X, Alphractal reveals other reasons why flagship cryptocurrency prices may have risks of short-term corrections. Related chain indicators support this bearish projection is whale position sentiment.

Whale position sentiment indicators track direction bias and trading behavior in large holders. It usually reflects the net positioning of whales, its market sentiment, and changes in open position.

Chart showing a decline in the Whale Position Sentiment from 1 to around 0.7 | Source: @Alphractal on X

Alphractal concluded that the decline in whale position sentiment reflects the interest of large investors in ending long-term positions, thus changing market sentiment. If the indicator continues to decline, the on-chain analysis firm infers that it could lead to price stagnation, or worse, corrections.

The price of Bitcoin is clear at a glance

As of this writing, BTC is priced at $103,035, reflecting no significant movement in 24 hours. While recent bullish momentum suggests that investors may exercise caution given recent on-chain observations, investors may exercise caution, but the Prime Minister’s cryptocurrency may reach new all-time highs

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured images from Istock, charts for TradingView

Editing process For Bitcoin experts, focus on thorough research, accurate and impartial content. We adhere to strict procurement standards and each page is diligently evaluated by our top technical experts and experienced editorial team. This process ensures the integrity, relevance and value of our content to our readers.