Bitcoin retail demand rose 3.4% as small investors return to the market

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

Morbi Pretium Leo et nisl aliquam Mollis. quisque arcu lorem, super quisque nec, ullamcorper eu odio.

esteartículo También Estádandousible enespañol.

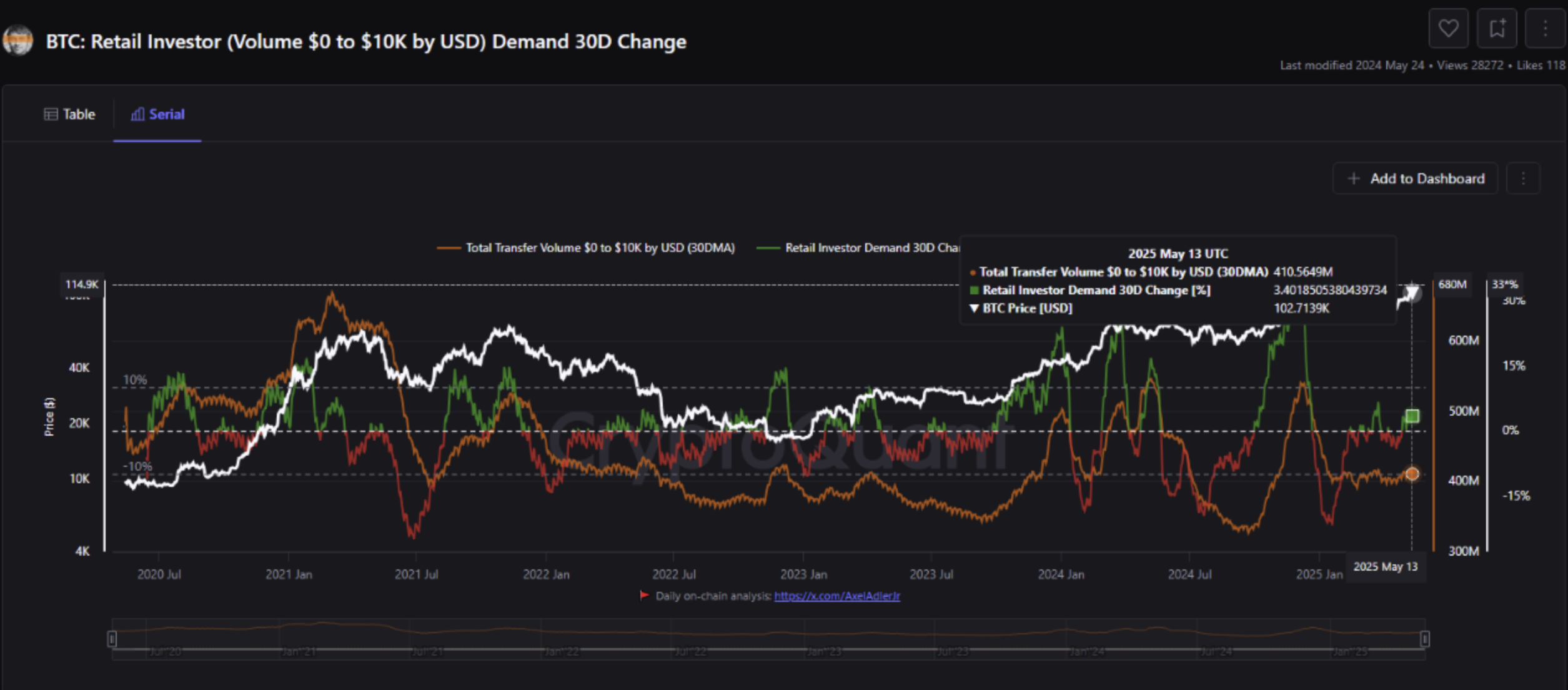

Retail participation in Bitcoin (BTC) market is rising as on-chain data suggests that smaller investors are gradually re-entering the space. This new activity often indicates an increasing confidence in asset confidence and can serve as a catalyst for the next price increase.

Bitcoin witnesses’ retail participation increases

A recent crypto-fast post by retail investor Carmelo Aleman, defined as a wallet holding a BTC worth less than $10,000, is steadily returning to the market. These players are often the most responsive to market movements.

Related Readings

Aleman noted that while retail investors may not always give the market as efficiently as institutional participants, their behavior remains a key barometer of broader market sentiment. As more retail investors join, they tend to create a positive feedback loop that enhances bullish narratives and drives increased buying pressure, which will attract more participants.

BTC: Retail investors’ 30-day change indicators reflect this trend. Since April 28 turned positive, the indicator shows retail purchases increased by 3.4% by May 13, indicating a reappearance of small investor activity.

Aleman added that if Bitcoin maintains its upward momentum, the wider crypto market could benefit as retail investors may start diversifying in search of higher returns. He wrote:

This could benefit the entire cryptocurrency space, as small investors could diversify to other projects, including Defi, Staking, Futures and other tools. All signs suggest that this shift in retail behavior is the beginning of new batch adoption in the cryptocurrency market.

Aleman also emphasizes monitoring metrics on other chains such as active addresses, unresolved transaction output (UTXO) counts, new addresses and transfers, which often increase simultaneously with the growth of retail activity.

Some warning signs from BTC

While encouraging retail benefits rise, some Red flags Caution is recommended. It is worth noting that the recent exchange stable ratio (USD) soared to $5.3 to $104,000 at the Bitcoin rally. This suggests that BTC reserves now exceed Stablecoin balances, which suggests that sales pressure may be building.

Related Readings

According to Egypthash, a contributor to CryptoQuant, readings above 5.0 are historically important. The January spike was similar to 6.1, followed by a sharp price correction, indicating that investors may return cash from BTC.

Despite some warning indicators, Bitcoin continues to show Bullish momentum. Random RSI is exhibit Updated power and other technical signals indicate that the rally can continue. At press time, BTC traded at $103,993, up 0.3% over the past 24 hours.

Featured images from Unsplash, charts from CryptoQuant and TradingView.com