Cardano Whale activity spikes – 80 million ADAs added in 48 hours

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

Morbi Pretium Leo et nisl aliquam Mollis. quisque arcu lorem, super quisque nec, ullamcorper eu odio.

Cardano (ADA) entered a decisive moment as the Bulls moved towards the $0.90 level to hold the $0.74 support zone and build momentum. After earning more than 68% since the April low, the ADA has shown strong signs of recovery, but current levels must be defended to confirm that it will continue. This stage is crucial because the price action tests a critical area of demand that previously triggered a large amount of upside.

Related Readings

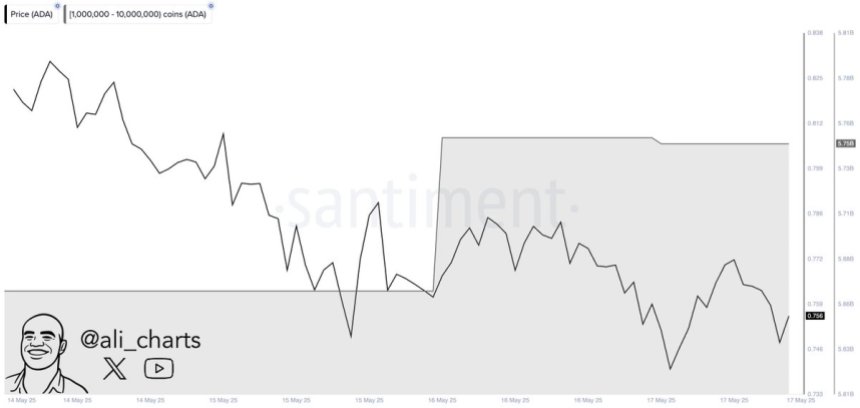

From the chain chain data of santiment, in addition to bullish sentiment, it also shows that whales have accumulated more than 80 million ADAs in the past 48 hours. This surge in mass buying activity shows that the growing confidence of large players has the potential to lay the foundation for breakthroughs. Whales often bring significant market shifts, and their new interest in Cardano may indicate a continuing rally forward.

However, the $0.90 level is now near-term resistance, and recycling higher targets is crucial. The days that follow may be crucial to the ADA’s price structure. If the Bulls manage to flip this level, the next game could bring Cardano back into focus, which could reignite the wider Altcoin enthusiasm in the process.

Whale accumulation signal strength: buyers push breakthroughs

Despite the impressive rebound, the ADA is still below its December 2024 high of 43% high around $1.32. This gap highlights the cautious optimism that dominates the altcoin landscape. Even as the Bulls gradually regain control, overall market fear and macroeconomic uncertainty continue to pressure altcoins, many of which are still working to push key resistance levels.

The ADA is currently combining above the $0.74 level, forming a basis for a possible breakthrough. The market structure is tightening, and the next move – backward or downward – may be sharp. Decisive driving force exceeding $0.90 will confirm breakthroughs for retail and institutional investors and may spark new benefits.

New data from top analyst Ali Martinez, who reported that whales have purchased more than 80 million ADAs in the past 48 hours. This large-scale accumulation shows that the growing confidence among large players can serve as a catalyst for further upward space. Whale activity is usually conducted before a strong price action, and this development supports the idea that the ADA may be in a major action.

As the ADA consolidates almost critical support and whale interest grows, market observers are closely monitoring signs of continuation. If the Bulls keep their momentum and outperform resistance, Cardano may quickly transition from a consolidation phase to a full rally, potentially focusing on starting momentum throughout the altcoin sector.

Related Readings

Cardano has vital support, as the Bulls’ goal is to recover

Cardano currently has a transaction volume of about $0.74, and after not holding a mark above $0.80, it tested a key support zone. The chart shows that the surge in early May brought ADA to $0.90, but since then, the price has been reviewed and is now consolidating above its 200-day EMA (approximately $0.71). This level is dynamic support and may be crucial for the next step.

The price structure shows that the ADA is in a decisive stage. The amount of decomposition and horizontal support below the EMA is around $0.72, which may expose the token to a deeper area of consolidation. Recovering $0.80 on the other hand will invalidate the bearish situation and indicate a potential push to $0.90, which ultimately increases $1.00, a sign of a strong historical resistance.

During the recent pullback, the number has dropped slightly, indicating that the pullback may be driven by profits rather than panic sales. The 200 SMA above ($0.80) remains a key target for monitoring bullish continuation.

Related Readings

If the Bulls can defend current levels and generate updated buying momentum, the ADA can resume its uptrend and break the current range, laying the foundation for retesting major resistance levels in the coming weeks.

Featured images from DALL-E, charts from TradingView