Bitcoin Gold Cross in the Game – Analysts Reveal the Best Action Plan

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

Morbi Pretium Leo et nisl aliquam Mollis. quisque arcu lorem, super quisque nec, ullamcorper eu odio.

esteartículo También Estádandousible enespañol.

Bitcoin’s price action over the past 24 hours is fascinating. After consolidating the tightening range for several days, the market surpassed $105,503 support earlier this week to turn into a resistance zone and started a steep climb over the past trading days. This allows Bitcoin push Entering a new historical high level, And there is no sign of slowing down.

Interestingly, technical analysis shows that the rally stands out The method of the golden cross Between the 50-200-day moving average, but FX_Professor offers a different view of the high-profile golden cross.

Analysts dispute gold cross-hype as late signal

In the nearest one Analysis published on TradingViewFX_Professor discusses different views on Bitcoin’s golden cross. While most market commentators interpret the 50-day simple moving average above the 50-day simple moving average as a strong bullish confirmation, analysts see it as a delay indicator. Analysts describe it as after retail investors were late to the live party.

Related Readings

Instead of waiting for the golden Cross to glitter green,FX_Professor points out that the predetector pressure zone is the actual value signal. In terms of Bitcoin’s price action in recent months, analysts have pointed to the $74,394 and $79,000 region, as accumulation and early positioning can be seen before the golden cross becomes visible. Therefore, by the recent appearance of the cross, the price action over Bitcoin has been greatly improved.

Merchants often use the golden cross as a signal to enter a long position, as this indicates that the price of the asset may continue to rise. However, this analysis is a trend among experienced traders who see the golden cross as a lagging confirmation rather than a trigger for the rally.

Analysts say that early entry into regions and structure is more important.

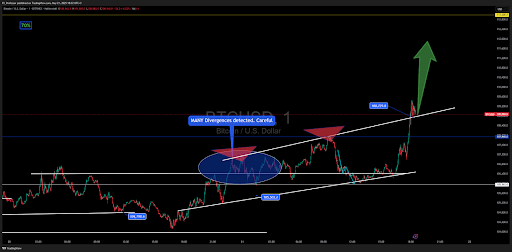

According to FX_Professor, metrics such as EMAS or SMA can be useful, but should not appear until you understand the price structure, trend lines and real-time pressure areas. He shared a snapshot of his Bitcoin price chart that combines custom EMAS with signed parallelogram methods to detect where price tension begins to build. What is visible on the chart are the earliest items formed during Bitcoin in April Bounced around $74,000long before cross confirmation.

Related Readings

Now, with Bitcoin’s push Go to the next target area Analysts’ strategy is close to $113,000, continuing to verify themselves in real time. Still, even if the price rally has reached half of its peak level, confirmation of Bitcoin’s price action remains bullish.

At the time of writing, Bitcoin trades at $110,734. This marks a slight callback to a new all-time high of 111,544, which was registered three hours ago. Bitcoin’s price is still at 3.1% over the past 24 hours and is a new all-time high before closing every week.

Featured Images from Getty Images, TradingView.com Charts