Trader’s $1 billion bet says BTC climbs this week

The high-risk bet has put a cryptocurrency trader in the headlines. He is known online as James Wynn, and his rise in Bitcoin is nearly $1 billion. He started to occupy bullish positions last week and did not say he intends to withdraw.

Bitcoin bets hit billions

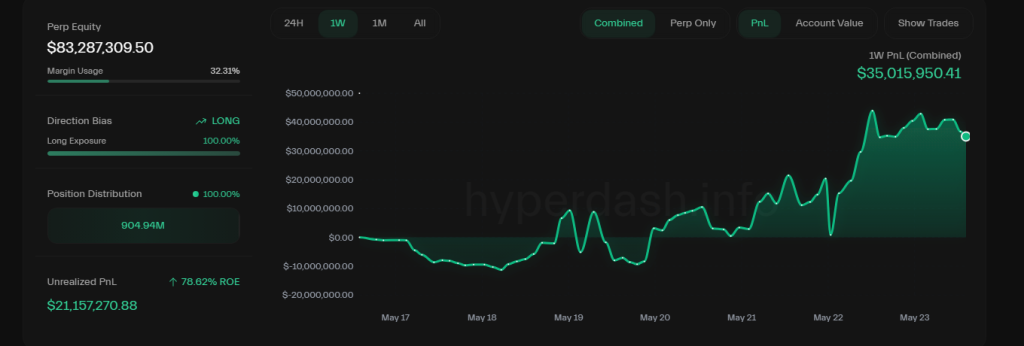

According to Wynn’s position on X, his position reached about $1 billion on May 21. He used $20 million of his funds and borrowed about 40 times the stake in the transaction. BET is located in a super-liquid exchange where traders can open permanent futures positions. Wynn has shut down part of it, reducing the size to just over $800 million as Bitcoin climbs.

Lookonchain data shows that his BTC price is about $108,084 and set his “kill switch” to just under $103,640, so if Bitcoin is lowered so far, then the entire transaction will be seen again. As of early Thursday, the bet sat on a cool $40 million unrealized gain.

Source: HyperDash

Traders’ past success in Memecoin

Wynn didn’t show up from nowhere. In 2023, he predicts that Pepe Memecoin will reach a market value of US$4.2 billion. The bet paid off a lot when Pepe peaked at more than $11 billion in December 2024. The wallet associated with “jwynn.eth” even sent $7 million in Pepe tokens to donate to May 2024. According to the report, the move helped him achieve eight-digit growth.

Bitcoin just broke $111,900!

Top traders @jameswynnreal40 times the length of the use is 10,200 $ btc($1.14B) Profits are now over $39 million! pic.twitter.com/5ulbeia984

– lookonchain (@lookonchain) May 22, 2025

Huge risks associated with price drops

His deal is not without its dangers. If Bitcoin is below $100,850, the position can be eliminated. Wynn said he would add more money instead of facing liquidation. In a turbulent market, a smaller decline could be a trigger for Cascade forced liquidation. Any large amount of money put into the market raises the question: Will there be serious losses if the price is transferred only a few percent in both directions?

Market logic is conducive to this move

According to Polymarket, the chance of hitting $115,000 in May is reportedly fixed at around 64%. Standard Chartered Geoff Kendrick also has bullish views. He predicts that Bitcoin will exceed $120,000 by the end of July. These forecasts are with Wynn’s own targets of $115,000 to $118,000, and even sooner or even $118,000-$122,000.

Update my little one $ btc Long position.

The job size is reduced today, with a profit of approximately $110,000 – $111K.

It seems like a good place for TP, and it seems that others are doing the same thing now.

In my opinion, Bitcoin is eager to get a higher breakthrough. My goal is still… pic.twitter.com/bufwtuqpou

— James Wynn (@JameswynnReal) May 22, 2025

Positioning in a shaky market

Before a slight callback, Bitcoin reached $111,800 on May 22, 2025. Traders point out that rapid growth also warns of rapid declines. In a diversified exchange, the cost of funding rate may increase. A large number of orders with high liquidity may face slippage, which will drive the market against Wynn if he tries to relax too quickly.

People saw the deal and thought it was a little stupid gambling a little bad, yes. But it is supported by my own paper. In turn, this is the calculated risk.

Since the local bottom of 74K Bitcoin has been retained in this channel. Touch the bottom to act as only two… pic.twitter.com/wenpkcwkrg

— James Wynn (@JameswynnReal) May 20, 2025

Calm words from adventurers

“People think it’s high-level gambling, yes,” Wynn said, adding that his bet depends on what he calls a solid paper. Whether he is right or wrong remains to be seen. For now, his willingness to risk a large sum of money has aroused the admiration and caution of onlookers.

Featured images from Unsplash, charts for TradingView

Editing process For Bitcoin experts, focus on thorough research, accurate and impartial content. We adhere to strict procurement standards and each page is diligently evaluated by our top technical experts and experienced editorial team. This process ensures the integrity, relevance and value of our content to our readers.