Tron Bulls Recovery Control – On-chain Data Shows New Purchase Pressure

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

Morbi Pretium Leo et nisl aliquam Mollis. quisque arcu lorem, super quisque nec, ullamcorper eu odio.

esteartículo También Estádandousible enespañol.

Although Bitcoin and other major cryptocurrencies have soared to new all-time highs, TRON (TRX) remains within a tight consolidation range. Despite the broader bullish momentum in the market, TRX remains below its peak in early December nearly 66%. However, this lagging price action has not attracted attention – investors and analysts increasingly view Tron as a potential breakthrough candidate.

Related Readings

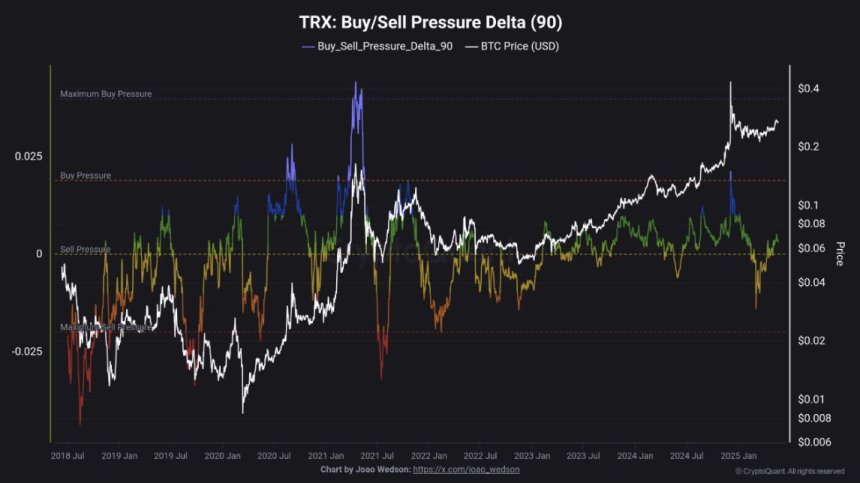

As one of the best-performing 1-tier blockchains in the past year, Tron’s fundamentals are still strong. The network continues to lead Stablecoin settlement volume and user activity, positioning Altcoins as a re-up if it follows Bitcoin’s lead. The latest on-chain data from CryptoQuant adds optimism: The buying pressure delta of net buying and selling activity measured over the past 90 days, indicating that TRX has re-entered the buying pressure zone.

Historically, the signal has been a bullish price movement, especially when combined with strong rationale and improved market sentiment. If the purchase pressure continues and the price falls to above current resistance levels, then Tron may hold a major rally to catch up with the broader market. For now, is all fresh demand going to inspire TRX to be higher next leg.

Tron stays strong as bullish momentum rebuild

Tron (TRX) is one of the most resilient altcoins in recent years, showing strength despite the challenges of most non-big assets. TRX has been on a steady upward trend since the second half of 2022, ignoring broader market corrections and maintaining strong chain fundamentals. Now, the assets consolidate near-critical technical levels, preparing for the next leg upwards.

While Bitcoin clearly leads the current cycle – hitting new all-time highs and attracting most of the capital, many altcoins like Tron are still lagging behind. The difference has led several analysts to question whether Altseason is still in the seat. Most people think it is a Bitcoin-based cycle, especially considering the inflow of BTC ETFs and macroeconomic uncertainty. However, hope to rotate to Altcoins.

Supporting this optimism, crypto insights suggest that TRX has returned to the buying stress zone. The Buy Pressure Delta shows a clear transition in the sales pressure zone. Demand once again outweighs supply, favoring bulls.

Importantly, TRX has not yet reached the historical threshold that is usually before the price rises. This shows that there is still room for growth until it is set carefully. If the broader market supports rotation, Tron could be a prominent tier 1 performer again, especially when traders search for powerful settings beyond Bitcoin.

Related Readings

Technical Analysis: Bulls defend higher than support

TRON’s daily chart shows that assets are consolidating after pushing a strong push towards the $0.28 resistance zone. Price action has maintained a clear bullish structure since early April, with high lows always forming along the 34-day EMA ($0.26) lows, which is now dynamic support. The 50, 100 and 200 SMA are all on an upward trend and are closely below the current price, which marks a long-term bullish alignment.

TRX maintains a short-term consolidation range of approximately $0.26 to $0.28. Price has tested the cap twice in the last two times, but failed to break through with strong momentum. However, the $0.26 support is firmly held, indicating that the buyer is still in control.

Related Readings

To confirm the breakout, the Bulls must decisively raise the price above $0.28, which could open the transition to $0.30 and potentially retest the December high to close to $0.36. On the downside, the loss of $0.26 weakens this setting and may trigger a drop in the $0.2430 region, which is currently located in the region.

Featured images from DALL-E, charts from TradingView