Analysts’ $910K Bitcoin prediction follows familiar scripts

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

Morbi Pretium Leo et nisl aliquam Mollis. quisque arcu lorem, super quisque nec, ullamcorper eu odio.

esteartículo También Estádandousible enespañol.

Bitcoin’s price fell to $105,235 today, down 1.5% in the past 24 hours and 4.2% in the last week. Some market observers view this dip as a pause before major actions. According to their chart, Bitcoin may be ready for another huge growth.

Related Readings

Historical mode points to rebound

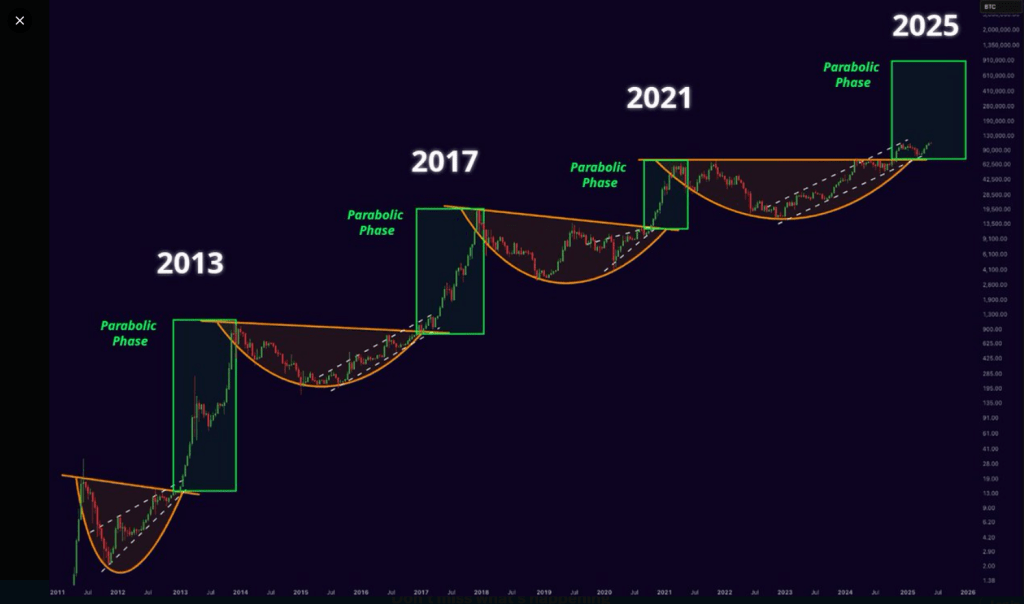

According to a report by analysts called “Mr. Crypto”, the circular underlying and rising triangles mark every large Bitcoin rally. In 2013, when Bitcoin traded below $10, it spent months on a steady, curved base before breaking through and climbing $1,000.

A similar pattern appeared in 2017. After nearly three years of side-oriented action, the price finally rose to $20,000. The last cycle of 2021 also follows the same script, building a base for nearly four years before shooting nearly $70,000.

Bitcoin will be parabola.

This time it won’t be different! pic.twitter.com/0femmmmclbd

– Mr. Crypto (@misterrcrypto) May 29, 2025

Mr. Crypto’s chart shows that another foundation has been formed in the period beyond 2021. If history works the same, his forecast points to a breakthrough in 2025, which could put Bitcoin up to $900,000, up 760% from today’s level.

Analyst charts accumulate again

Bitcoin often moves in phases, according to a chart shared by another analyst. First, there is an initial “leg” that marks a shift from deep accumulation to growing bull trends. Then, the price enters the side “re-energy” stage before it finally runs.

From 2019 to 2021, Bitcoin closely follows this path. Analysts point out that from the end of 2023 to mid-2025, Bitcoin looks to be in the same re-energy phase. If this unfolds like the past cycle, the next big rise could push Bitcoin into the $270,000 to $350,000 range before any parabolic peaks can be seen.

Long-term holders keep increasing coins

On-chain data shows that long-term holders (without the address of moving coins within 155 days) are still stacking. The overall supply of these holders increased by nearly 1.4 million BTC between March 3 and May 25, 2025.

This will increase long-term holdings from 14,354,000 BTC to 15,739,400 BTC. In previous bull markets (such as those in 2013, 2017 and 2021), long-term holders often sold during rally to lock in profits.

Related Readings

But today, they seem to be satisfied. If a large amount of bitcoins are still in exchange, new buyers have fewer coins. Once demand increases, this may tighten supply and make sharp moves more likely.

Looking for an uncertain market

Bitcoin has lost momentum lately, but many analysts believe that these dips will not last. Priced at $105K, below last week’s level.

According to the report, some people believe it is a healthy merger before a bigger run. Others warn that global interest rates, regulations and macro factors may slow things down.

Featured images from Pexels, charts for TradingView