Analysts say Bitcoin must clear the critical cost base level of the sustained upside potential.

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

Morbi Pretium Leo et nisl aliquam Mollis. quisque arcu lorem, super quisque nec, ullamcorper eu odio.

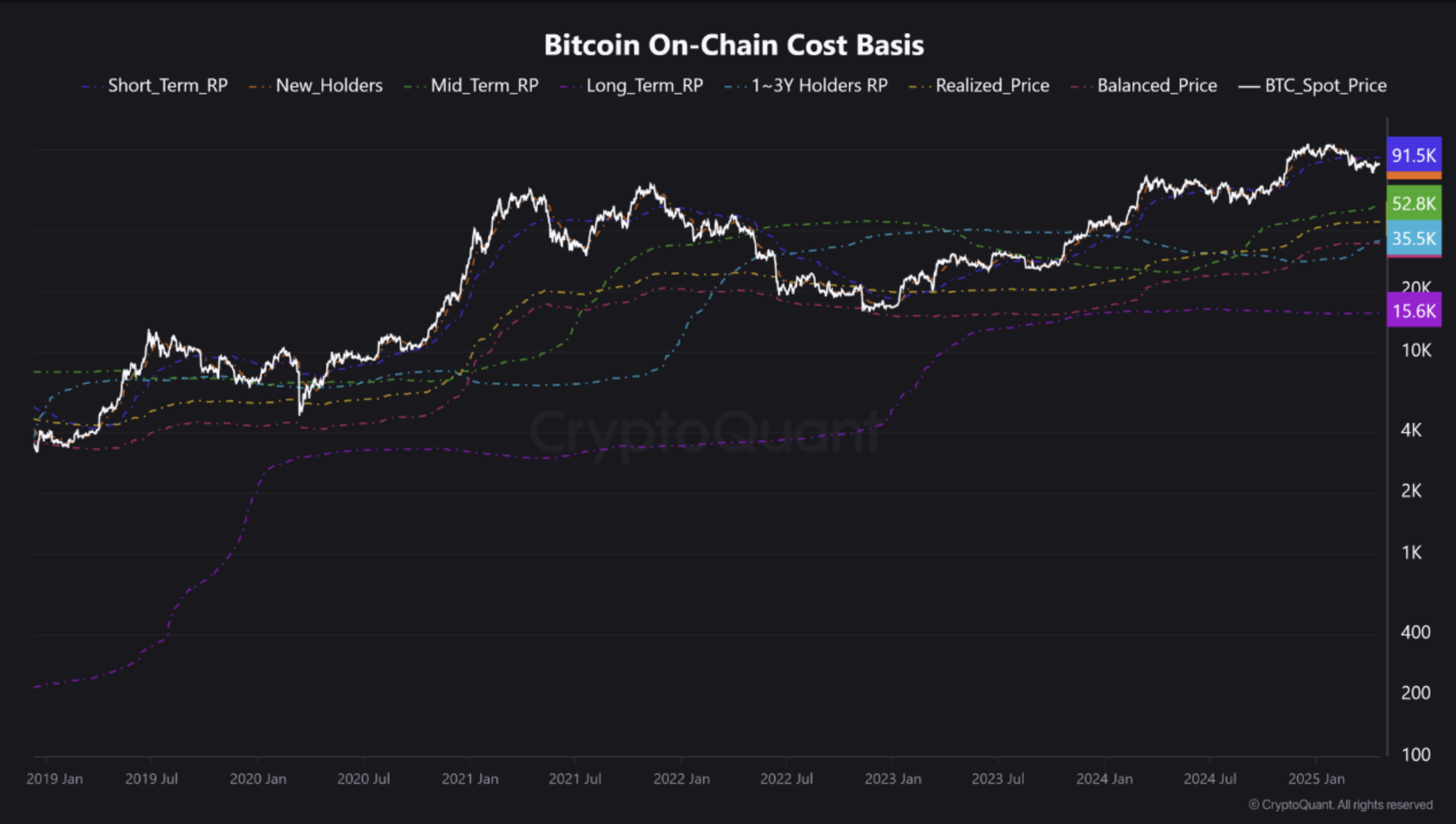

In a recent crypto quick post, contributor Crazzyblockk highlighted the major Bitcoin (BTC) cost base area where leading cryptocurrencies must be cleared (or avoid breaking through below) to maintain their bullish momentum.

Analysts highlight key Bitcoin cost base areas

Bitcoin starts to display The power of new discoverythe highest digital assets have soared nearly 3.5% over the past week, and at the time of writing, the transaction range of digital assets is $80,000. The rise of BTC has rekindled discussions about the potential for cryptocurrencies to “disband” from traditional markets amid the decline of global stock markets.

Related Readings

In a recent QuickTake post, CryptoQuant contributor Crazzyblockk outlines various cost-based areas of Bitcoin and implements price-like similarities to identify key resistance and support levels.

Analysts point out that short-term holders — those who hold BTC for less than 155 days — currently have a price or average cost of $91,500 and a resistance level of $91,500. Crazzyblockk added that this group is often the most sensitive.

On the other hand, the cost base for new holders – those who own digital assets for one to three months – currently have the strongest support level, at about $83,700. Analysts point out that this level represents the cost basis for recent market participants, who often lead to short-term trend changes.

To clarify, the cost base area is the price level of the last move or the acquisition of a large amount of BTC. Potential breakthroughs beyond the price achieved by short-term holders will indicate new bullish momentum as these holders will regain profits and are less likely to sell their holdings.

Instead, breakouts below the cost-based support level of new holders may mark a potential downside movement as recent buyers may start causing losses and be forced to surrender.

It is worth noting that each cost baseline highlighted in the following chart is calculated based on the implementation price of uncommitted transaction outputs (UTXOs) held within a specific age group. Likewise, the implementation price is determined by dividing the total value of all UTXOS by the number of coins.

Do investors expect more room for growth?

Recent chain analysis suggests that BTC holders may be expect Further rise. Short-term holders seem to be Keep Despite being in a loss position, it is still on their BTC.

Related Readings

In addition, encrypted exchange of net flow data hint BTC price rally may be imminent. Some analysts also have similar recent historical price action to Gold, predict That “digital gold” may soon experience a similar momentum.

In other words, Bitcoin futures index sentiment is Point to Driven by macroeconomic uncertainty, pessimism surrounding BTC continues to rise. At press time, BTC was trading at $88,759, up 1.7% over the past 24 hours.

Featured images created with Unsplash, charts from CryptoQuant and TradingView.com