Analysts warn that Bitcoin must shut down this level every week.

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

Morbi Pretium Leo et nisl aliquam Mollis. quisque arcu lorem, super quisque nec, ullamcorper eu odio.

esteartículo También Estádandousible enespañol.

The market recovery this week has seen Bitcoin (BTC) surge more than 10% to retest the barrier for the first time in weeks. In this performance, some analysts believe that the flagship cryptocurrency is about to restart its bullish rally, while others believe holding a key level will determine the next step for BTC.

Related Readings

Bitcoin reclaims its “ultimate” level breaks

Bitcoin has been corrected from $40,000 in early April after soaring 11% in the past week. On Friday, the largest cryptocurrency with market capitalization recovered its $85,000 hurdle, which has been a key hurdle since late March.

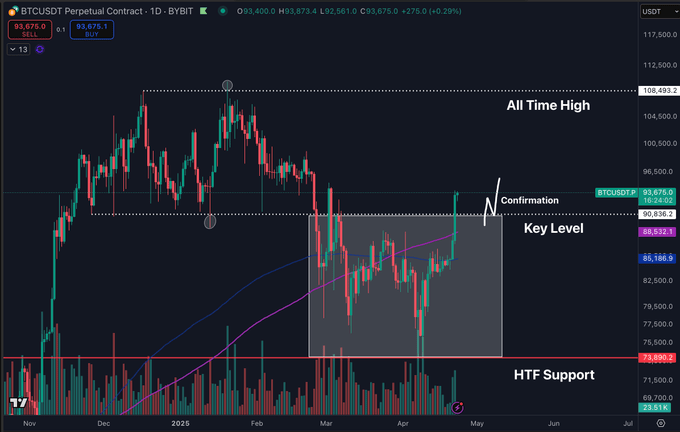

BTC has climbed several key levels since Friday, surpassing Tuesday’s $90,000 resistance and maintaining resistance over the past 24 hours. Analyst Daan Crypto Trades noted that Bitcoin has “returned to the previous range, higher than the daily 200ma/EMA.”

It is worth noting that over the past few weeks, cryptocurrencies have been trading in major areas as it has been retesting its multiple month downtrend lines and the moving average (EMA) and moving average (MA) of the daily 200 index.

Bitcoin exploded for a four-month downward trend after launching the Thursday pump that continued recovery. Cryptocurrency bounced from 200ma per day to 200mA per day consolidation of 200mA per day, and then broke through that level yesterday.

This brings cryptocurrencies to the “final level” of the Bulls, which is the $90,000 to $91,000 range. However, analysts suggest that Bitcoin must continue to hold the region to confirm that the breakthrough is not “just liquidity reduction to the liquidity below.”

Additionally, he said that the daily closure of BTC should be “ideally” maintained at these levels, and that “it would be perfect here to do some mergers to restore fuel and try higher fuels” for the rally continuation.

Ali Martinez also highlighted the price performance of BTC, which opened at an annual price of $93,500. Analysts assert that this level is a strong support for the entire post-election breakthrough, but noted that if it is not retracted, it now “can now fall into key resistance.”

Analyst Eye BTC closes weekly

Crypto Jelle called the bear’s “last line of defense” by $93,500, and he said that once BTC returns to that level, “all bets have been closed.”

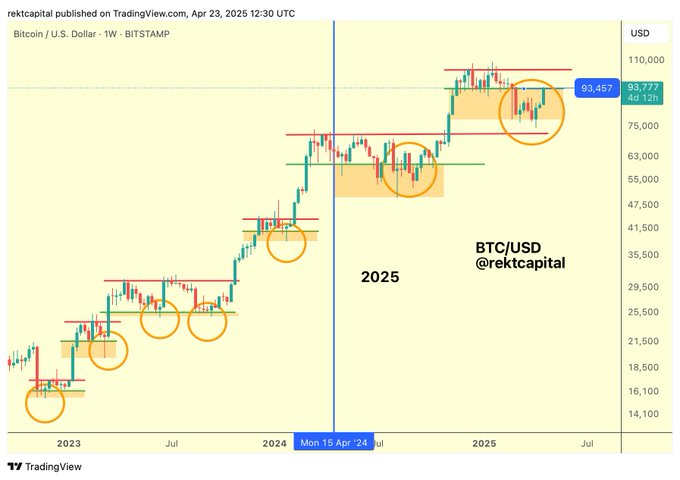

Meanwhile, Rekt Capital noted that Bitcoin has been rallying to resynchronize its previous re-summarization range and confirm the end of its first price discovery correction. ”

He stressed that after yesterday’s performance, BTC approached the end of its downside bias, confirming that cryptocurrencies need to stabilize above $93,500.

To achieve this, Bitcoin needs to be more than this critical level per week and use it as a new support. He also stressed that it is repeating its mid-2021 price performance “very good.”

Related Readings

The analyst previously explained that in 2021, Bitcoin merged between the two largest bull index transfer averages (EMAS), 21-week and 50-week EMA, then exploded from the triangle structure and resumed the rally.

Now, BTC is bursting from the range formed by two bull markets, “This is not only expected to happen in mid-2021, but also in this cycle.” Rekt Capital concluded that it closed more than $87,000 a week, “a breakthrough that will be positioned for confirmation by BTC.”

As of this writing, Bitcoin is trading at $93,459, with a monthly time range of 8.2%.

Featured images from Unsplash.com, charts from TradingView.com