How to generate a click summary of any YouTube video

- This extension allows you to choose between different AI models and also gives you the options to not only sum up but also edit tips for your preferences.

- Now you’ve heard of many tools that can create summaries, but the tools I’ll share with you are smarter than the rest.

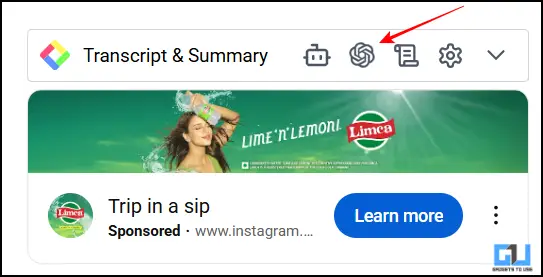

- Simply click on the Chatgpt icon and it will redirect you to Chatgpt via the full summary of your YouTube video.

YouTube is a learning platform where you can learn almost anything from cooking to atmosphere coding. Taking notes can help learn a lot, but pausing videos to write everything down can be tiring. So to solve this problem, you can now create a summary of the entire video. Now you’ve heard of many tools that can create summaries, but the tools I’ll share with you are smarter than the rest. So let’s dive right in and see what this tool can do for us.

Create a YouTube video summary

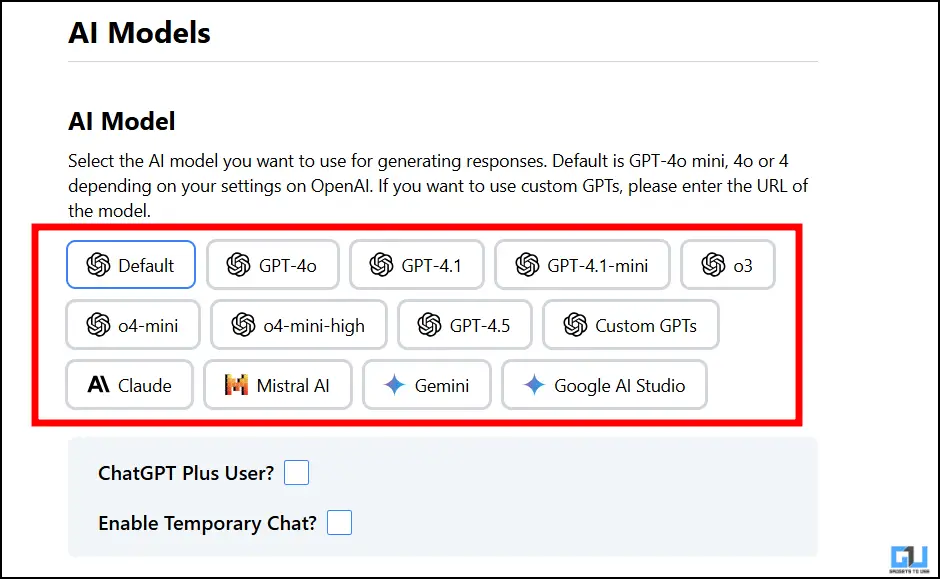

This YouTube ssay extension uses Chatgpt and Claude, giving you the perfect summary every time. Now, what makes it different from other extensions is that you can click once. This extension allows you to choose between different AI models and also gives you the options to not only sum up but also edit tips for your preferences. You can change the desired AI model from the settings of the extension and prompt. You can also use Claude, Gemini, Chatgpt and AI studios.

Extensions with YouTube Summarization

The process is very simple. First, download the extension from the Chrome web store. Then fix it and follow the steps mentioned below.

1. Open the YouTube video you want to summarize.

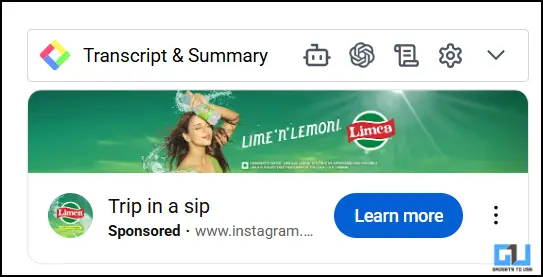

2. In the upper right corner, you will see a dashboard Summarize all options.

3. Hover over the ChatGpt symbol and you will see all the AI models you can switch from.

4. Simply click on the Chatgpt icon and it will redirect you to Chatgpt via the full summary of your YouTube video.

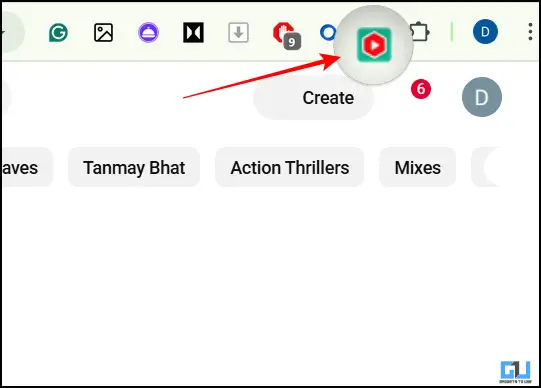

5. To change an AI model or summary prompt, just click the extension icon.

6. In the next menu, you can select any AI model.

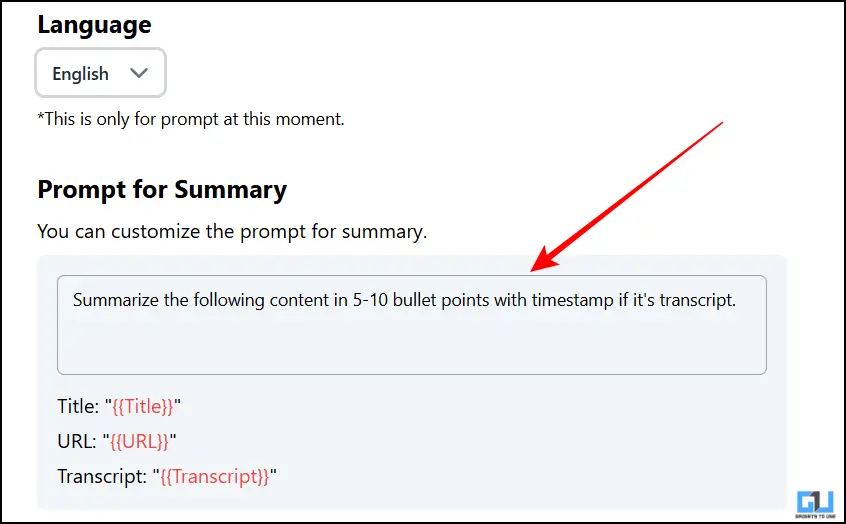

7. Scroll down and you will see the text box, double-click it to edit the prompt.

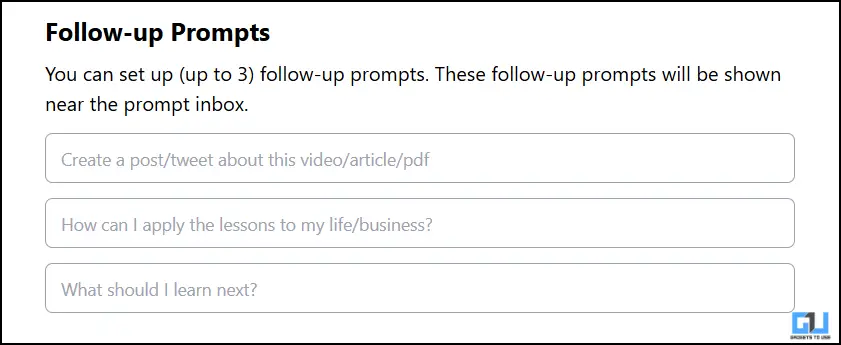

8. You can also add subsequent prompts according to your choice.

Summary of the process of YouTube videos.

FAQ

Q: How to summarize YouTube videos for free?

You can use chrome-plated extensions like Notegpt, YouTube summary, etc. These extensions are free to use and can summarize any video with transcripts.

Q: Can this extension summarize YouTube videos in Hindi?

Yes, you can also summarize the Hindi YouTube videos. This is possible because of the transcript, if your YouTube video has that video, you can summarize it.

Summarize

This article discusses a special extension that allows you to easily summarize any YouTube videos with just a click. You can use different AI models and can even prompt it to meet your needs and likes. All of these features are free and you can use AI models like Chatgpt, Gemini and even Claude.

You may also want to read:

You can also follow us for instant tech news Google News Or comments about tips and tricks, smartphones and gadgets, please join Gadgetstouse Telegram Groupor subscribe Gadgetstouse YouTube Channel About the latest review video.

Was this article helpful?

YesNo