Bitcoin Buyers Regain Control – Live CVD Flash Bullish, Over $110,000

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

Morbi Pretium Leo et nisl aliquam Mollis. quisque arcu lorem, super quisque nec, ullamcorper eu odio.

esteartículo También Estádandousible enespañol.

Yesterday, Bitcoin (BTC) won a new all-time high (ATH) on Binance Crypto Exchange, and technical data shows that the latest BTC rally is dominated by buyers. If this trend continues, BTC may see further price appreciation in the near term.

Buyers restore control of Bitcoin spot market

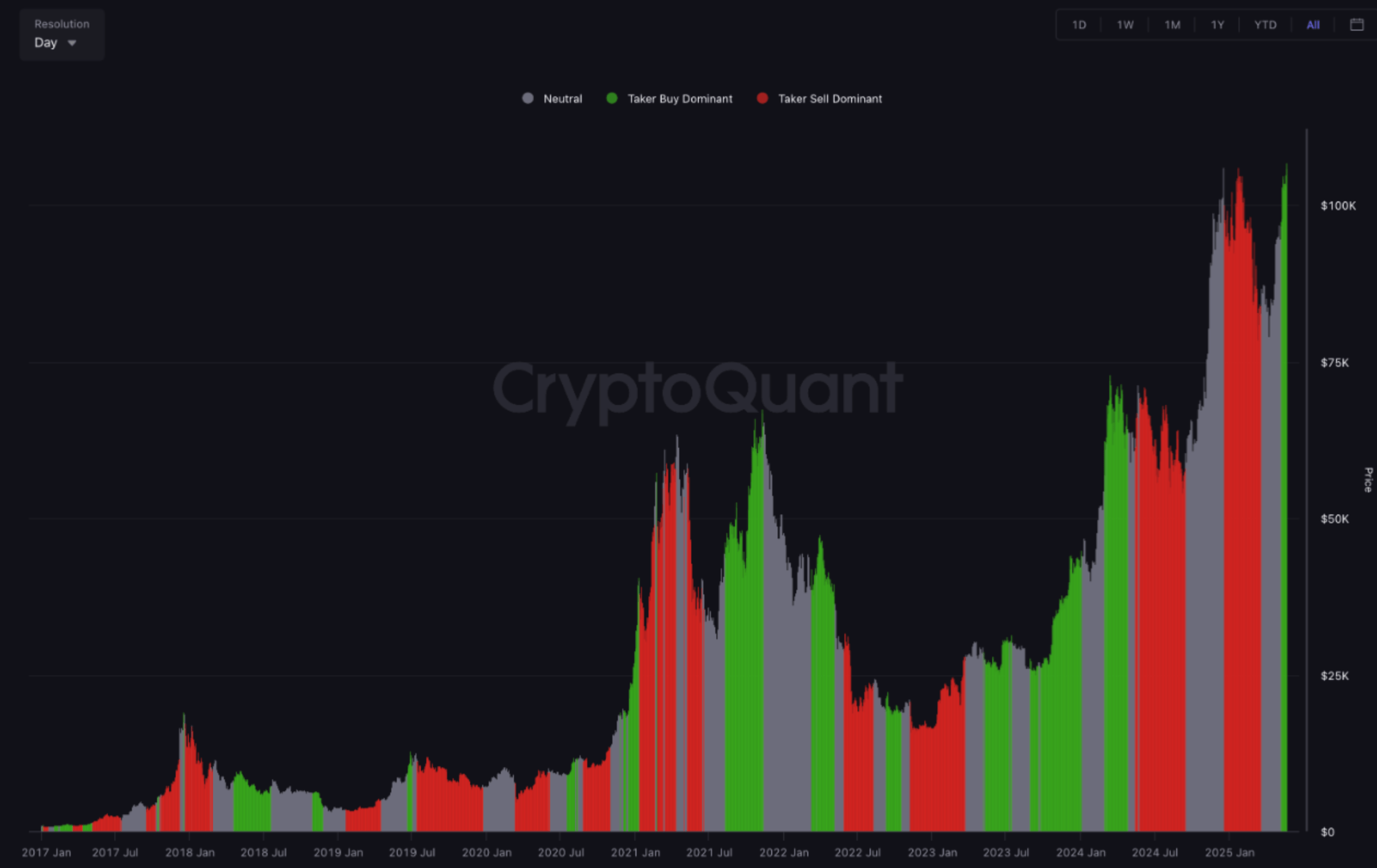

Buyers appear to be dominant in the BTC spot market, according to a recent crypto-fast post by crypto analyst Ibrahimcosar. Analysts have observed that Bitcoin takeover cumulative volume increments (CVD) have turned back to the green field.

For uninspired Bitcoin, Bitcoin Takeover CVD measures the difference between sales volumes sold on spot exchanges and sales volumes on sellers over time. A rising receiver CVD shows that aggressive buyers dominate the market, marking potential bullish momentum.

Related Readings

BTC Spot Taker CVD Turning Green is significant. Most notably, this means that purchase orders have regained dominance after long-term sales orders lead the market’s extension. Higher buy orders over time suggest that Bitcoin’s current bullish momentum may continue.

As shown by Ibrahimcosar shared chart, the CVD remains red for most of the first quarter of 2025 – indicating a lot of sales pressure. This sales behavior is consistent with BTC’s price action, with the company’s assets falling from ATH in January to a low of $76,000 in April.

The fact that BTC’s live Taker CVD turns green with asset setting fresh ATHS makes this trend particularly noteworthy. This shows that buyers are willing to accumulate BTC at historically high prices, which may continue to rise.

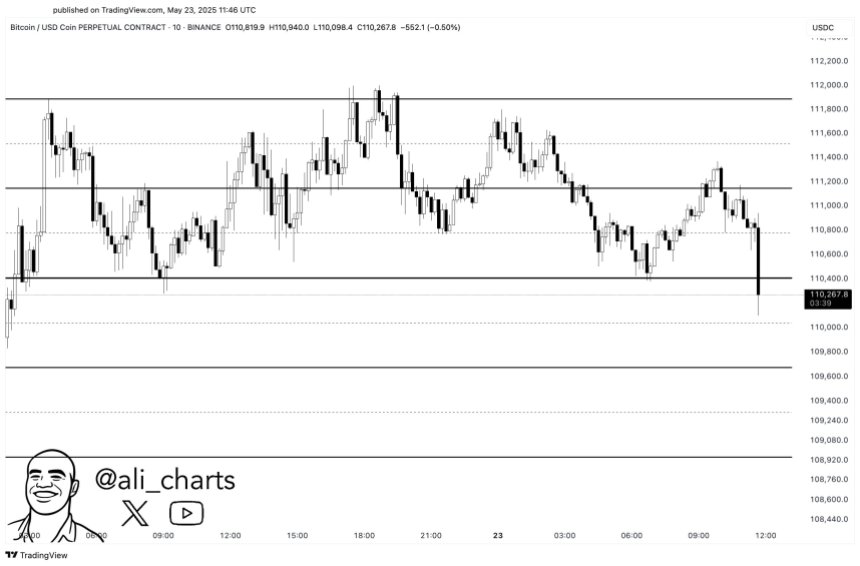

That is, recent price action may temporarily interrupt BTC’s momentum. Crypto analyst Ali Martinez suggested in an X post that BTC could soon break down to $111,100 from the current $110,400 range.

Another gathering

Often, BTC hits new ATHs often encounters ecstasy with the wider market, resulting in a sharp drop in price drops that catch most investors off guard. However, experts believe that the current gathering is different from previous cycles.

Related Readings

Latest analysis by crypto contributor Crazzyblockk suggestion New and short-term BTC investors are sitting on a large amount of unrealized profits and show no signs of panic selling as cryptocurrencies rise to new highs.

Similarly, whales’ reactions to the bullish price trajectory of BTC are mixed together. While the new whales have been making a lot of profits during the ongoing rally, the old whales have resistance The sale of its shares shows the least sales activity.

Finally, the neutral funding rate in the BTC futures market strengthen There are fewer ideas for current rallies than guesses than in the past. At press time, BTC was trading at $108,553, down 2.6% in the past 24 hours.

Featured images from Unsplash, charts from CryptoFant, X and TradingView.com