Bitcoin Eyes $124,000, Golden Ratio Increases Early

Famous crypto analyst Burak Kesmeci has paid a $124,000 target based on data from the Golden Ratio Multiplier Price Model. This bullish forecast suggests that premium cryptocurrencies may have more room for immediate price increases after impressive price increases over the past week.

Can Bitcoin return a 1.6x accumulation peak target?

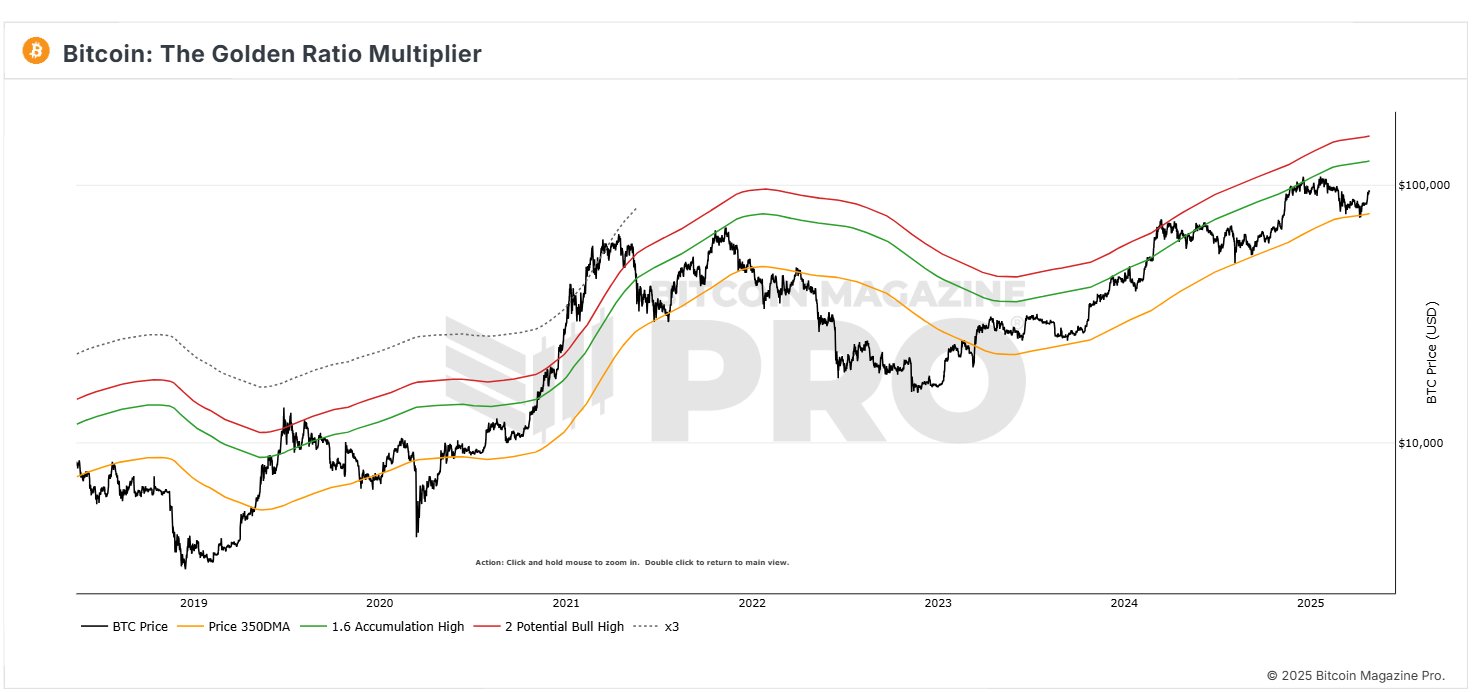

In an April 26 X post, Burak Kesmeci shared the latest update to the Bitcoin Golden Ratio Multiplier Model and referenced data from Bitcoin Magazine Pro. In the context, the Golden Ratio Multiplier Model uses moving averages and Fibonacci ratios to help identify when BTC may be overestimated or underestimated, thereby signaling possible upper-level markets or good accumulation opportunities.

According to the chart below, Bitcoin recently retested the 350 moving average (350DMA) at $77,000. As the name implies, 350DMA tracks the average price of BTC over the past 350 days and acts as a key support area. Contact or brief immersion into this level often marks a potential long-term buying opportunity.

Bitcoin recently rebounded from 350DMA, and after the price fell to $75,000, Bitcoin then held two traded price rallies, up to $96,000.

Consistent with the price band of the gold multiplier ratio, BTC is now accumulating at 1.6 times higher, or 1.6 times the 350 DMA, currently at $124,000. Therefore, despite the continued consolidation of prices, BTC may generate another price rallies based on the gold multiplier ratio model.

Interestingly, when Bitcoin moves nearby or above this level, it usually marks the end of the accumulation phase and the beginning of a stronger bullish trend. As a result, reaching $124,000 BTC will only pave the way for further price increases, which is consistent with the lofty goals of some market analysts.

BTC miners make $18.6 million in profit

In other news, another top crypto analyst, Ali Martinez, reported that miners recently took advantage of Bitcoin’s impressive price rally and realized nearly $18.6 million in profits as prices soared $94,000.

This realized profits were enhanced, and early miners strategically made profits at these high-priced levels. However, it is worth noting that despite multiple factors, including a large amount of inflows into ETFs, Bitcoin still retains a strong bullish momentum.

At the time of writing, BTC is worth $94,393, reflecting a 0.76% drop in price over the past day.

Featured images from Investopedia, charts from TradingView

Editing process For Bitcoin experts, focus on thorough research, accurate and impartial content. We adhere to strict procurement standards and each page is diligently evaluated by our top technical experts and experienced editorial team. This process ensures the integrity, relevance and value of our content to our readers.