Bitcoin faces a wave of profits, but at $105k

Data on the chain shows that the Bitcoin network has witnessed a surge in profit activity among investors, but so far, prices have managed to hold.

Bitcoin has recently seen a profit rate of $500 million per hour

According to data from the Chain Analytics Glass Section, the realized profit metric has recently registered multiple large peaks for Bitcoin. The “realization profit” here refers to an on-chain indicator that tracks the total profit “realized” by BTC investors through transfers on the network.

Metric work is to view the price of this previous transaction by browsing the transfer history of each coin to be sold or moved. If the previous transaction price is lower than the current selling price of any token, the sale of a particular coin will result in the realization that the return is equal to the difference between the two values.

The profits achieved summarize the differences in all profit actions to determine the total number of networks. A peer metric called realized losses will take care of the opposite type of sales.

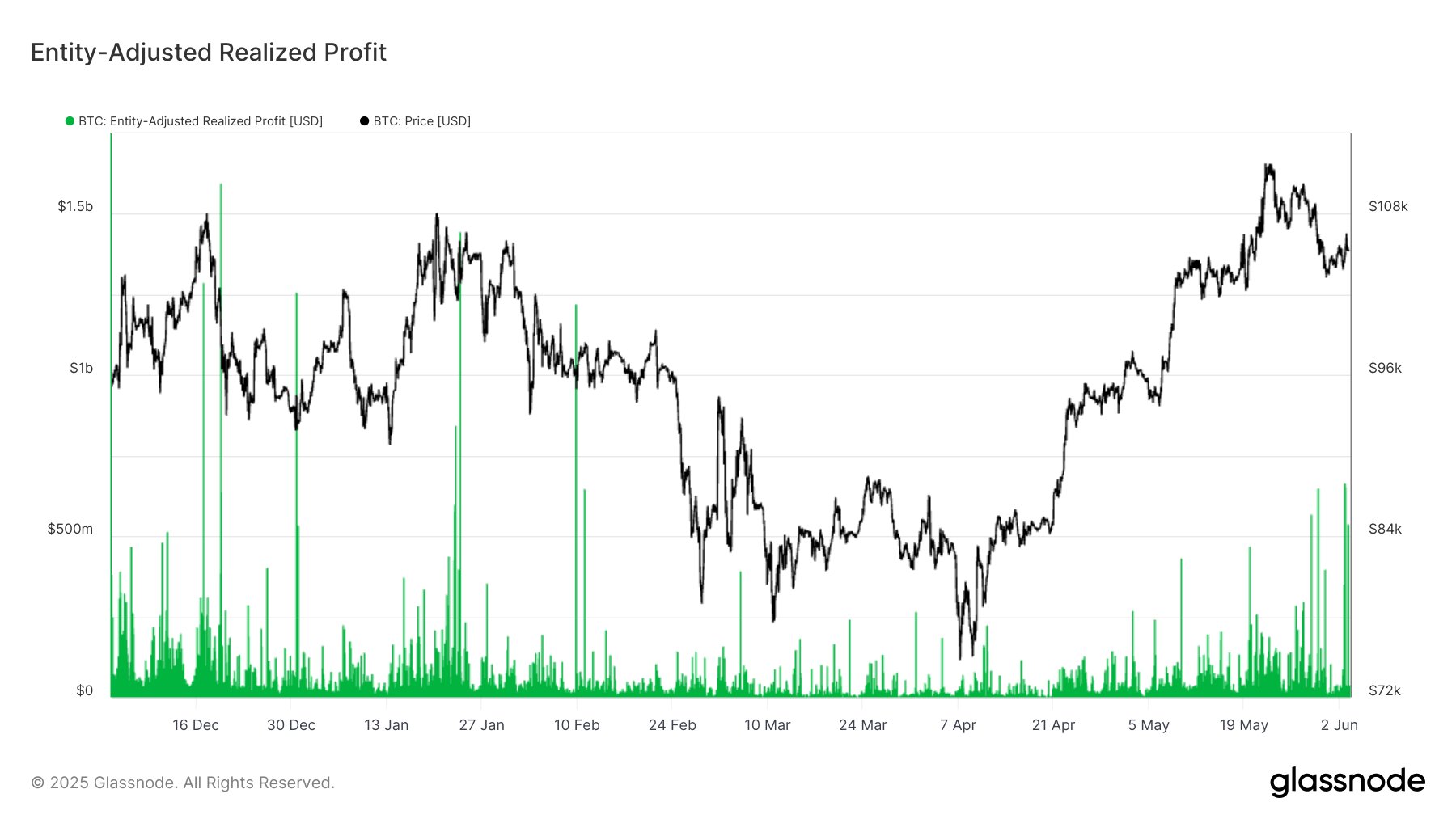

Now, here is a chart shared by analytics companies that show the trend of Bitcoin’s profitability over the past few months:

Looks like the value of the metric has been quite high in recent days | Source: Glassnode on X

Note that the version of the realized profit in the chart is the “entity adjustment” version, which means it tracks not only the transfers occurring between different wallets, but also between different entities.

GlassNode defines an “entity” as a cluster of addresses that have been determined to belong to the same investor through which it is analyzed. Naturally, actions occurring between the same owner’s wallets do not reflect any profit realization, so consideration of entities cleans up the data.

As can be seen in the figure, profits realized after being adjusted by Bitcoin entities experienced some massive peaks at the end of last month, indicating that investors have made substantial profits. These spikes coincide with the asset’s drop from its approaching speed level, so this sales may be triggered.

Now, the metric has experienced more of these spikes, corresponding to profit margins of more than $500 million per hour. Therefore, it seems that investors have not yet completed the gains.

However, Bitcoin has not seen the move so far this time. However, it remains to be seen how long this will last only if the realized profit continues to occur.

BTC price

At the time of writing, Bitcoin has floated around $104,900 in the past seven days, down almost 4%.

The price of the coin appears to have been moving flat recently | Source: BTCUSDT on TradingView

Dall-E, Featured Images of GlassNode.com, Charts of TradingView.com

Editing process For Bitcoin experts, focus on thorough research, accurate and impartial content. We adhere to strict procurement standards and each page is diligently evaluated by our top technical experts and experienced editorial team. This process ensures the integrity, relevance and value of our content to our readers.