Bitcoin giant whale calms down when buying – rally?

Data on the chain shows that the largest whales on the Bitcoin network have slowed down their purchases recently. This is what BTC means.

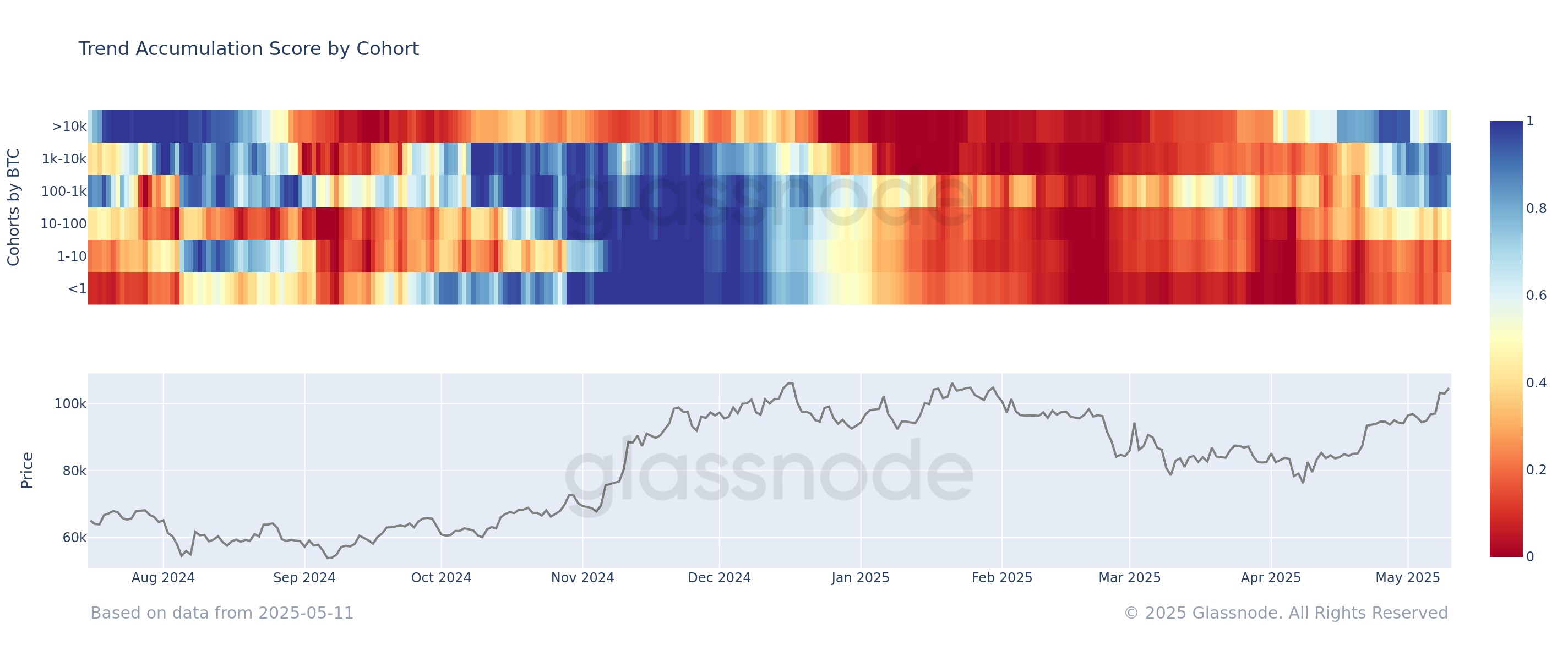

Bitcoin accumulation trend score indicates the cooling of giant whales

In a new post on X, on-chain analytics firm GlassNode shares the latest updates on cumulative trend scores from various Bitcoin investor accomplices. The “cumulative trend score” here refers to an indicator that tells us whether BTC investors are accumulating.

This indicator not only determines its value by looking at the balance changes that occur in the investor’s wallet, but also refers to the size of the wallet itself. This means that large investors have higher weight.

When the cumulative trend score is above 0.5, this means that large investors (or, large numbers of small holders) are in the accumulation stage. On the other hand, below this threshold means the dominance of distribution in the market. These behaviors are strongest at the extreme positions of 0 and 1.

Now, here is a chart released by the analytics firm that shows the trends in the cumulative trend scores of different Bitcoin holders over the past year:

Looks like the behavior has been different across these groups recently | Source: Glassnode on X

As shown in the chart above, investors at the bottom of the market (below 1 BTC and 1 to 10 BTC cohorts) have a cumulative trend score of less than 0.5, meaning they are being distributed.

This story is different for the larger group of people who are in the accumulating stage. The metric for sharks (holders carrying 100 to 1,000 BTC) is 0.8 and whales (1,000 to 10,000 BTC) is 0.9, which means a strong trend in buying.

A cohort stands out in its cumulative trend score, however, holds over 10,000 BTC “giant whales.” From the chart, this cohort moved from distribution to the rest of the market earlier this year and earned nearly perfect scores on the indicators.

However, recently, the group showed another shift as the metric’s value dropped to around 0.5 of its members. This suggests that the trend in this cohort is now neutral. These huge investors may back up the accumulation, which may negatively impact on ongoing Bitcoin rally.

That said, at least for the time being, sharks and whales are still supporting running. During the rally in the last months of 2024, giant whales performed brightness distributions, but the rest of the market continued to accumulate, fueling the run.

The rally ended when giant whales were distributed in large quantities. Just like the way I bought from the queue this year before the rest of the stock, this sell-off has also reached the rest of the relocation.

Given this wise behavior from the big whales, their Bitcoin accumulation trend score may be a focus.

BTC price

Bitcoin rally has stalled over the past few days as cryptocurrencies are still around the $104,000 mark.

The price of the coin seems to have been moving sideways recently | Source: BTCUSDT on TradingView

Dall-E, Featured Images of GlassNode.com, Charts of TradingView.com

Editing process For Bitcoin experts, focus on thorough research, accurate and impartial content. We adhere to strict procurement standards and each page is diligently evaluated by our top technical experts and experienced editorial team. This process ensures the integrity, relevance and value of our content to our readers.