Bitcoin is close to ATH, but social media FOMO signal warning

Data suggest Bitcoin sentiment on social media may start to overheat, which could eventually become a threat to price rally.

Bitcoin social media sentiment is especially positive at the moment

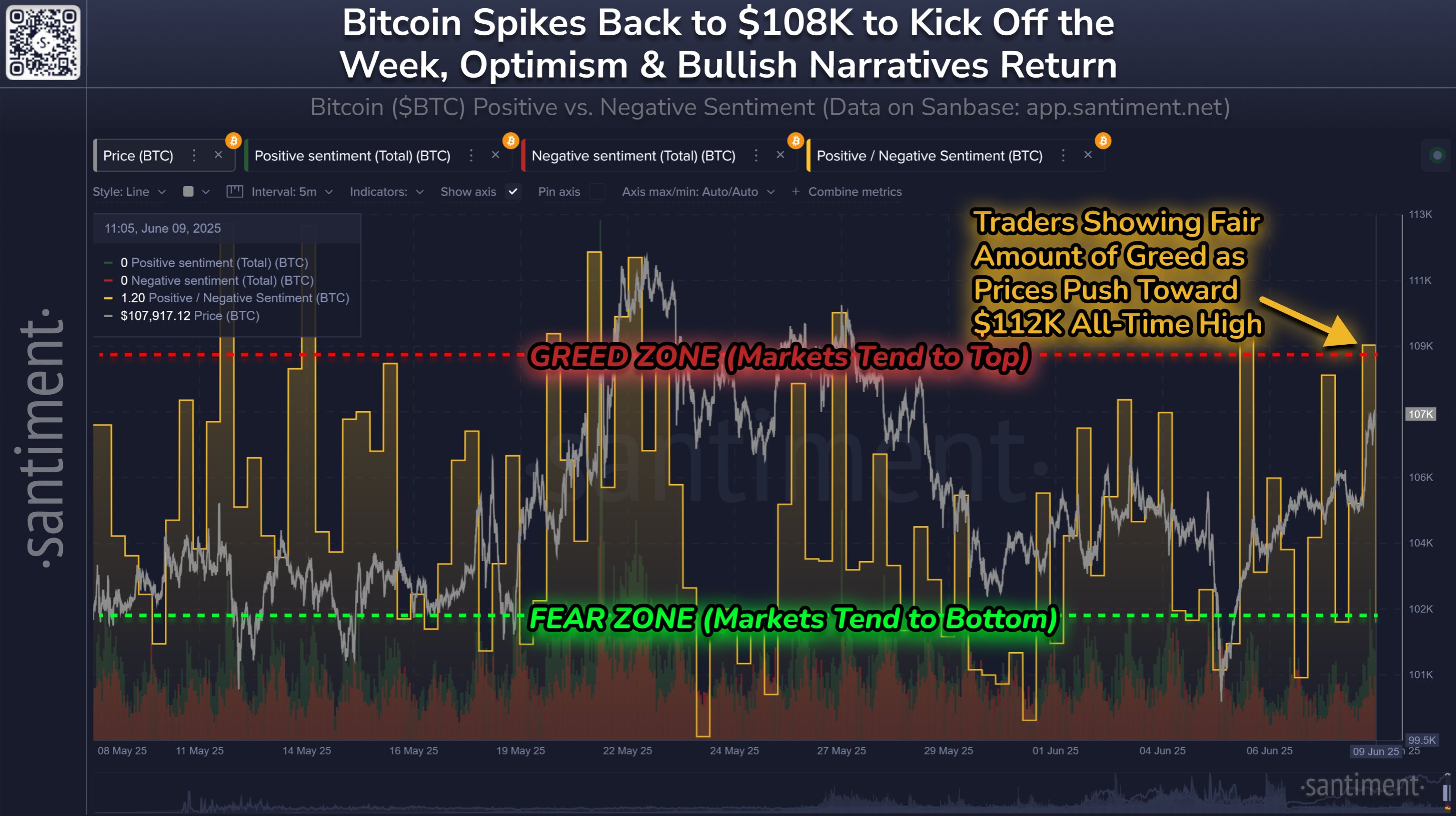

In a new post on X, analytics firm Santiment discusses how sentiment towards Bitcoin changes on major social media platforms after the latest recovery rally.

The indicator of correlation here is “positive/negative sentiment”, comparing the levels of positive sentiment with the negative sentiment surrounding a given cryptocurrency on social media.

Metric is filtered through posts/messages/threads that contain mentions of assets and through machine learning models separated between positive and negative comments. This metric calculates the number of posts of both types and provides them with a net representation of social media in their proportion.

Now here is the chart shared by Santiment, showing the trends in positive/negative sentiment in Bitcoin over the past month:

The value of the metric appears to have spiked in recent days | Source: Santiment on X

As shown in the above chart, Bitcoin positive/negative sentiment soared in the area above the 1.0 mark, indicating that the flood of asset-related positive posts has touched on social media platforms. This shift has seen significant positive sentiment as cryptocurrencies prices have been recovering from surges.

This is not a particularly unusual trend, and traders’ excitement tends to increase whenever bullish price action is taken. Especially in the context of the latest surge, people are inspiring mood, which is not surprising, as it brings prices closer to the highest ever-high price (ATH).

Although you can expect some hype, too much may be something to pay attention to. The reason behind this is that Bitcoin and other cryptocurrencies have historically tended to move in the opposite direction of crowd perspectives.

This means that a surge in greed in the market may lead to the highest asset prices. Likewise, an emotional cooling time could mean a bullish reversal.

From the chart, it is clear that when Bitcoin saw the $100,000 expulsion a few days ago, positive/negative sentiment dropped to a relatively low level. This fear among social media users may have helped the coin reach its lowest point.

After the latest peak in the indicator, the situation is now just the opposite, worrying (FOMO) may develop among investors (FOMO). Now, it remains to be seen whether this overexcitement will provide impedance for price gatherings.

BTC price

Bitcoin briefly broke $110,000 in the past day, but the asset has since pulled back slightly as it has a return of $109,500.

The trend in the BTC price over the last five days | Source: BTCUSDT on TradingView

Featured images from istock.com, santiment.net, charts from tradingview.com

Editing process For Bitcoin experts, focus on thorough research, accurate and impartial content. We adhere to strict procurement standards and each page is diligently evaluated by our top technical experts and experienced editorial team. This process ensures the integrity, relevance and value of our content to our readers.