Bitcoin Layer 2: Ark

ARK is a new type of chain transaction batch processing mechanism, originally proposed by young Turkish developer Burak. There are currently two implementations, one built by Ark Laboratory and the other one that Burak has not participated.

The initial proposal on Ark is much more complex and involves some design goals that revolve around privacy than the implementation of the current build. It was initially also envisioned that CheckTemplateyify (CTV) was needed to build.

The protocol depends on the central coordination server to function normally, but despite this, the protocol is able to provide the same functionality and security to ensure the functionality of the Lightning Network. As long as the user is always online for the required period of time (unless they choose to trust the operator for a short period of time), each user can unilaterally exit the Ark system at any time and restore complete unilateral control of their funds.

Unlike Lightning, Ark does not require users to allocate liquidity pre-allocated to them to obtain funds. Ark users can simply board the wallet and get funds immediately without liquidity pre-allocation at all.

Let’s walk through different ark components.

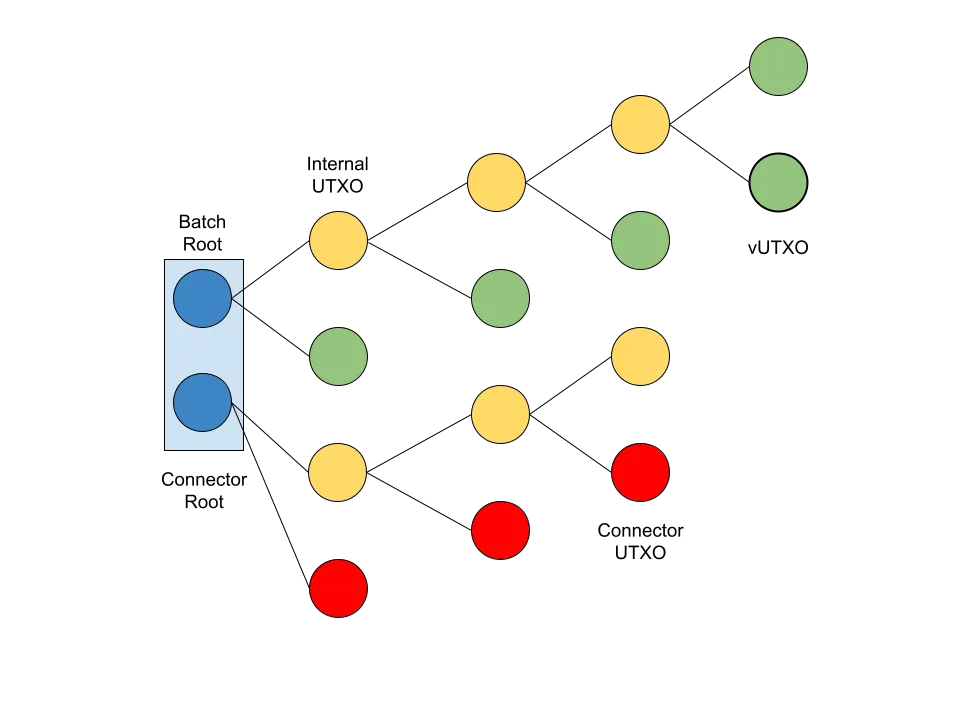

Ark Tree

The coins held on the Ark are called Virtual UTXO (VUTXOS). These are just pre-signed transactions that guarantee the creation of a true UTXO under the unilateral control of the user who submits OnChain, but otherwise it is considered a chest-defeating.

Each user’s Vutxos is nested in a tree of pre-signed transactions or “batches”. ARK facilitates coordination among users required to create batches by having a coordination server or ARK Service Provider (ASP). Whenever a user receives funds, boards the ark, or unloads, a transaction and related transaction trees must be built to create a new batch.

The tree is constructed to lock the OnChain confirmed by a single UTXO and lock it with NN-of-N Multisig, including all users who load Vutxos in the tree and ASP, and slowly split into more and more UTXOS until finally reaching the leaf, each user is Vutxo per user. Each VUTXO can use a script that must be signed by 2 Multisig, a key held by the user, another script held by the ASP, or only signed by the user after the schedule.

Every time the tree splits, Vutxos is created on the chain, but more internal UTXOs are not yet divided into Vutxos. Each of these internal UTXOs is locked with NNNN-OFXOS composed of ASPs, and all users with Vutxo under the tree. During batch creation, users start with their respective Vutxos and then gradually return to the root of the tree. This ensures that each user will never sign until the claim against VUTXO is claimed, ensuring that in the worst case, they will always have unilateral access to their funds.

Each batch also has a valid period of time (which will make sense in the next section). This expiration expenditure path is the alternative expenditure conditions for Root UTXO OnChain and each internal UTXO, allowing the ASP to unilaterally and individually spend all funds.

Transactions, pre-confirmation and connector input

When trading on the ark, there are two possible mechanisms that are possible, both in terms of its own cost and the meaning of the security model. There are unfeasible transfers or pre-confirmed transactions, and there are internal transfers or actual confirmed transactions.

Carrying out-of-reach transfer is a very simple process. If one user (Alice) wants to pay another user (Bob), they simply contact the ASP and have them sign the transaction together, spending Vutxo to Bob. Bob is then allowed to make pre-signed transactions, as well as return all other transactions before it to the batch root. Bob is now able to unilaterally exit the ark through this deal buthe must believe that ASP should not conspire with Alice to make it twice as much. These idle transactions can even be bound by before finally confirming these transactions.

To finalize the ark transaction, the user must conduct a “batch exchange”. Users can’t actually acknowledge the transfer without trust in a single batch, they have to exchange vutxo in an existing batch with fresh vutxo created in the new batch. This is done using ASP as a facilitator of interchange and with the help of so-called “connector input”.

When users finalize the ark transaction using batch exchange, they place control over VUTXO on the ASP. This could be problematic, what is what is preventing ASP from simply keeping it, rather than giving them a confirmation vutxo in the new batch? Connector input.

When creating a new batch, a second output is created in the transaction, which is acknowledged on the chain, which instantiates a new tree composed of the connector UTXOS. When Bob (Bob) From the new batch.

This creates atomic guarantees. Bob’s confirmed Vutxo is included in a batch of transactions in the same transaction, and this connector input is required for its forfeiture transaction, which is valid. If the batch was never created, i.e. Bob never actually received a new confirmed Vutxo, then the forfeiture transaction of the ASP he signed would never be valid and confirmable.

Liquidity dynamics and block space

ASP provides all the liquidity required to create new batches to facilitate transfer between users. They must have enough liquidity to create new batches for users until the old batches have expired, and the ASP can unilaterally scan them to reclaim the old liquidity that has been locked before to create VUTXOS for users.

This is the core of the liquidity dynamics at the Ark Agreement Center. While this is a huge efficiency win in a sense, it doesn’t require liquidity providers to evaluate users and basically guessing that they will actually receive a lot of payments before they get any funds, and on the other hand, it’s a loss of efficiency because ASPs have to have enough liquidity to continue creating new batches for users to how long to configure you with enough time and they can start collecting liquidity.

The frequency provided by ASPs can create new batches to finalize pending transactions, which can mitigate this to a good extent. If the ASP tries to create a new batch in real time in the transaction, the liquidity requirements will rise. However, ASP can reduce the frequency of creating new batches and greatly reduce its liquidity requirements.

This dynamic also has an impact on the use of block space. Unlike Lightning, it can provide strong confirmation guarantees that are fully chained so that the ark transaction has an equivalent trustless ultimate limit. have OnChain is created. This means that unlike Lightning, the speed of ARK transactions inherently requires proportional amounts of block space use, although in a very compressed and efficient way, in a very compressed and efficient way. This creates a theoretical upper limit of how many ark batches can be created in any given time interval (although the ark tree can be larger or larger according to this dynamic).

Summarize

The Ark shows in many ways almost the opposite trade-off from the Lightning Network. This is a huge block space efficiency that improves the efficiency of off-chain transactions and eliminates liquidity allocation issues on the Lightning Network, but it does have a tighter bound throughput limit associated with blockchain throughput limits.

This dynamic of almost opposite tradeoffs makes it a very complementary system for the Lightning Network. It can also interoperate with it, i.e., IE Vutxos can be replaced with atoms in transactions entering or exiting the Lightning Network.

Ultimately, how it fits into the broader Bitcoin ecosystem, but it is undoubtedly a valuable protocol stack, and it will find some functional niches even if it is different from the original intention.