Bitcoin LTH sales pressure hits annual lows – Is the bull market ready to take off?

The Bitcoin bull market continues to be at equilibrium after extensive price corrections over the past three months. Despite the moderate price in April, the Prime Minister’s cryptocurrency has not shown a strong intention to resume its bull rally amid a lack of positive market factors. However, crypto analyst Axel Adler Jr. highlighted a promising development that could indicate the main upward potential of Bitcoin.

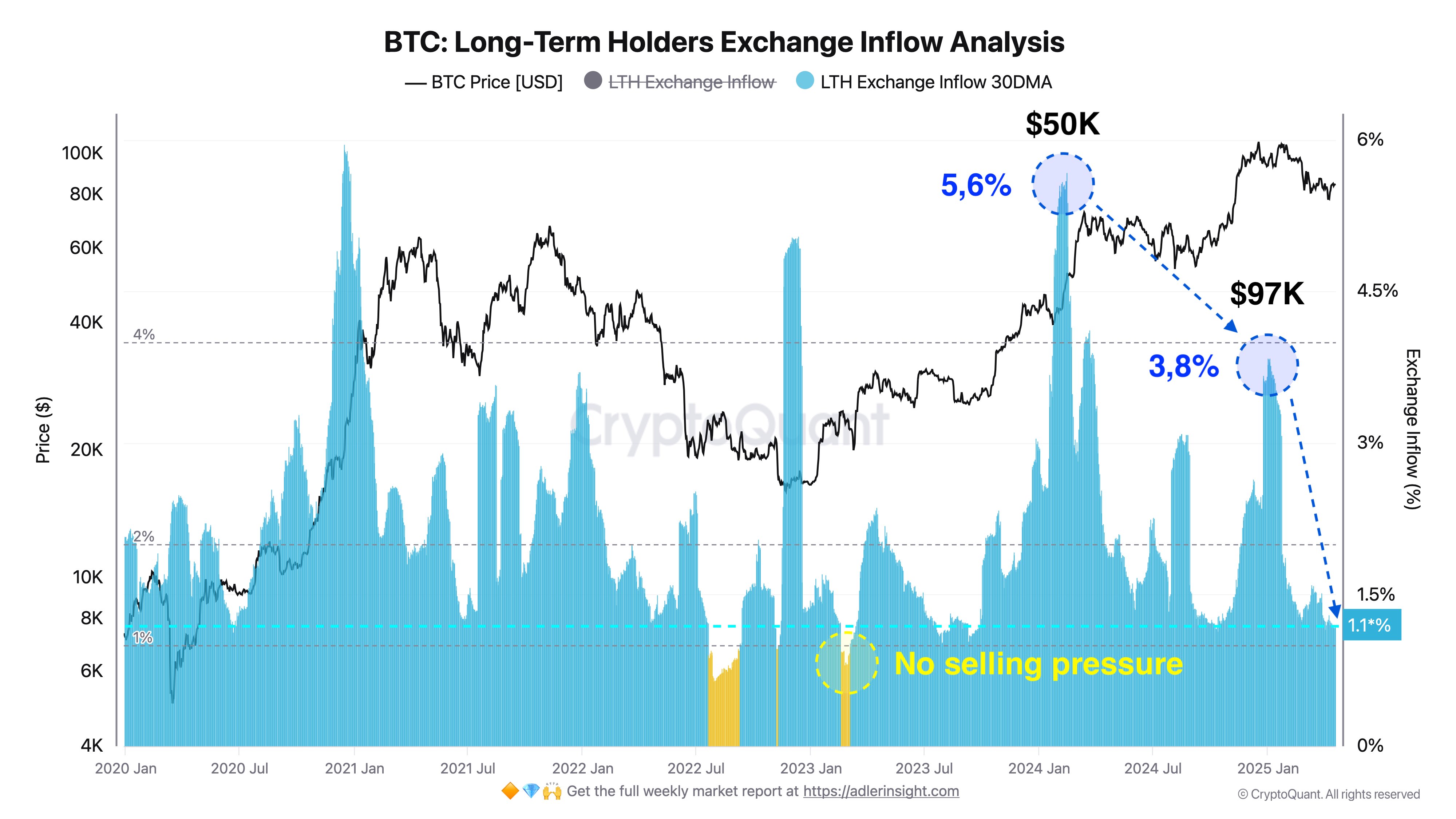

Long-term Bitcoin holders want to stop selling pressure

In a recent article by X, Adler Jr.

The well-known analyst reported that using CryptoQuant’s chain data reported that long-term holders’ sales pressure, namely LTH holdings on exchanges, has now reached its lowest point in the past year at 1.1%. This development shows that Bitcoin LTH now chooses to retain its assets rather than make profits.

Adler explained that the further decline of these LTH Exchange Hothings to 1.0%, indicating an overall lack of sales pressure. It is worth noting that this development can encourage new market entry and continuous accumulation, thereby creating a strong bullish momentum in the BTC market.

Importantly, Alder stressed that most Bitcoin LTH entered the market at an average price of $25,000, and since then, CryptoQuant had the highest sales pressure of $50,000 at the beginning of 2024, and $97,000 at the beginning of 2025, at $97,000.

According to Adler, these two examples may represent the main profit phase for long-term holders who intend to exit the market. Therefore, in the short term, the resurfacement of sales pressure from the BTC investor cohort is unlikely to support bullish cases in the building, as long-term holders currently control 77.5% of Bitcoin circulation.

BTC Price Overview

At the time of writing, Bitcoin has traded at $85,226 after a loss of 0.02% in the past week. These two indicators reflect only ongoing market consolidation as BTC continues to struggle to achieve a convincing price breakthrough of over $86,000.

Meanwhile, the performance of assets in monthly chats now reflects a 1.97% increase, indicating that potential trends reverse as market corrections cease. However, BTC still needs strong market catalysts to ignite any sustainable price rally. Bitcoin, with a market capitalization of $1.67 trillion, is rated as the largest digital asset, controlling 62.9% of the cryptocurrency market.

Featured images from Adobe Stock, charts from TradingView

Editing process For Bitcoin experts, focus on thorough research, accurate and impartial content. We adhere to strict procurement standards and each page is diligently evaluated by our top technical experts and experienced editorial team. This process ensures the integrity, relevance and value of our content to our readers.