Bitcoin market shows Hodling transfer -1m coins mature to LTH

Data shows that a large amount of Bitcoin has been transferred to the long-term holder group, indicating that Hodling’s sentiment is getting stronger.

The Bitcoin supply has been transferred from Sths to LTHS in the past month

In a new post about X, CryptoQuant community analyst Maartunn talks about how the Bitcoin supply for short-term and long-term holders has changed.

Short-term Holders (STH) and Long-term Holders (LTHS) make up for one of the two major sectors of the BTC market, based on holding time. The deadline between the two cohorts is 155 days, with investors holding less than this period. When STHs exceed the 155-day mark, they will be promoted to LTHS.

There are several ways to track behaviors related to these groups, one of which is a position change indicator that tracks the 30-day changes held by these traders.

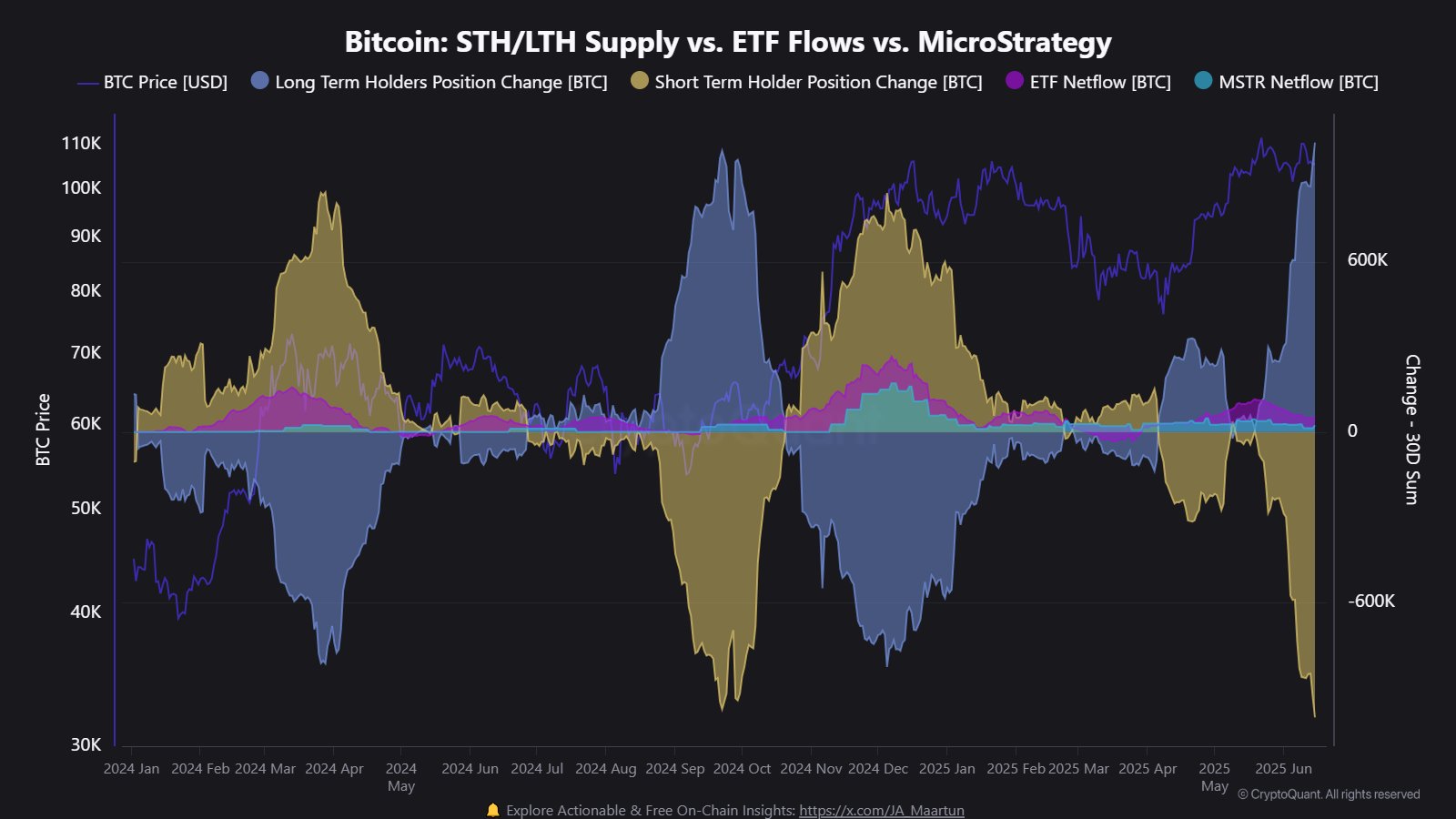

Here is a chart shared by analysts showing the trends in Bitcoin STH and LTH positions changing over the past year:

Looks like the LTH supply has witnessed a rise in recent weeks | Source: @JA_Maartun on X

As can be seen in the figure, Bitcoin LTH position changes have recently seen a sharp rise in positive areas, indicating that the supply held by the queue has experienced a rapid increase. More specifically, LTH supply has increased by 1.019 million in the past month. Naturally, the STH supply reduced the same amount.

Statistically speaking, the longer investors hold coins, the less likely they are to participate in the sale. Therefore, STH holding a lower holding time is considered a weak hand in the market, while diamond hands are considered a diamond hands.

Given that there is a recent trend in STH integration into LTHS, it seems that investors’ beliefs in cryptocurrencies have been strengthening.

Judging from the chart, it is obvious that the last time this trend occurred was in the integration stage in 2024. In the subsequent lateral period, Hodler’s accumulation was the rise of Bitcoin to a new all-time high (ATHS).

The rise in LTHS dominance is not the only signal that holders have long-term convictions. As the Link Analytics company pointed out in its X post, the accumulator address recently showed an accelerated demand for assets.

The trend in the demand of the Accumulator Addresses | Source: CryptoQuant on X

These addresses have zero sales history so far. That is, they only conduct incoming transactions, no outgoing transactions. As shown, these “permanent” holders have recently seen their needs follow a parabolic curve. “This signal is usually preceded by Bitcoin rally and reflects a long-term conviction,” CryptoQuant noted.

BTC price

At the time of writing, Bitcoin’s float is around $108,500, up more than 3% in the past 24 hours.

The price of the coin appears to have shot up during the past day | Source: BTCUSDT on TradingView

Featured images from dall-e, charts from cryptoquant.com, tradingview.com

Editing process For Bitcoin experts, focus on thorough research, accurate and impartial content. We adhere to strict procurement standards and each page is diligently evaluated by our top technical experts and experienced editorial team. This process ensures the integrity, relevance and value of our content to our readers.