Bitcoin miners’ sales pressure reaches its lowest level since 2024 – What happened?

After hitting a three-month high of $103,800 on Friday, May 9, the price of Bitcoin started slowly at the start of the weekend and then recovered to $014,000. Although the Prime Minister’s cryptocurrency continues to score more than $100,000, market participants seem to believe the coin can play a role in the fresh highs over the next few weeks.

Interestingly, Bitcoin miners have become increasingly reactionary since the fourth halving in 2024, and he also seems to have confidence in the price of BTC. The latest chain data shows that miners have been holding their assets in recent weeks, which coincides with the latest price rally of coins.

Are Bitcoin miners preparing for an extended rally?

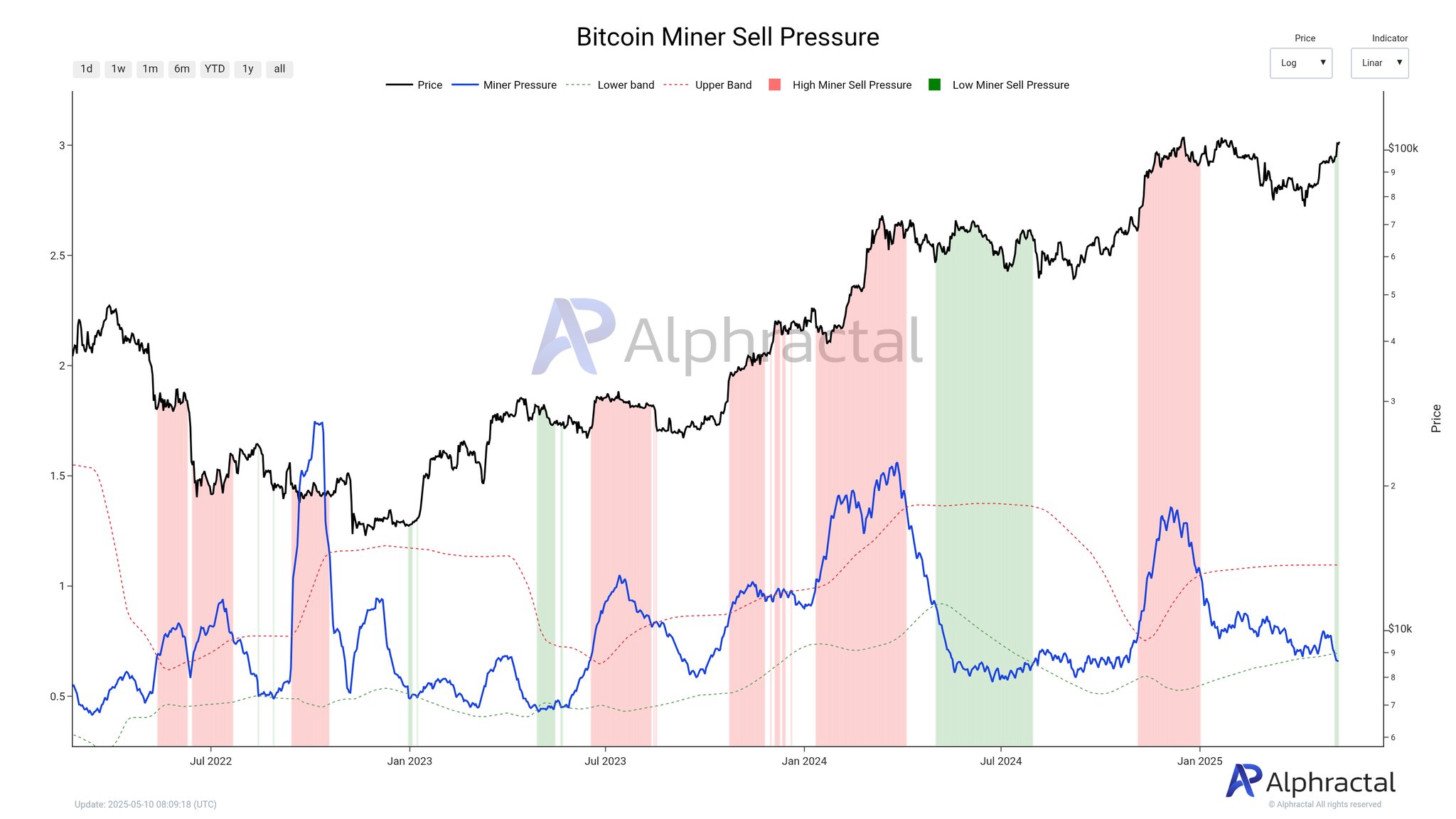

In a May 10 post on X, Crypto Analytics platform Alphractal revealed that Bitcoin miners are becoming increasingly active in the market, accumulating their mining rewards instead of selling them for profits. The relevant indicator here is the miner sales pressure indicator, which measures the sales intensity of Bitcoin miners during a given period.

The indicator compares the total BTC outflow of miners over the past 30 days to the average number of coins in reserves over the same period. Miner selling stress indicators can provide valuable insight into the behavior and emotions of relevant network participants groups.

In the highlighted chart, red represents high sales pressures between these Bitcoin miners and is often associated with a sluggish market condition. Green, on the other hand, reflects low sales pressure from miners, which may be a positive sign of Bitcoin prices.

Source: @Alphractal on X

As shown in the above figure, when the miner pressure moving average (blue line) crosses above (red line) (red line), the miner sales pressure measure enters the red territory, which is a signal strong bearish pressure from miners. Meanwhile, the miner’s pressure line crosses the lower belt (green line), which indicates that the miner’s sales pressure is low.

According to data provided by Alphractal, the miner pressure line recently crossed below the lower band, indicating that network miners have been sticking with their coins in recent weeks. The chain analysis company added that the metric is at its lowest level since 2024, as miners appear to be waiting for fresh highs for Bitcoin prices.

Although the Bitcoin market is mature, so miner sales won’t have much impact on prices, sales pressures from network participants may naturally be bullish for a long time. However, Alphractal noted that the market may see new sales interest as prices rise in the coming weeks.

The price of Bitcoin is clear at a glance

As of this writing, BTC is about $104,250, reflecting over 1% of the past 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured images from Istock, charts for TradingView

Editing process For Bitcoin experts, focus on thorough research, accurate and impartial content. We adhere to strict procurement standards and each page is diligently evaluated by our top technical experts and experienced editorial team. This process ensures the integrity, relevance and value of our content to our readers.