Bitcoin mining giant unloads $40 million in cryptocurrency

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

Morbi Pretium Leo et nisl aliquam Mollis. quisque arcu lorem, super quisque nec, ullamcorper eu odio.

esteartículo También Estádandousible enespañol.

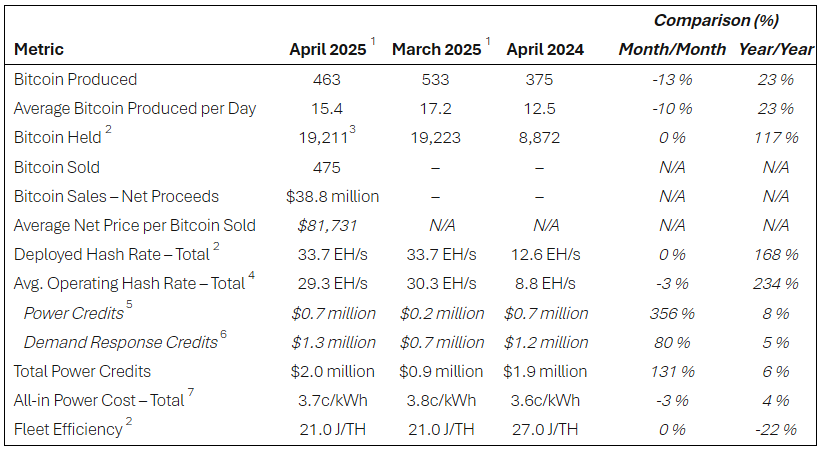

Riot Platforms sold 475 bitcoins in December, worth $38.8 million, as profit margins across the mining industry shrank. The Colorado company is the second largest publicly traded bitcoin miner, selling cryptocurrencies by market capitalization, with an average price of $81,731 per coin, an operational update Monday.

Related Readings

Mining profits narrow after Bitcoin halving event

The sell-off has been a year later since Bitcoin’s fourth halving campaign, where mining rewards have been halved. Now miners get 3.125 bitcoins per block, down from 6.25, with pre-programmed cuts occurring every four years or so. The self-adjusted cuts increase profit margins for mining operations, depending on continuous new token streams to increase expenses.

Riot Platforms mined 463 bitcoins last April, which, despite its same computing power, fell 13% from last month. The company mined the remaining 12 bitcoins from the reserves to complete the sale.

Source: Riot Platforms

CEO defends strategy as “reduce” shareholder dilution

Riot said throughout April that it sold its monthly production of Bitcoin to strategic choices for sustained growth and operations. Rice said the sale of Bitcoin could reduce the company’s need to raise funds by issuing new shares, which would dilute the ownership shares of current shareholders.

Riot announces production and operation updates for April 2025.

“Riot mined 463 bitcoins in April as the network experienced two consecutive difficulty adjustments this month.” @Jasonles_CEO of Riot. “April is a big month for Riot when we close the acquisition… pic.twitter.com/0csznh5fbm

– Riot Platform, Inc. (@RiotPlatforms) May 5, 2025

Even with the sell-off, Riot still retains 19,211 bitcoins on its balance sheet. The reserve is worth about $1.8 billion, and the current price suggests that the company has a large cryptocurrency holdings, even if it sells some cash.

As competition heats up, mining difficulty increases

The problems experienced by the riots reflect a broader trend in Bitcoin mining. As of May 4, the difficulty level of the network is to measure the difficulty of the new Bitcoin, which as of May 4, almost reached 1.20 trillion hashes.

As more miners compete for the same expenditure, each operation must increase electricity and equipment fees in order to accept Bitcoin. This competition limits profits across the industry, forcing the business to reevaluate its cash management practices.

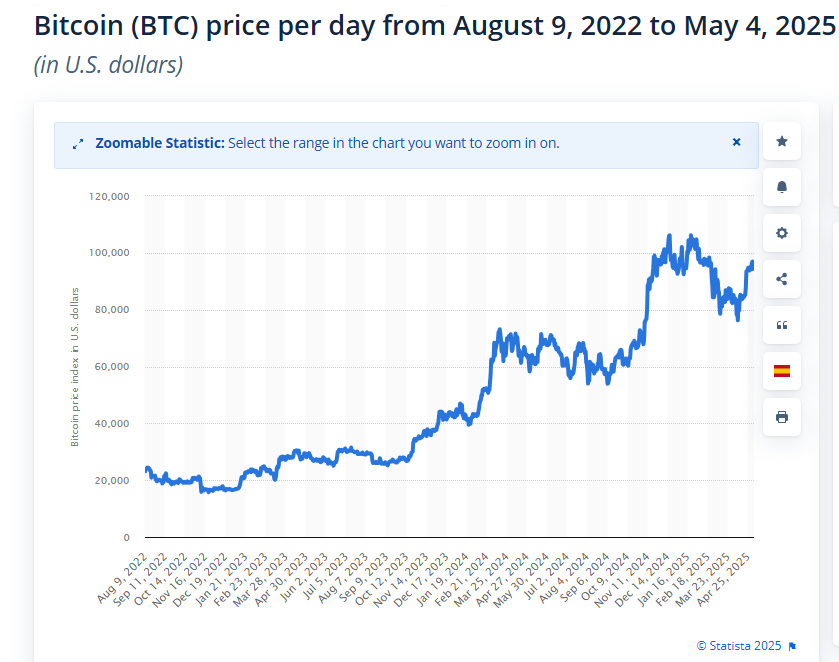

Source: Statista

Related Readings

While Bitcoin has risen 45% over the past year and has recently traded more than $95,000, it remains below its January peak of $109,000. This price retreat further stresses mining companies that have dealt with higher costs and lower output.

Riot’s move highlights Wightrope Bitcoin Miners Walk: They must balance short-term cash requirements and guess future price tags for the most popular cryptocurrencies. Currently, at least one large player chooses to buy cash upfront rather than future potential.

Featured images from Riot Platform, charts from TradingView