Bitcoin MVRV ratio forms bear cross-impact?

On-chain data shows that Bitcoin’s market value (MVRV) ratio forms a cross that can be considered a bearish signal.

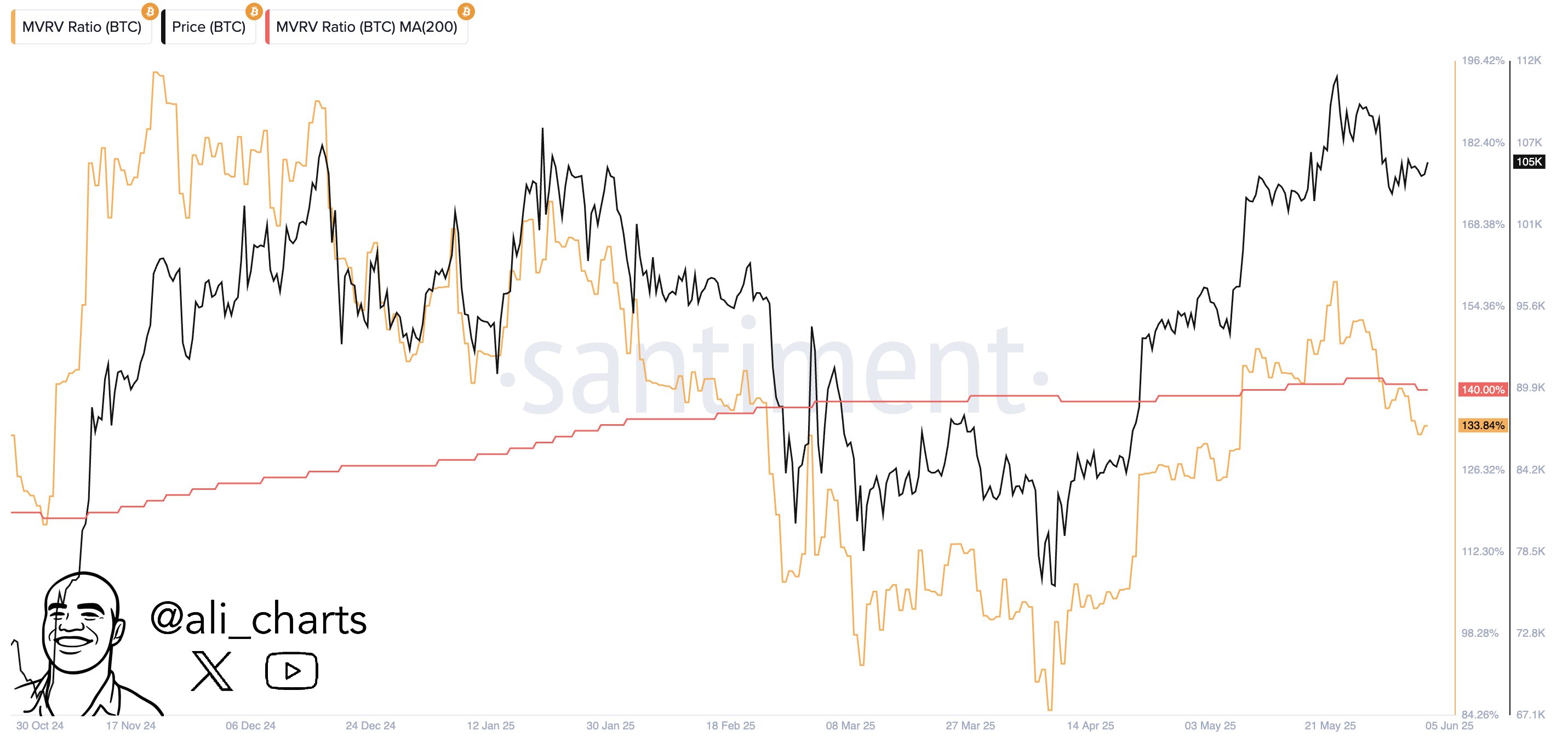

Bitcoin MVRV ratio has recently declined under 200-day SMA

As analyst Ali Martinez pointed out in a new post on X, the Bitcoin MVRV ratio recently crossed its 200-day simple moving average (SMA). “MVRV ratio” refers to a chain indicator that measures the ratio between BTC’s market value and the implemented upper limit.

The cap implemented here is the capitalization model of cryptocurrencies, which calculates the total value of asset supply by assuming that the “actual” value of each token is equal to the spot price that was last listed on the blockchain. This model is different from the usual market capitalization, which only equals the value of all tokens to the current price.

Since the last transfer of any coin may represent the last change of hand, the price at that time can be considered as the current cost basis. Therefore, the upper limit of implementation is only the sum of the acquisition prices of all tokens in circulation.

One way to explain the model is to measure the total amount of capital invested by investors in Bitcoin. On the other hand, as the holder is currently at the value of the market value.

Since the ratio of MVRV compares these two models, it basically tells us the overall investor’s profit loss situation. Below is a chart shared by analysts showing indicators over the past year and their 200-day SMA trend.

The two lines seem to have gone through a crossover in recent days | Source: @ali_charts on X

As can be seen in the figure, the Bitcoin MVRV ratio has been significantly higher than 0% recently, indicating that investors as a whole have been making considerable profits.

As assets gathered previously raised prices to an all-time high (ATH), the metric naturally raised and managed to exceed 200 days of MA. However, recently, the bearish twist in the coin means the indicator has lagged behind.

The last time the MVRV ratio dropped to 200-day SMA was in February. From the chart, it is obvious that this cross-border fact proves to be a bearish on cryptocurrencies.

Now, it remains to be seen whether the same type of crossover will prove another bad sign for Bitcoin.

BTC price

At the time of writing, Bitcoin was trading around $105,000, down 1% last week.

Looks like the price of the coin has rebounded from its latest plunge | Source: BTCUSDT on TradingView

Featured images from dall-e, santiment.net, charts from tradingview.com

Editing process For Bitcoin experts, focus on thorough research, accurate and impartial content. We adhere to strict procurement standards and each page is diligently evaluated by our top technical experts and experienced editorial team. This process ensures the integrity, relevance and value of our content to our readers.