Bitcoin price recovers upward momentum? These bitfinex desires may have answers

Bitcoin’s price has witnessed its fair share of corrections in recent days after reaching a new all-time peak last week. The Prime Minister’s latest performance reflects the exhaustion of seemingly bullish forces as the general market drops a certain downward pressure in the last week of May.

With the ongoing battle between the bull and the bear, there is no clear way to judge the next step in Bitcoin’s price. However, recent on-chain observations have shown that bullish activity on popular concentrated exchanges has increased, which provides insight into the short-term movement of market leaders.

“Reducing bitfinex longs may be beneficial for BTC momentum” – letters

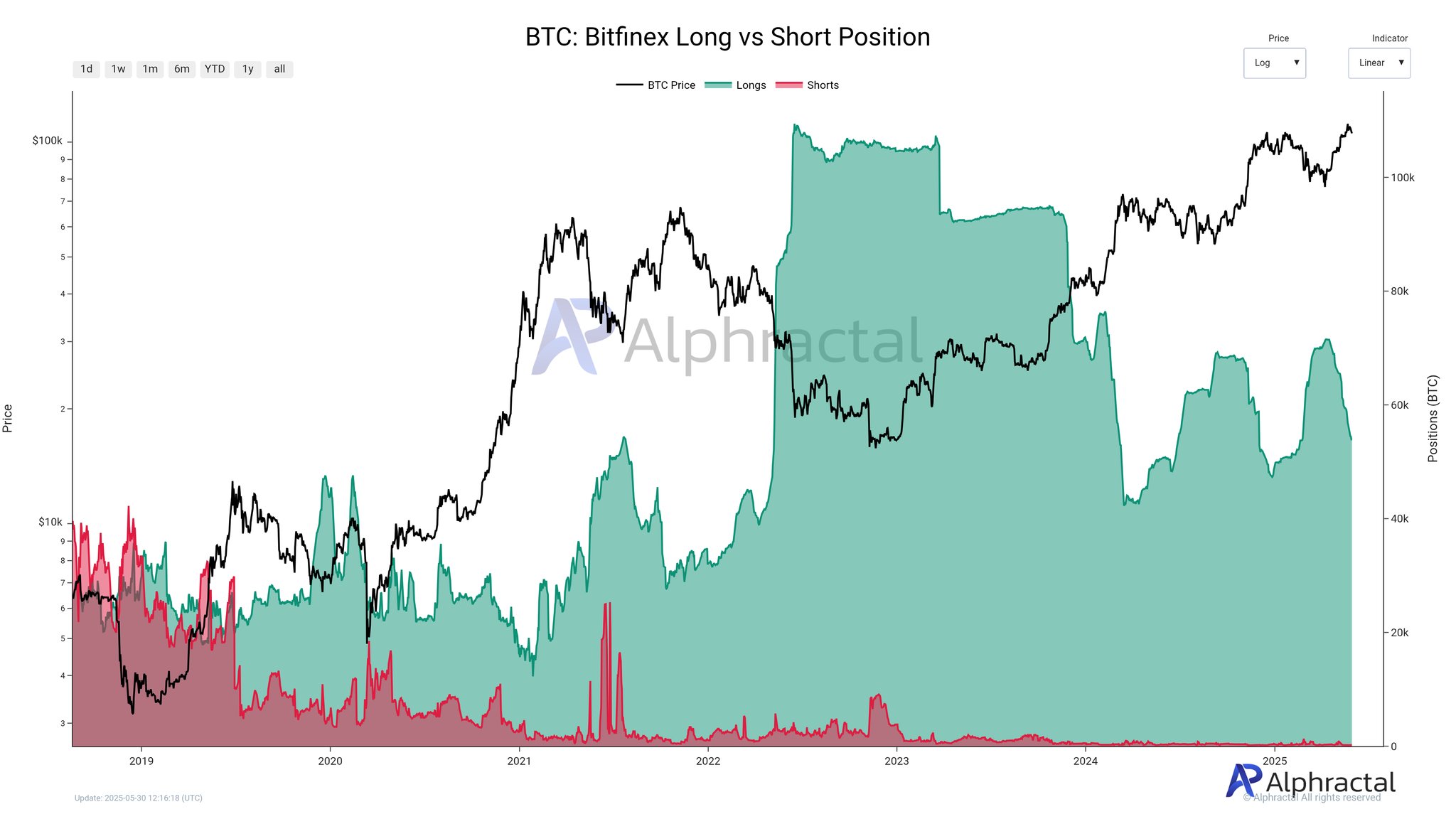

In a May 30 article on social media platform X, crypto analytics firm Alphractal digs into the relationship between long-term position on Crypto Exchange Bitfinex and the direction of Bitcoin’s price. This analysis is based on Bitfinex Long vs. Short position metric, which estimates the purchase ratio to the sale of cryptocurrencies (BTC in this case).

According to Alphractal, the price trajectory of BTC is inversely proportional to the relationship between the long-term position on Bitfinex. This means that if there are more long positions on the cryptocurrency trading platform, the likelihood of a price drop will increase. Meanwhile, long-term declines in exchanges may be optimistic about Bitcoin prices.

Analytical companies attribute this pattern to traders’ tendency is wrong to the actual trajectory of the market. According to Alpractal, these wrong price predictions ultimately lead to liquidation and forced position closures, which pushes the price of BTC in the opposite direction.

The chart above shows a decline in long positions and a low volume of short positions | Source: @Alphractal on X

Alphractal noted in a recent post on X that Bitfinex’s long position is falling and if this trend continues, the Prime Minister’s cryptocurrency may resume its upward running. On the other hand, if the metric rises above its current level, the Bitcoin price may be preparing for a serious pullback.

The price of Bitcoin is clear at a glance

As of press time, the Bitcoin transactions were trading slightly above $104,100, reflecting a decline of more than 2% over the past 24 hours. The flagship cryptocurrency has performed even more disappointingly over the weekly timeframe, losing more than 4% of its value over the past seven days.

The price of BTC drops beneath the $104,000 level on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured images from Istock, charts for TradingView

Editing process For Bitcoin experts, focus on thorough research, accurate and impartial content. We adhere to strict procurement standards and each page is diligently evaluated by our top technical experts and experienced editorial team. This process ensures the integrity, relevance and value of our content to our readers.