Bitcoin price surged by $30,000 in 30 days! What’s next?

Bitcoin’s price has soared by $30,000 in a month recently, indicating that the bull market has a high return rate. But as the excitement develops, it is necessary to take a step back and evaluate whether the rally is sustainable or whether we may be ahead of ourselves. Let’s break the current situation and what it means to investors.

Key Points

- The price of Bitcoin rose from $75,000 per month to nearly $106,000.

- Indicators indicate that potential cooling periods may be required.

- Historical data suggests that rapid price increases often lead to corrections.

- Monitoring key indicators can help measure market sentiment and future price movements.

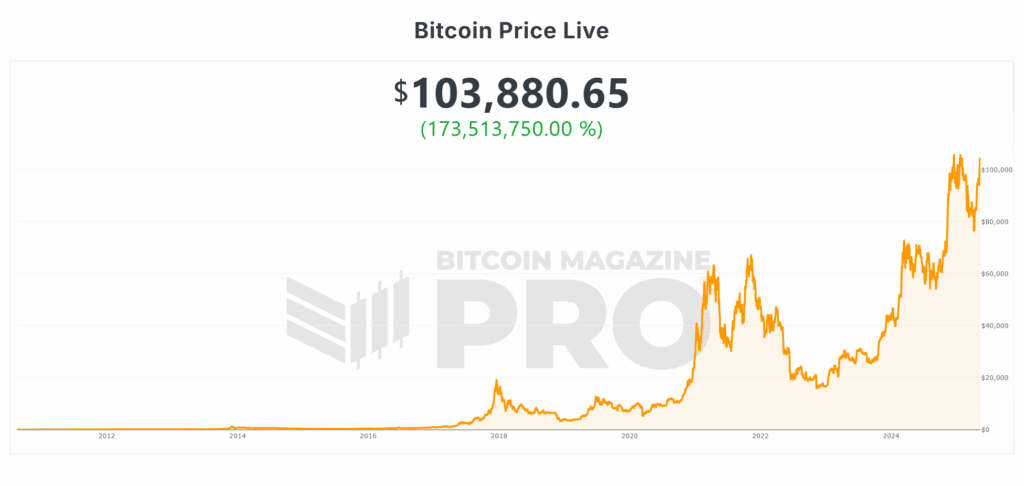

Recent Bitcoin price action

The recent Bitcoin price action is nothing more than spectacular. In about 30 days it increased from about $75,000 to $106,000. This movement is exciting, especially after a long period of lateral trading and downward trend. The market seems full of optimism, but we need to be cautious.

Bitcoin’s Fear and Greed Index

One of the first metrics to view is Fear and Greed Indexcurrently 70. This level indicates healthy greed in the market, but also increases red flags. When emotions are too positive, it usually leads to a callback.

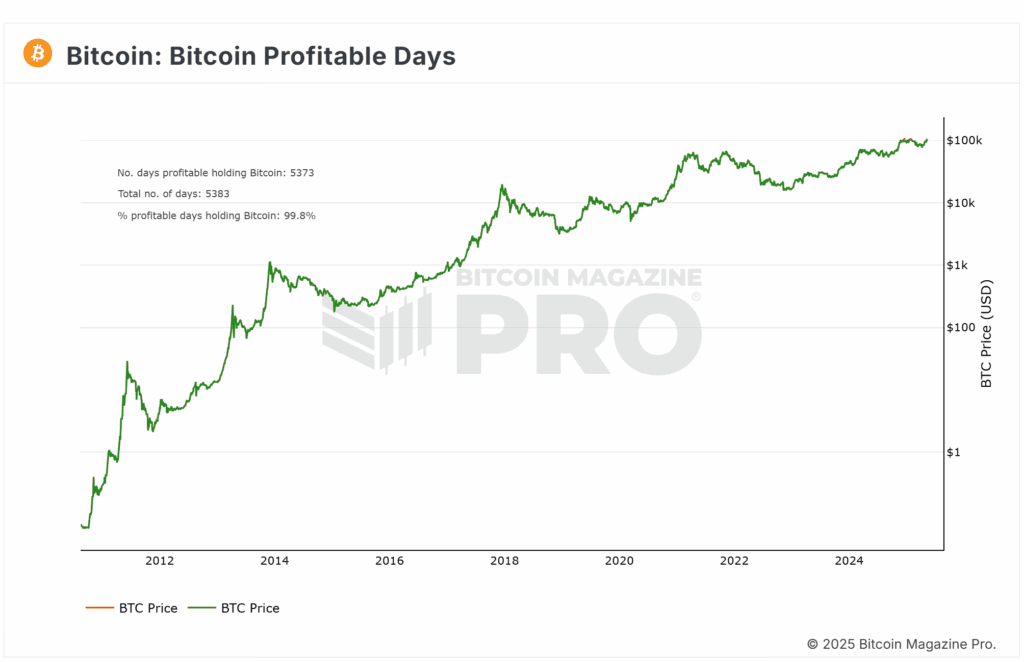

Bitcoin Profit Day Chart

Another encouraging sign is Bitcoin Profit Day Chartwhich shows that 99.7% of the days of holding Bitcoin is profitable. This is a strong indicator of market health, but it also shows that many investors sit on earnings, which can lead to profits if prices start to fall.

Bitcoin historical background

To put this assembly in perspective, we need to look at the time when the price of Bitcoin first reaches $30,000. It took more than 11 years to get there, but now we’re seeing similar price increases in just one month. This rapid rise often leads to corrections as the market tends to over-expand itself.

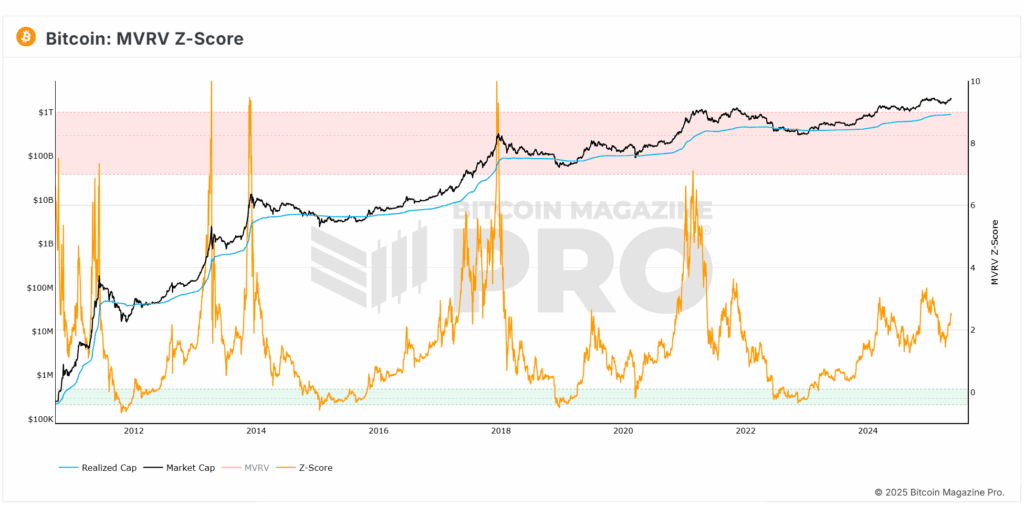

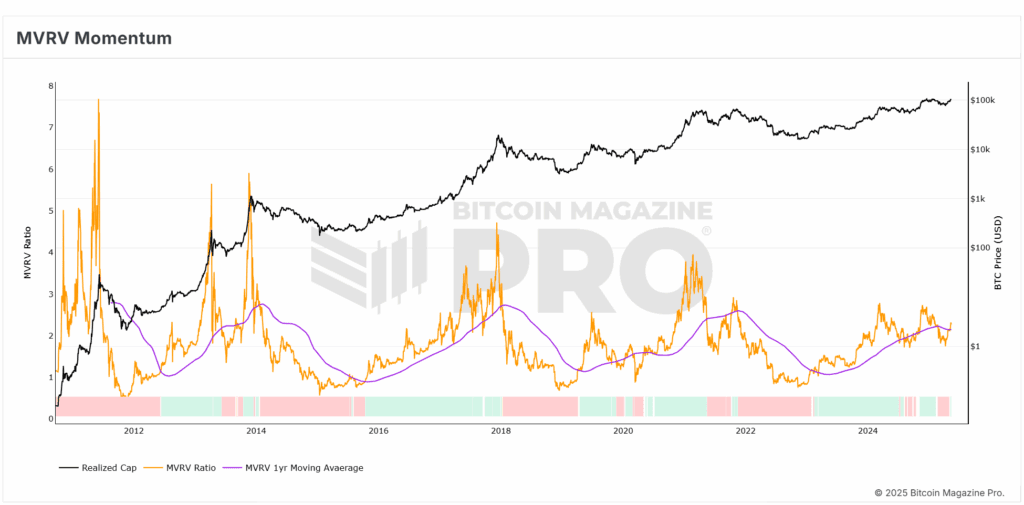

Bitcoin MVRV z score

this MVRV z score It is another key indicator. This score helps us understand whether Bitcoin is overvalued or undervalued based on historical data. Currently, we are approaching a key level that historically indicates potential callbacks. If we see rejection at this level, it may mark a cooldown period.

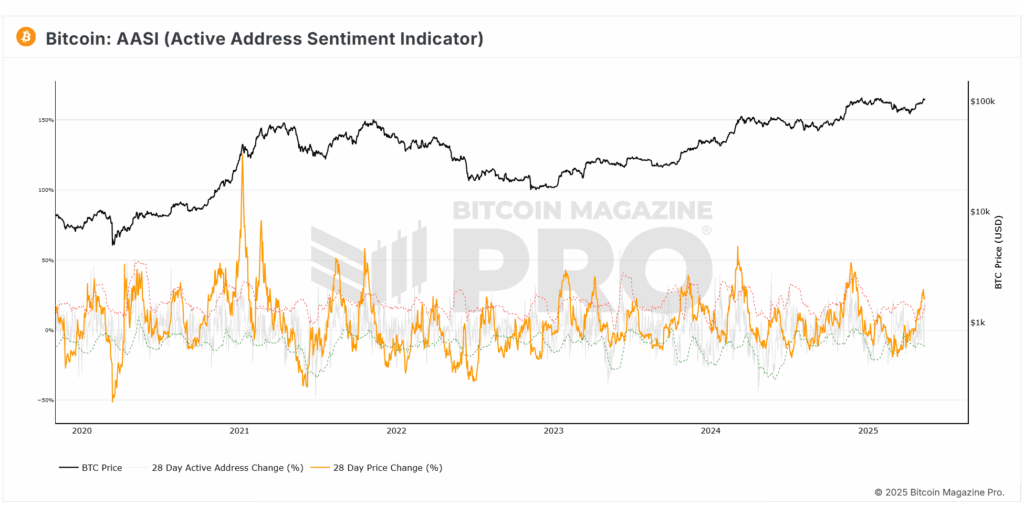

Bitcoin active address sentiment

Look Active address emotional indicatorsWe can see that when the price of Bitcoin rises significantly without corresponding active users increase, it usually results in unsustainable price levels. If we see prices rising but not rising in active addresses, it may indicate that the set will not be supported by strong fundamentals.

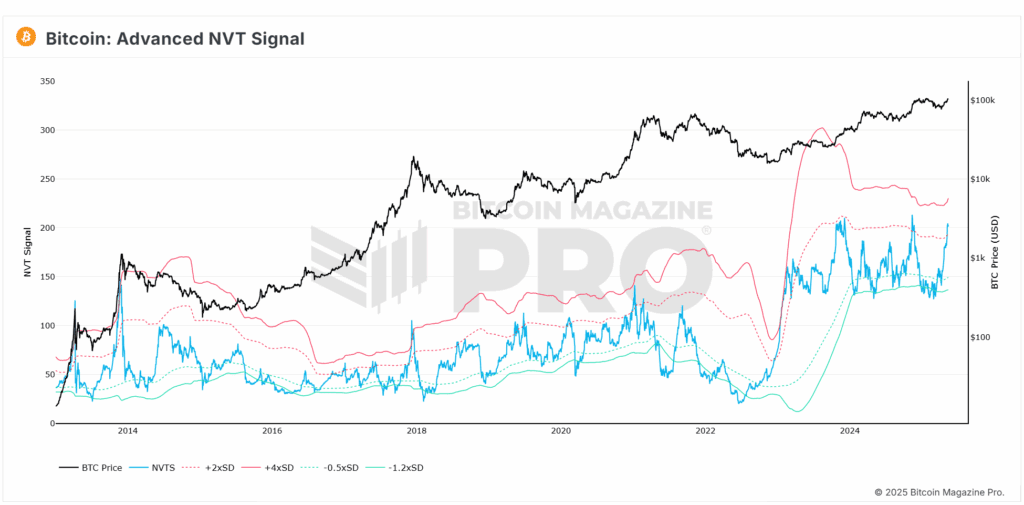

Bitcoin Advanced NVT Ratio

this Advanced NVT ratio Similar trends are also shown. When this ratio rises above a certain level, this indicates that the market may be overscaling. Historically, it was a sign of caution about entering a new position or making a lot of investments.

Technical resistance level

From a technical analysis perspective, we need to focus on key resistance levels. Recent price action hits the level of previous involvement of the seller, leading to the answer. If Bitcoin can hold over $100,000 and turn it into support, that would be a positive signal for future growth.

While the current bullish sentiment is exciting, it must be remembered that a slight pullback may be healthy for the market. The cooling period can reset expectations and can help inflows of new capital without over-expanding the market.

Bitcoin macro perspective

Despite short-term concerns, Bitcoin’s macro prospects remain strong. this MVRV momentum indicator It shows that we have retracted a significant moving average, which historically shows the beginning of bullish market conditions. This shows that while we may see some short-term volatility, the long-term trend is still rising.

in conclusion

All in all, the recent Bitcoin price rally is impressive, but we need to be cautious. Data shows that despite the strong market, corrections may be required. Investors should focus on data and avoid sweeping over it in excitement. A healthy pullback may lay the foundation for greater gains in the future.

As always, keep an eye on the indicators and be prepared for whatever way the market offers. Stay informed and don’t let emotions drive your investment decisions.

For more in-depth research, technical metrics, real-time market alerts, and access to the growing community of analysts, visit Bitcoinmagazinepro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Be sure to do your own research before making any investment decisions.