Bitcoin prices are currently at the intersection – below $100,000 or new cycle high?

Bitcoin continues to be one of the best performers of large assets, with value climbing nearly 25% over the past month. Even more out of reach, despite the slow market conditions in the past week, Bitcoin’s price still exceeds the six-figure valuation threshold.

After weeks of strong bullish action, the flagship cryptocurrency appears to have settled within the $102,000 to $105,000 merger range. Despite returning to its all-time highs throughout the market, Bitcoin prices currently appear to face some level of investors.

BTC prices may be preparing to sell

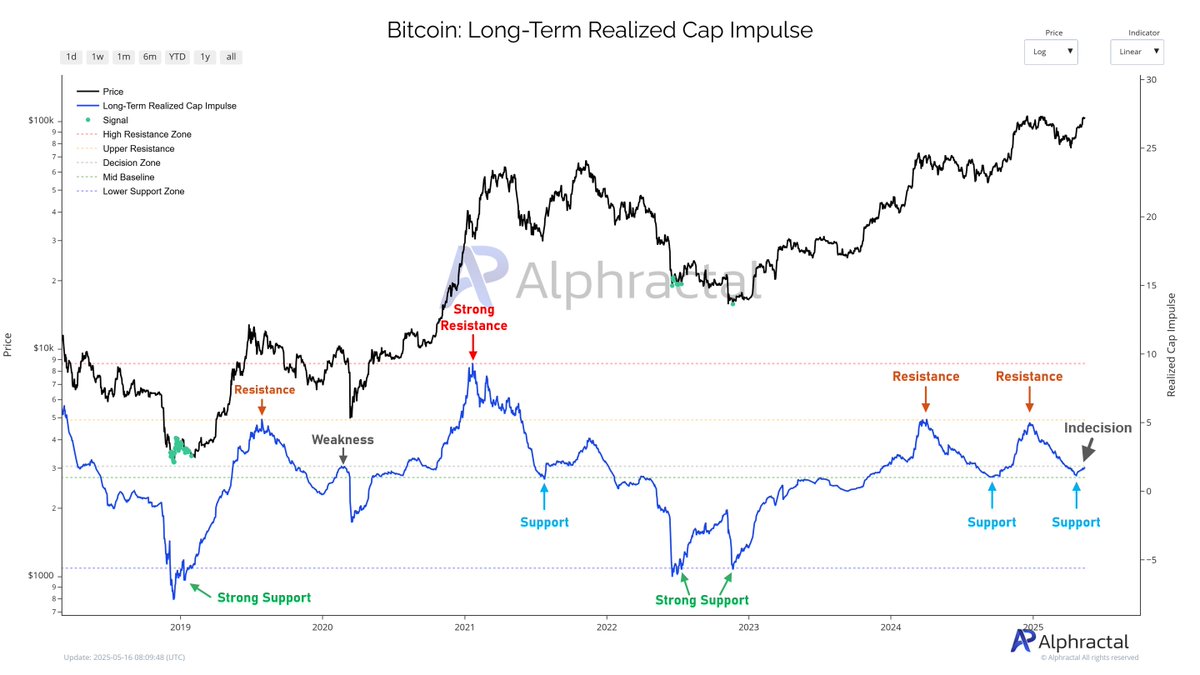

In an article on social media platform X on May 16, on-chain analytics firm Alphractal explained that Bitcoin prices are at a critical moment, which is crucial to its future trajectory. This on-chain evaluation is based on the long-term implementation of CAP IMPULSE, which measures the growth rate of capitalization achieved by long-term holders.

For clarity, the positive value of the long-term realized CAP IMPULSE signal shows that long-term investors are buying more BTC at higher value. This trend usually indicates that long-term holders are in accumulating mode at the beginning of a bullish period or at the beginning of a bull market.

On the other hand, when the long-term realized CAP IMPULSE indicator is negative, this means that the long-term holder unloads the coins at a price below the cost base. This is usually seen in late bull cycles and early bear markets where long-term investors are allocating their assets.

In addition, the long-term realized CAP IMPULSE indicator provides insights into Bitcoin supply and demand dynamics, highlighting the major support and resistance areas. As shown in the chart provided by Alphractal, the price of Bitcoin is at a critical point marked with a horizontal line called the Indecisive Level.

Source: @Alphractal on X

The market intelligence company noted that the breakthrough of the CAP IMPULSE indicator from this level could prove key to Bitcoin’s long-term health, with continued strong demand and potential price appreciation.

However, the letters are related to the level historical relevance, and noted that the long-term implementation of the upper limit pulse pulse indicator was rejected before the Covid-19 dump in March 2020 and indecisive areas in March 2020. If any historical precedent is to be taken, investors may want to be aware of any rejection at this level, which could cause a significant sell-off.

The price of Bitcoin is clear at a glance

As of this writing, BTC’s price is around $103,713, reflecting 0.6% of the past 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured images from Istock, charts for TradingView

Editing process For Bitcoin experts, focus on thorough research, accurate and impartial content. We adhere to strict procurement standards and each page is diligently evaluated by our top technical experts and experienced editorial team. This process ensures the integrity, relevance and value of our content to our readers.