Bitcoin Random RSI Signal Brewing Bullish Momentum

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

Morbi Pretium Leo et nisl aliquam Mollis. quisque arcu lorem, super quisque nec, ullamcorper eu odio.

esteartículo También Estádandousible enespañol.

Bitcoin (BTC) has soared 14.6% over the past two weeks, from about $84,500 on April 18 to the $90,000 range at the time of writing. With this upward momentum, the leading cryptocurrency appears to be turning its sights to new all-time highs (ATHs), as several technical and momentum indicators hint at an increasing number of bullish trends.

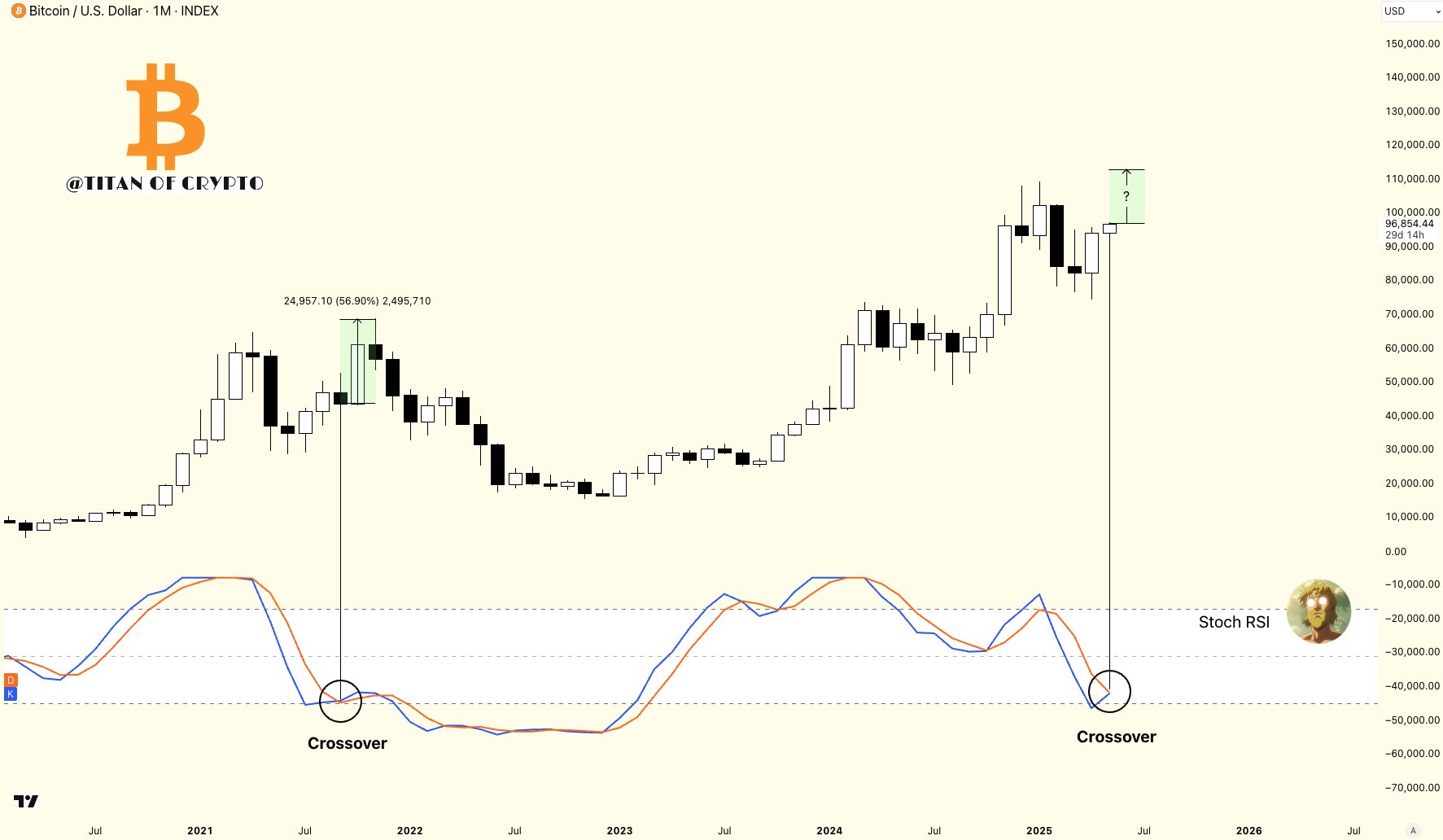

Bitcoin’s monthly random RSI turns bullish

In the latest article on X, cryptocurrency cryptocurrency analyst Titan shared the BTC monthly table, indicating that the Random Relative Strength Index (RSI) is in a bullish crossover.

For uninspired people, a random RSI bullish crossover signal is rising upward, often interpreted as a potential buy signal or the beginning of a potential rally. Crypto’s Titan added that if confirmed, the bullish crossover could kick off the next leg of BTC.

Related Readings

For example, analysts mentioned BTC’s price action on the monthly chart for the third quarter.

However, Bitcoin must remain above key support levels to maintain this bullish structure. In another X post, well-known analyst Ali Martinez pointed out that BTC could retest the $95,700 support zone before it could be promoted to the $100,000 milestone.

On the resistance, Martinez stressed that $97,530 remains a “key level.” one A successful breakthrough Beyond this threshold, it can pave the way for BTC to revisit or surpass its previous ATH. For now, Bitcoin is trading below its record high of 10%.

Analysts predict the next step in BTC

Crypto analyst Rekt Capital also weighs BTC Potential trajectory. In an X post published yesterday, he suggested that it could face a refusal to approach $104,500 once BTC decisively breaks the $97,000 to $99,000 zone. After this, putting the $97,000-$99,000 range as support is crucial for BTC to launch new highs.

Related Readings

Similarly, analyst TED pointed out that BTC is currently trading in the Wyckoff accumulation phase. The analyst added that BTC had a slide below $76,000 in early April, which could be the lowest point in the market cycle. He added:

Judging from Wyckoff’s accumulation mode, it seems that the $96K-$99K level can be used as a resistor. I think BTC can merge here for a few days and then eventually break into the upside.

Despite the bullish momentum, there are still some concerns. Analyst warn The Bitcoin is unlikely to face a real supply shock in the near future, which could reduce the upward potential. At press time, BTC traded at $97,142, up 0.9% over the past 24 hours.

Featured Images Created with Unsplash, Charts for X and TradingView.com