Bitcoin returns $109,000, but Hodler’s profits drop 89%

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

Morbi Pretium Leo et nisl aliquam Mollis. quisque arcu lorem, super quisque nec, ullamcorper eu odio.

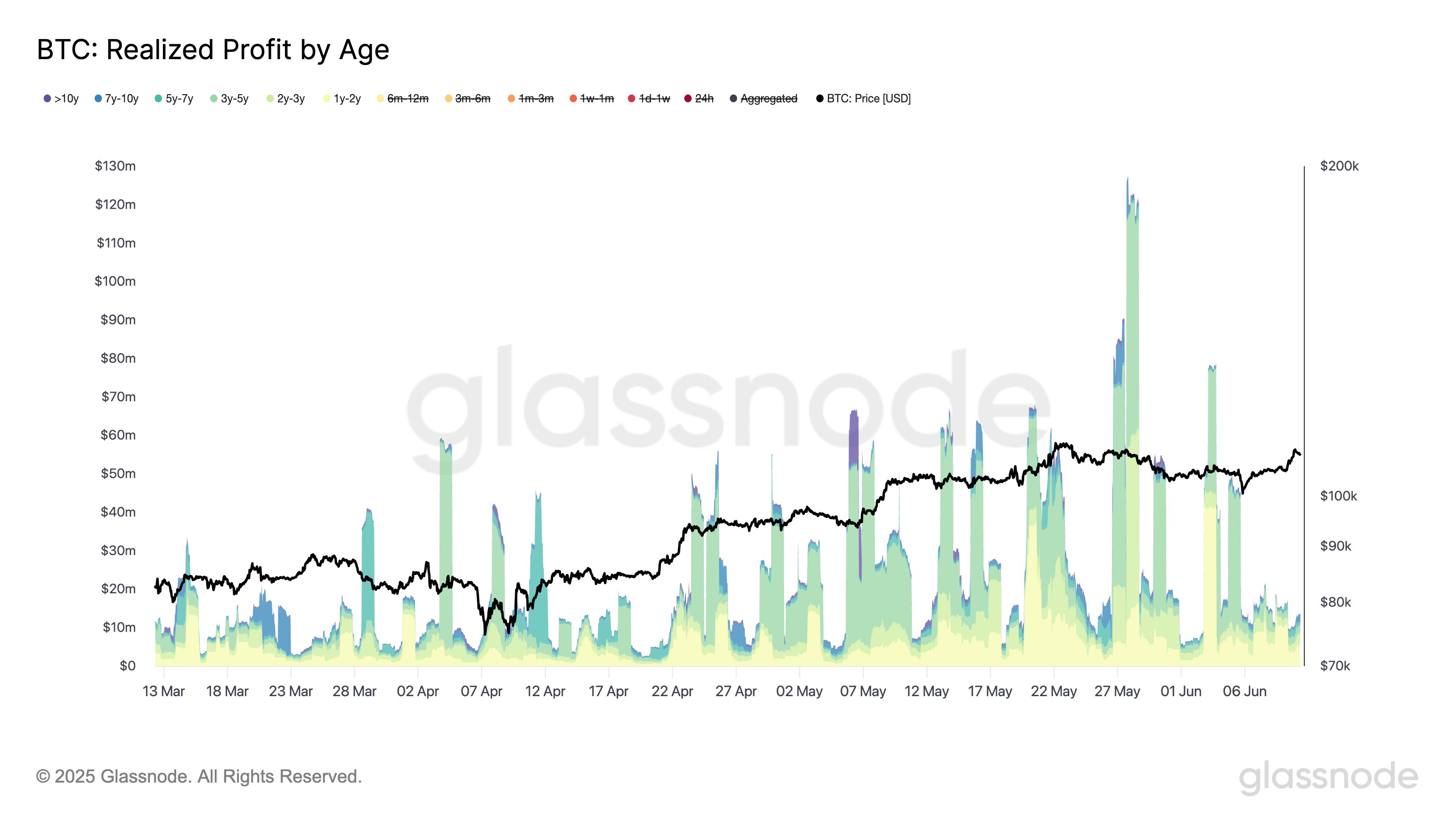

On-chain data shows that despite similar prices, veterans in the Bitcoin market have reduced profits by 89% from the May peak.

Bitcoin achieved 1Y+ lots of profit now relatively low

In a new post on X, the chain analytics firm GlassNode talks about the latest trends in realizing profits in experienced hands on the Bitcoin network. “Achievement of Profits” refers to the indicator as the name implies, and its name implies the amount of profits achieved by BTC investors through sales.

The indicator is to view the price proposed before this by browsing the transfer history of each coin on the chain or “for sale”. If the value of the previous sale is lower than the current price of any token, the sale of a particular token will result in a profit realization.

Related Readings

The amount of profit realized in a sales is naturally equal to the difference between the two prices. The realized profit sums up this value to transfer all tokens to find the total number of the entire network.

In the context of the current theme, the realized profits of the entire user base are not of interest, but only a specific part of it: a holder of more than 1 years. These investors have been sticking to their coins for more than a year, and have not even traded once.

Statistically speaking, the longer an investor holds their tokens, the less likely it is to sell them in the future. Therefore, this part of the user base and its large amount of holding time will include diamond hands on the market.

Now, here is the chart shared by GlassNode that shows the profits of Bitcoin achieved these Hodlers over the past few months:

As shown in the above chart, Bitcoin achieved profits from investors for more than one year and observed a surge in late May. This huge profit orgy in these experienced hands is soaring to $110,000 after BTC’s posts’ highest all-time (ATH) pullback.

Shortly after the queue sold out, BTC began to decline. However, over the past day, the asset seems to have finally gotten rid of this bearish momentum as it returns again at $109,000.

However, there was no major reaction from the Diamond Hand this time. Currently, the group has realized profits of $13.6 million, down 89% from its $126 million peak last month.

Related Readings

Veterans in the market may think there is more to the latest Bitcoin rally, so they chose Hod Strong.

BTC price

At the time of writing, Bitcoin has floated about $109,100, up more than 2% over the past seven days.

Dall-E, Featured Images of GlassNode.com, Charts of TradingView.com