Bitcoin shorts were wiped off – Is the fuel for the rally or the highest signal?

Data shows that Bitcoin short liquidation has recently exceeded the longer liquidation. Is this shocking?

Bitcoin clearing oscillator is currently in negative zone

In a new post on X, crypto writer Axel Adler JR provides an overview of the futures market from the perspective of clearing the dominant oscillator. “Liquidation” refers to the powerful closure that any open contract will be subject to after accumulating a certain degree of loss (as defined by its platform).

Naturally, this happens after the price drop (bulking bet) of long-term contracts, while in a brief case (bearing bet) surge. The risk of these contracts being liquidated increases the leverage ratio chosen by investors.

The dominant oscillators of liquidation compare the long and short liquidations that occur throughout the department and represent their balance as 0% marks nearby oscillators.

Below is a chart of the oscillators shared by analysts showing the trend of its 30-day moving average (MA) values over the past few years.

The value of the metric appears to have been negative in recent weeks | Source: @AxelAdlerJr on X

As can be seen in the figure, the 30-day MA temporary oscillator for Bitcoin clearing has recently had negative values, indicating that the shorts observed clearing is more high.

This advantage of short-term clearing already exists as cryptocurrencies have reached new all-time highs (ATH). Judging from the chart, it is obvious that similar trends have been witnessed in past gatherings.

Often, large-scale liquidation incidents involving shorts help support upward space. But, as analysts highlight in the graph, the extreme dominance of short-term liquidation means that Bitcoin’s overheating conditions, with its price reaching the top beside it.

However, for the moment, the indicator sits at “Just” -11.5%. The rating at the end of 2024 saw that the measure reached a peak negative of -16.5%. Likewise, it reached -19% in April 2024 and -24% in January 2023.

“So, despite the recent pullback, the bullish momentum remains intact – there is no such “overheating” that can trigger a sharp reversal.”

In some other news, link analytics firm GlassNode reveals in X post how the Bitcoin network has been biased towards institutional engagement over the past six months.

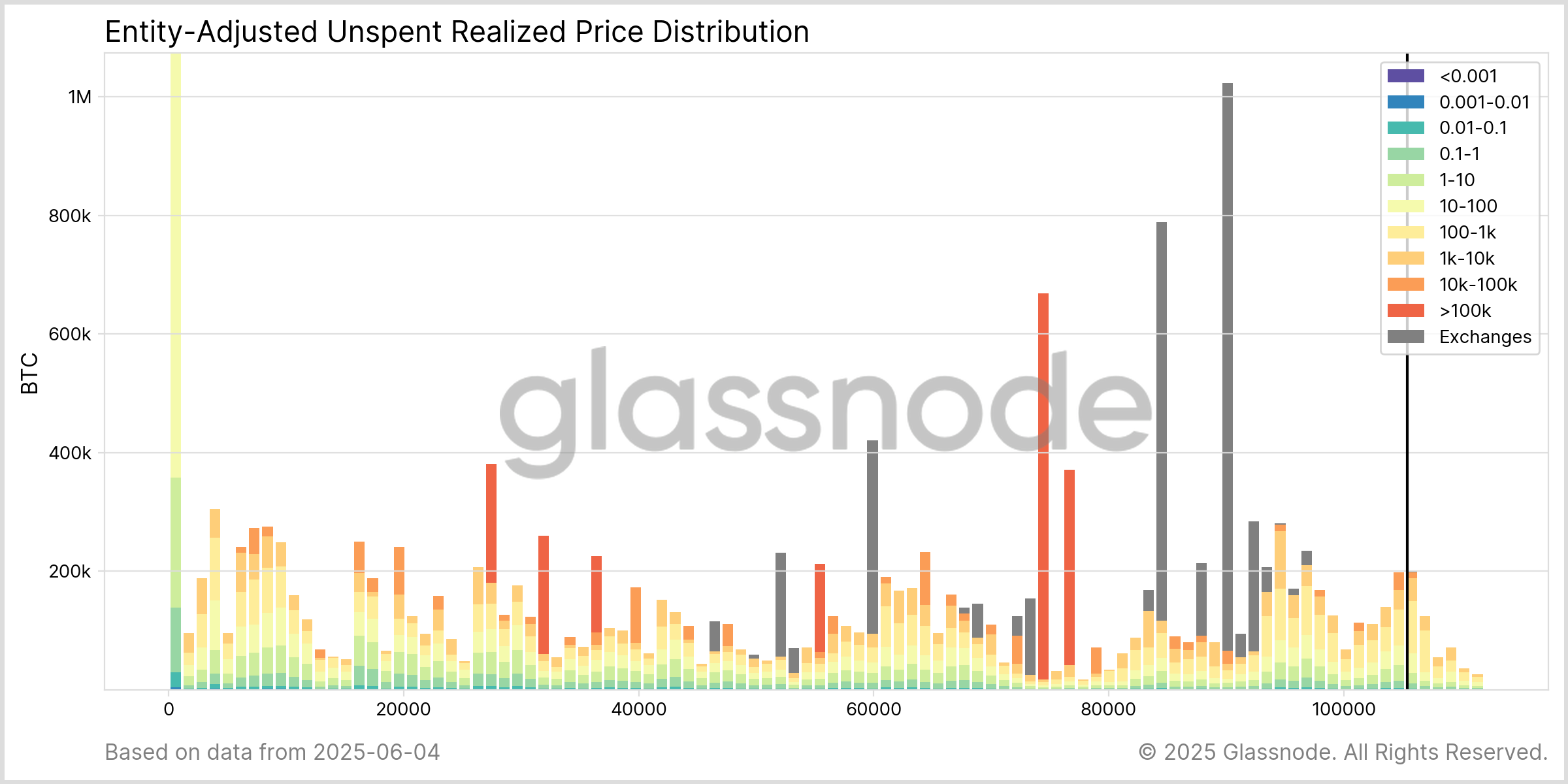

The metric shared by GlassNode is an unimplemented price distribution (URPD), which tells us what price level the cryptocurrency supply was last purchased.

The current entity-adjusted URPD of the asset | Source: Glassnode on X

As the analysis company explains,

Activities over $90k are led by 100-10k $btc holders. Wallet > 100k $btc is most concentrated in $74K – 7.6k, the Big Whale (10k – 100k) is priced at 78k – 79k, 85k – 90k $85k – 90k, and is close to current levels.

BTC price

Bitcoin has remained at around $104,800 in the past few days.

The trend in the BTC price during the last month | Source: BTCUSDT on TradingView

Dall-E, GlassNode.com, Featured Images of cryptoquant.com, TradingView.com Charts

Editing process For Bitcoin experts, focus on thorough research, accurate and impartial content. We adhere to strict procurement standards and each page is diligently evaluated by our top technical experts and experienced editorial team. This process ensures the integrity, relevance and value of our content to our readers.