Bitcoin’s price could hit $159,000 in this cycle – Crypto analysts reveal how

Bitcoin’s price efforts maintain its 2024 momentum in the first quarter of 2025, collapsed under U.S. macroeconomic uncertainty. While the cryptocurrency market looks set to continue to struggle in early April, prices are looking to recover their cyclical highs due to improved market atmosphere.

Bitcoin prices so far so far have risen by more than 25%, outperforming most large assets in the same period, according to recent price action data. Interestingly, the major cryptocurrencies seem to have more room for further growth, and the current high prices seem to be the next direct target.

Watch the three important levels of Q2

In an article on X Platform on May 17, Chain Chain analyst Burak Kesmeci evaluated the potential of Bitcoin prices for the remaining weeks of the second quarter. Crypto experts reveal three levels in his latest analysis, which are crucial to the price trajectory of BTC.

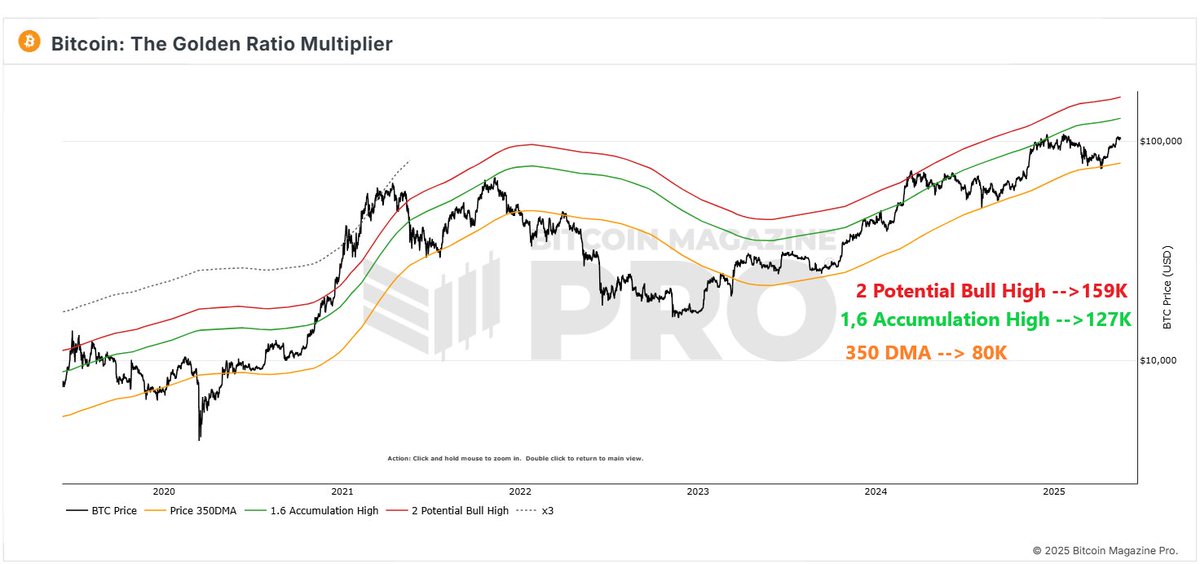

The relevant indicator here is the gold multiplier ratio, which is mainly used to track cyclical price behavior and determine important price levels. This technical analysis tool applies Fibonacci-based multiplier to the 350-day moving average (350DMA) to identify potential price tops and bottoms.

Kesmeci identified the $127,000 and $159,000 levels as the resistance areas to be watched in this bull rally. Specifically, the $127,000 level is consistent with the 1.6x multiplier that moves 350 days Average, this is one The previous mid-term high in bulls running.

Source: @burak_kesmeci on X

On the other hand, the $159,000 level is related to the 2x multiplier of 350DMA and issuing a flag at the top of the loop from history In the BTC market. However, if there is a chance to rally towards the $159,000 level, the Bitcoin price will need to successfully violate the top of the mid-cycle.

Additionally, Kesmeci pointed out the most important level of support in order to watch Bitcoin prices for the rest of the second quarter. Based on the gold multiplier ratio, this mat is around the 350-day moving average, and long-term accumulation usually occurs. The decline under this support may invalidate the bullish theory currently held at BTC.

Finally, Kesmeci notes that the gold multiplier ratio is based on the moving average, so the highlighted level will change as the price of Bitcoin moves in the coming days.

The price of Bitcoin is clear at a glance

As of this writing, BTC’s value hovers around $103,275, with no significant price transfer in the past 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured images from Istock, charts for TradingView

Editing process For Bitcoin experts, focus on thorough research, accurate and impartial content. We adhere to strict procurement standards and each page is diligently evaluated by our top technical experts and experienced editorial team. This process ensures the integrity, relevance and value of our content to our readers.