Bitcoin’s violent bull indicator reopens, but this level retains the key

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

Morbi Pretium Leo et nisl aliquam Mollis. quisque arcu lorem, super quisque nec, ullamcorper eu odio.

esteartículo También Estádandousible enespañol.

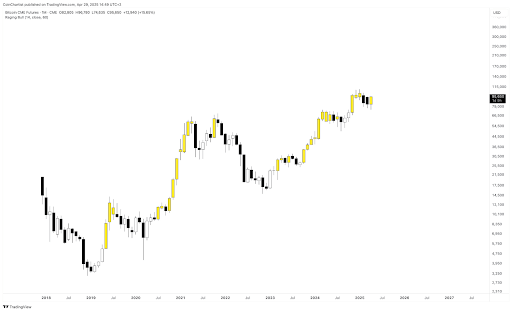

Bitcoin keeps moving forward Show signs of elasticity In this $95,000 region, it has pushed higher from its recent lows and attempted to restore its vulgar structure amidst the turbulent April situation. The April monthly candlestick in the CME futures chart currently shows a strong bullish sanction formation, which can provide the market with bullish momentum that can end with another bullish candle if maintained.

The potential of this bullish close relative is enough Swing emotions Bearish supporters, according to crypto analyst Tony “The Bull” Severino.

Fierce bull tool flashes signal on CME futures

Bitcoin price action In the past two weeks It has been positive and has seen a gradually fading bullish sentiment slowly recovering among cryptocurrency traders. Interestingly, this price action even saw the net income of Bitcoin Become positive This is the first time in a while. Although this trend is still in its early stages, new strength has begun to soften some of the more bearish outlooks, especially as key indicators begin to turn.

Related Readings

Tony “The Bull” Severino, a stable crypto analyst, Revealed recently Social media platform XX, his proprietary “Angry Bull” metric has been reopened. However, this indicator is only open on the Bitcoin CME futures chart, not the spot BTC/USD chart.

The difference between CME futures and spot charts only adds to the complexity of Bitcoin’s current outlook in the flashing signal of the former. The Raging Bull tool using weekly price data is designed to identify early stages of powerful upward movement. According to Severino, the emergence of the signal, although he cannot see, indicates that a meaningful shift in the market structure may be developing. However, he quickly added that it is still necessary to make a weekly end of confirmation before any definite conclusions are drawn.

Beyond this level is the key

The bullish swallowing candlestick is clearly visible after a sharp rebound below $83,000 in April when researching monthly charts shared by analysts. Bitcoin started in April and was about $83,000, but it fell rapidly In the first few days Push the price down until it bottoms out at around $75,000. However, the current April candle not only eliminates the losses in March, but also indicates an increase in interest in Bitcoin among institutional traders on the CME platform.

Related Readings

Despite this, despite the encouraging candlestick group, Bitcoin must decisively surpass the $100,000 region of $96,000 to $100,000, while previous uptrends have stalled. This level is a ceiling that determines the recent bullish momentum Continue or booth. Failure to exceed this range within the weekly or monthly time range may invalidate the violent bull signal.

Additionally, the angry bull indicator needs to retreat on the spot BTCUSD chart to confirm the strong bullish outlook. Only in Bitcoin manages to go a long way over $96,000.

At the time of writing, Bitcoin trades at $94,934.

Featured images from Pixabay, charts from TradingView.com