Blockchain Group Receives EUR 8.6 million to Improve Bitcoin Strategy

The blockchain group (ALTBG) listed on EuroNext Growth in Paris and known as the first Bitcoin Finance Ministry company in Europe, announced that it has driven a capital increase of approximately €8.6 million due to its Bitcoin Finance Corporate strategy. The funds are made through two operations, retained capital increase and private placement, with the price of two shares at €1.279 per share.

This price represents a 20-day average share price premium of 20.18%, while the closing price on May 19, 2025 was discounted at 46.26%, reflecting the recent high share price volatility.

“The company’s board of directors decided on May 19, 2025 to use the authority granted by the shareholders’ meeting on February 21, 2025, under the terms of its fifth resolution, in the issuance, the company has no pre-share shareholder rights, at a price of 3,368,258 Company at a price of 3,368,258 Company at a price of 3,368,258 Company at a price of 3,368,258 Euros, including 1.2790 Euros, including 1.2790 Euros, including 1.2790 Euros, including 1.2790 Euros, including 1.2790 Euros, including 1.2790 Euros, including 1.2790 Euros, including 1.2790 Euros, and the company’s stock authority is shareholders. Prior to the decision of the company’s board of directors, the weighted average of the twenty-twenty-share stocks increased by the Paris European Text was 20.18%, corresponding to 4,308,001.98 Euros.”

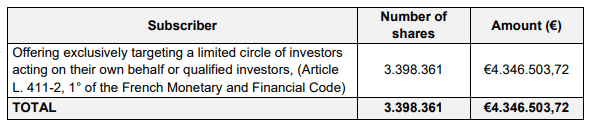

In retained capital growth, 3.37 million shares were issued to selected investors, including Robbie van den Oetelaar, Tobam Bitcoin Treasury Opportunity Fund and Quadrille Capital, raising more than 4.3 million euros. The private location raised an additional €4.35 million by issuing 3.4 million shares, aiming at qualified investors.

“The board also decided to implement limited investors by targeting limited investor representatives or qualified investors without providing shareholders with preemptive rights,” the release said.

The funds will support the blockchain group’s ongoing strategy to accumulate Bitcoin and expand its subsidiary in data intelligence, AI and decentralized technologies. As capital grows, the company’s equity is 4.37 million euros, divided into more than 109 million shares.

“The funds raised through capital growth will enable the company to strengthen its Bitcoin fiscal corporate strategy, including the accumulation of Bitcoin, while continuing to develop the operating activities of its subsidiaries,” the release said.

In addition, on May 12, the Blockchain Group announced that it had received approximately €12.1 million through the issuance of convertible bonds reserved for BlockStream CEO Adam Back.