Capitalists say cryptocurrencies have no ceiling on value than the dollar

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

Morbi Pretium Leo et nisl aliquam Mollis. quisque arcu lorem, super quisque nec, ullamcorper eu odio.

esteartículo También Estádandousible enespañol.

The dollar is weakening this year. The dollar index reportedly fell by just 7% year-on-year, one of the worst vacancy in its recent history.

The U.S. dollar index measures the value of the U.S. dollar to six other major foreign currencies. As tensions in the U.S. and several countries in trade have intensified, concerns about the long-term strength of the dollar have begun to emerge.

Related Readings

Bitcoin has attracted more attention from investors

As the dollar weakens, more and more investors see Bitcoin as a potential hedge. Venture capitalist Tim Draper said Bitcoin could be an insurance policy for failed Fiat currency.

He believes that the value of digital currencies relative to the US dollar will continue to be appreciated, especially as international confidence in fiat currencies declines.

In his comments on the X platform, he said that Bitcoin “may be worth unlimited dollars.”

Bitcoin may be worth unlimited dollars.

During the Civil War, the Confederate Dollar in the South experienced excessive inflation.

After 1:1 from the dollar, the war ended with more than 10 million to 1.

People lost confidence and scrambled to trade cash into US dollars.

But now… pic.twitter.com/qrtekl4vku

– Tim Draper (@timdraper) May 1, 2025

Draper likens the current surge in Bitcoin to changes in monetary behavior. He noted that in times of uncertainty, individuals will transfer their funds to assets that make them safer.

Although gold has played the role before, Draper said Bitcoin has begun filling the position due to its digital format and convenience.

The metaphor of the Civil War era attracted people’s attention

To illustrate his argument, Draper mentioned American history. He cites the United States’ allies, which had printed its own banknotes during the Civil War in 1861.

Initially, it had a ratio of 1:1 to the US dollar. But at the end of the war, the US dollar of the Allies had collapsed, and compared with the US dollar, the exchange was 10 million to 1.

Draper explains this how quickly money collapses when it loses trust. He warned that something similar could happen again if individuals, businesses and even governments lose confidence in the stability of the current system. He believes that Bitcoin will profit from this change.

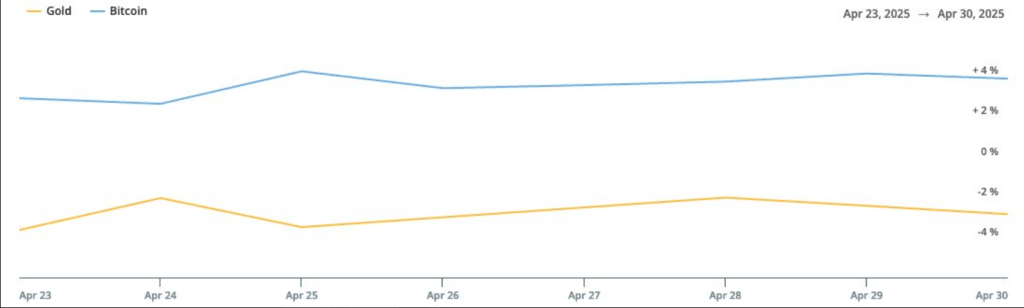

Bitcoin and gold in a changing market

Gold is usually the first haven with financial pressure, but Draper thinks it is no longer number one. He pointed out that gold has huge storage fees and physical movement issues. However, Bitcoin is a purely online presence that can easily be quickly transferred across the border.

Related Readings

He also said that Bitcoin has special advantages such as limited supply and autonomy from central banks, which makes it more attractive than traditional assets.

Draper explained that these characteristics are becoming increasingly difficult to ignore as the global financial system is under greater pressure.

The government begins to pay attention

Draper claims that even some governments are trying to find out whether Bitcoin reserves should be retained. This marks a changing way of perception of cryptocurrencies, not only among private investors, but also among public institutions.

Featured images from Unsplash, charts for TradingView