ChainLink sees a month of exchange outflow – altcoin worth paying attention to?

Data on the chain shows that chain links (links) have seen a month of outflow, which may prove that the price of substitutes is bullish.

ChainLink Exchange NetFlow has been negative lately

In a new post on X, market intelligence platform Intotheblock discusses Chainlink’s trend to swap NetFlow. “Exchange Netflow” refers to a chain-level indicator that tracks net links to wallets associated with centralized exchanges.

When the indicator has positive value, this means that investors store the net amount of assets into these platforms. One of the main reasons for transferring coins to exchanges as holders is that for sales-related purposes, this trend may have a bearish impact on the price of an asset.

On the other hand, the metric below the zero mark indicates that the flow of exchange outflow is greater than the flow of inflow. Often, investors move coins away from custody of these central entities when they want to maintain them for a long time, so this trend can have a bullish impact on cryptocurrencies.

Now, here is a chart shared by analytics companies that show trends on the chain link exchange NetFlow over the past month:

The value of the metric seems to have been negative recently | Source: IntoTheBlock on X

As shown in the above figure, the chain link exchange network has been inside the negative region for the past month, which means investors have been conducting a continuous net withdrawal.

During this period, the exchange registered a total of US$120 million in net outflows. Given this trend, investors may already be in the accumulation stage.

Link’s price has recovered a bit over the past few days, which could be the impact of this buying activity. Now, the switching network may be monitored in the next few days, as the next place may also have an impact on the coins.

Naturally, the continuation of outflow stripes will be a bullish signal for chain links, and witnessing a reversal of positive areas may mean a bearish end to recover.

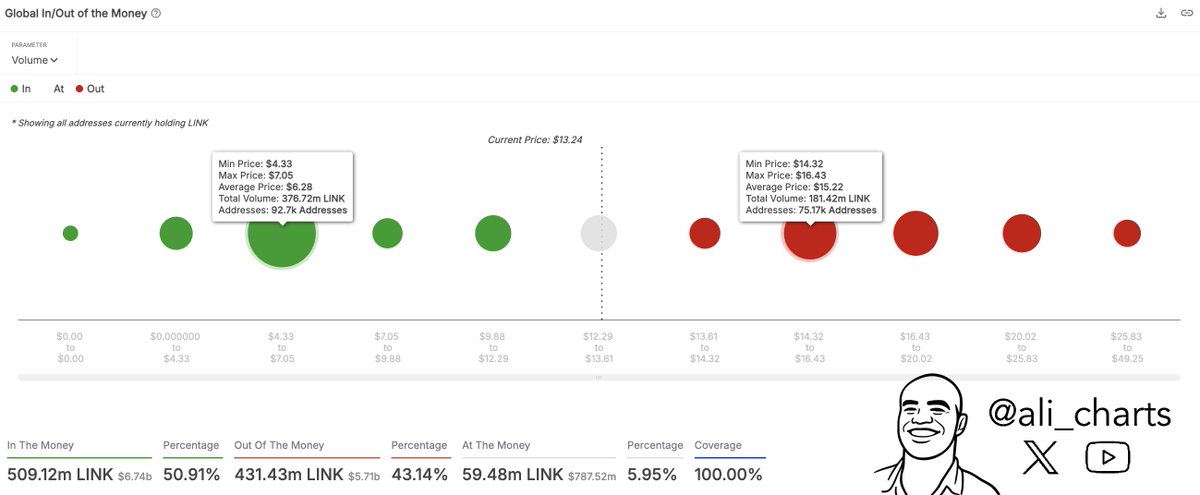

Speaking of price recovery, as analyst Ali Martinez explained in X’s post, on-chain data could hint that the next major resistance wall might be at the link.

The cost basis distribution of the LINK supply across the different price ranges | Source: @ali_charts on X

Judging from the above chart, Chainlink investors last purchased 181.42 million links in the range of $14.32 to $16.43. These investors, currently underwater, may provide impedance for prices if retests occur, as they may be eager to exit their breakeven.

Link price

At the time of writing, ChainLink’s trade was around $13.74, up more than 10% over the past seven days.

The trend in the LINK price during the last five days | Source: LINKUSDT on TradingView

Featured images from dall-e, intotheblock.com, charts from tradingview.com

Editing process For Bitcoin experts, focus on thorough research, accurate and impartial content. We adhere to strict procurement standards and each page is diligently evaluated by our top technical experts and experienced editorial team. This process ensures the integrity, relevance and value of our content to our readers.