Chris Kuiper of Fidelity introduced “Bitcoin Investment Cases” at the company meeting

Chris Kuiper, vice president of Fidelity Digital Assets Research, spoke in Strategic World 2025, challenging the company’s re-examination of its views on risk, capital allocation and long-term financial health. “Bitcoin has outperformed every major asset class over the past decade,” Cooper said. “If you’re a company sitting with cash or low-yield bonds, you’re behind.”

With more than a decade of data, Kuiper believes that Bitcoin is not only a speculative asset, but also an excellent strategic reserve. These numbers are front row and center: over the past decade, Bitcoin has provided a CAGR of 79% over the past five years, while 65% over the compound. By contrast, Kuiper shows that investment-grade bonds nominally return only 1.3% during the same period.

“Companies are usually focused on volatility. But volatility is not risk, and permanent capital losses are.” He sees inflation and currency depreciation as the surface threat to the balance faced today, indicating that even traditional havens like Treasury bonds have negative effects over time, real real returns.

To address concerns about Bitcoin volatility, Cooper offers two practical strategies: location size and long-term thinking. “Bitcoin doesn’t have to be all or nothing,” he said. “It’s not a switch, it’s a dial.” He believes that even a 1–5% allocation can significantly improve the risk-adjusted returns for the company while limiting trend exposure.

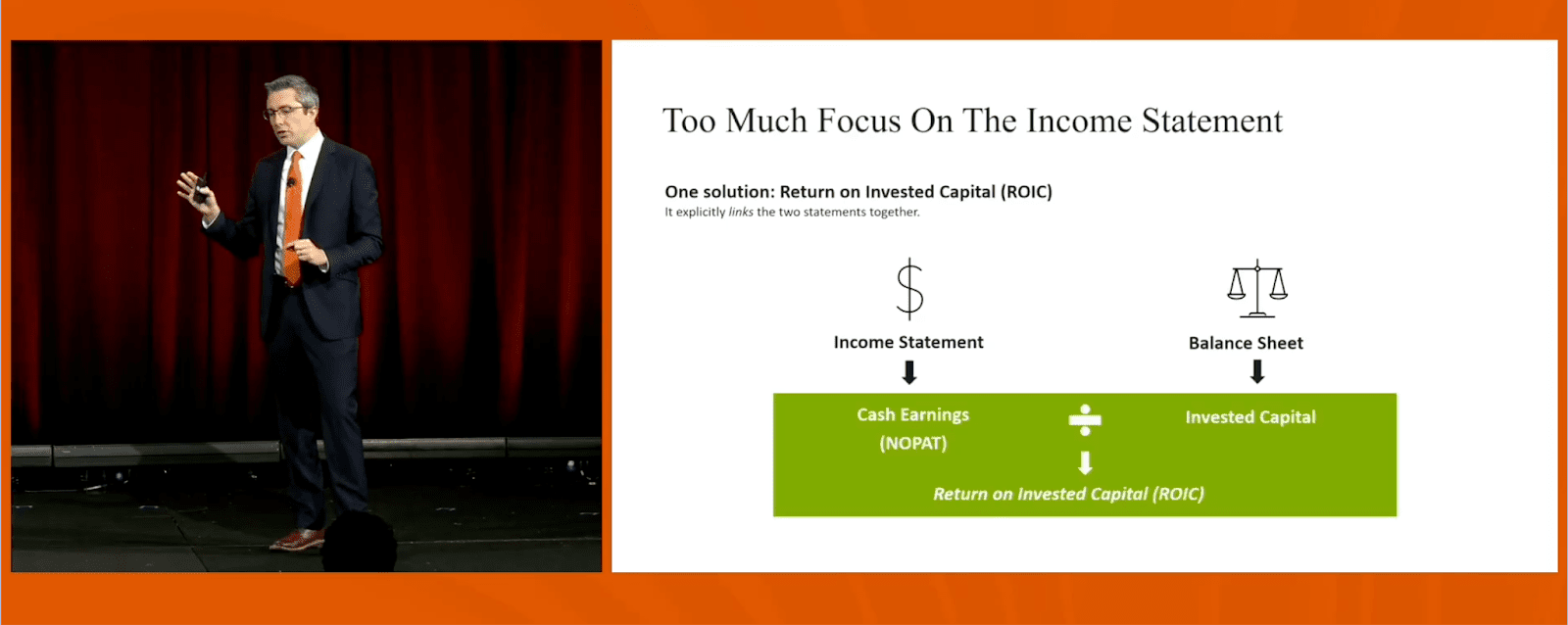

Speech then move to the fundamentals of the company. Kuiper stressed the importance of return on investment capital (ROIC) over headlines earnings, summoning inefficiency in sitting cash. For example, he noted that Microsoft’s ROIC fell from 49% to 29% when excessive cash was included, which is the height of abandoning idle capital creation.

“The company is focused on the profit and loss statement, but it’s the balance sheet that tells a true story,” Cooper said. “Cash is part of this story – Bitcoin can turn it from weight loss to an effective asset.”

He closed his immediate questions to executives: “What are your opportunities? Do you think these opportunities can outperform Bitcoin?”

In Kuiper’s opinion, the answer is becoming more and more obvious.