Coinbase becomes the major alliance of the S&P 500’s only cryptocurrency company

Major U.S. stock indexes are about to welcome the first cryptocurrency-focused exchange next week. Coinbase will officially join the S&P 500 before trading on May 19. The move comes for more than three years on the Nasdaq and cements the company’s position in the large-scale stake name.

Confirm the S&P 500 includes

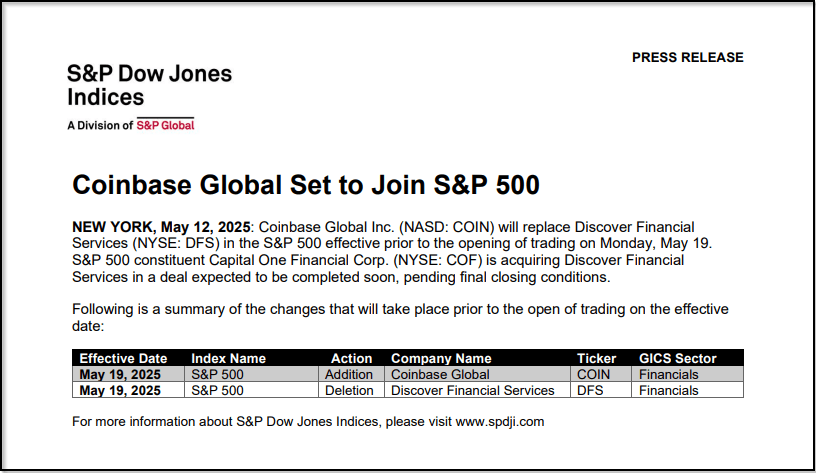

According to S&P Dow Jones’ index, Coinbase will replace Discover Financial Services in the benchmark before opening on Monday. This is after companies that comply with strict rules – positive revenue in the most recent quarter and the first four quarters. This is a feat of destiny for a business, and it is not a big feat.

Source: S&P Dow Jones Indices

Income and income trends

Based on reports, Coinbase posted revenue of $7.4 billion in 2021 but then swung to a loss of $1.1 billion in Q2 2022. In Q1 2025, revenue reached $2 billion, up 24% from the same period last year, although it fell about 10% from Q4 2024. Net income, however, plugged 94% to $66 m after the firm marked its crypto holdings to market.

Coinbase has just become the first and only cryptocurrency company to join the S&P 500.

This milestone represents the knowledge of true believers, from retail investors to institutional investors to our employees and partners.

Encryption stays here.

– Brian Armstrong (@brian_armstrong) May 12, 2025

Market reaction and stock performance

So far, investors have given companies a vote of confidence. Stocks jumped more than 10% in expansion trading on Monday as index funds tracked the S&P 500 gear to add Coinbase to their portfolio. The stock has climbed about 250% over the past two years, although it has fallen nearly 17% so far this year, while Bitcoin’s climb is close to 10%.

Strategic expansion and industry impact

According to the report, Coinbase plans to acquire Deribit for $2.9 billion in one of the largest deals in crypto history. Purchasing will make option trading a suite of products and increase revenue potential. Meanwhile, it adds to the integration risk and debt services that investors will pay close attention to.

The prospects of encryption and regulations

According to analysts, inclusive signals are increasingly accepting traditional finance’s acceptance of digital assets. Under the current government, regulators have taken a more relaxed stance on cryptocurrency companies. Competitors such as Gemini and Cracon have been following their public list. However, fluctuations in token prices may still swing Coinbase’s earnings, which in turn may affect its position in the S&P 500.

This milestone marks a turning point for Coinbase and the broader crypto sector. As index funds flow into stocks, the exchange will gain greater visibility among mainstream investors. However, the business faces a rope walk: balancing growth with large deals like deribit while managing risks associated with cryptocurrencies’ famous price fluctuations.

Featured image from startupnews.fyi, charts for TradingView

Editing process For Bitcoin experts, focus on thorough research, accurate and impartial content. We adhere to strict procurement standards and each page is diligently evaluated by our top technical experts and experienced editorial team. This process ensures the integrity, relevance and value of our content to our readers.