Data display

Data shows that Bitcoin derivatives trading volume is higher than BTC’s latest recovery rally, exceeding $100,000.

Bitcoin transaction volume declined by 1.0 marker

In a new post on X, CryptoQuant writer Axel Adler JR talks about the trend in Bitcoin transaction volume ratio. “Trading Volume Ratio” is an indicator that tracks the ratio between the number of assets traded on a spot exchange and the volume associated with derivatives.

When the value of this indicator is greater than 1, this means that the trading volume of the spot platform is higher than that of derivatives (derivatives). On the other hand, its threshold indicates the dominance of derivatives trading activity among investors.

Now, here is a chart shared by analysts showing the trends in Bitcoin volume ratios over the past few years:

As shown in the above figure, the recent Bitcoin transaction volume ratio is below 1 mark, indicating that the volume on the derivatives platform has exceeded the platform.

This has been maintained as the cryptocurrency goes through the latest recovery rally, which brings its price back to the $100,000 level. Judging from the charts, the trends were different in last month’s rally.

Previous running phases were accompanied by spikes in trading volume ratios above Level 1, suggesting that spot trading may be the main fuel behind it.

Historically, sustainable price gatherings have usually been like this. High speculation in the derivatives market is often unstable.

Given that the derivatives market has dominated this rally so far, it may continue to be difficult. However, it is only to be seen how Bitcoin’s development will develop.

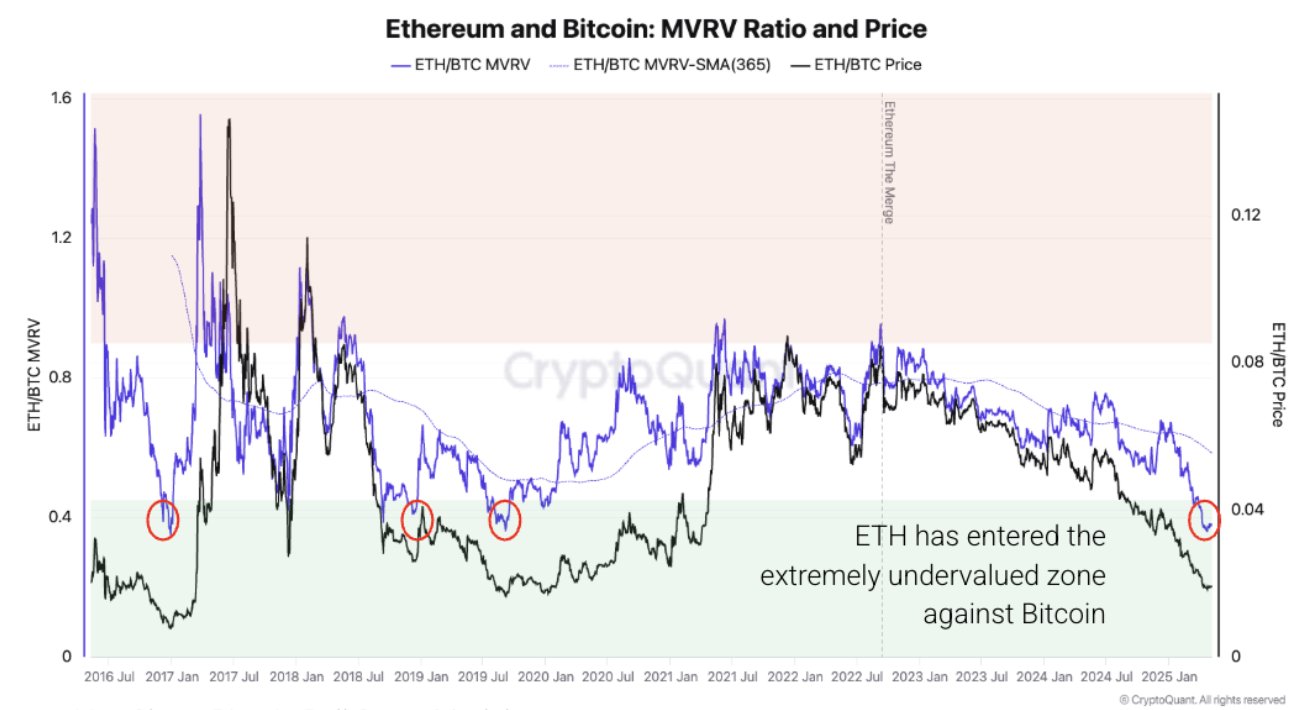

In some other news, Ethereum is undervalued compared to Bitcoin, as link analytics firm CryptoQuant revealed in X’s post.

The metrics shared by the analytics companies are the ratio between the Ethereum and Bitcoin market value and the realized value (MVRV) ratio. The MVRV ratio is a popular on-chain metric that basically tracks the profit loss status of the entire investor.

As can be seen in the figure, the MVRV ratio of ETH is very low compared to the MVRV ratio of BTC. “Historically, this has led to better performance in Ethereum,” crypto literacy notes. “But supply pressure, weak demand and flat activity could fall into a rebound.”

BTC price

Bitcoin manages to surpass the $101,000 level after a nearly 3% surge in the past 24 hours.