Dogecoin bounce, analysts call Bitcoin bottom

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

Morbi Pretium Leo et nisl aliquam Mollis. quisque arcu lorem, super quisque nec, ullamcorper eu odio.

esteartículo También Estádandousible enespañol.

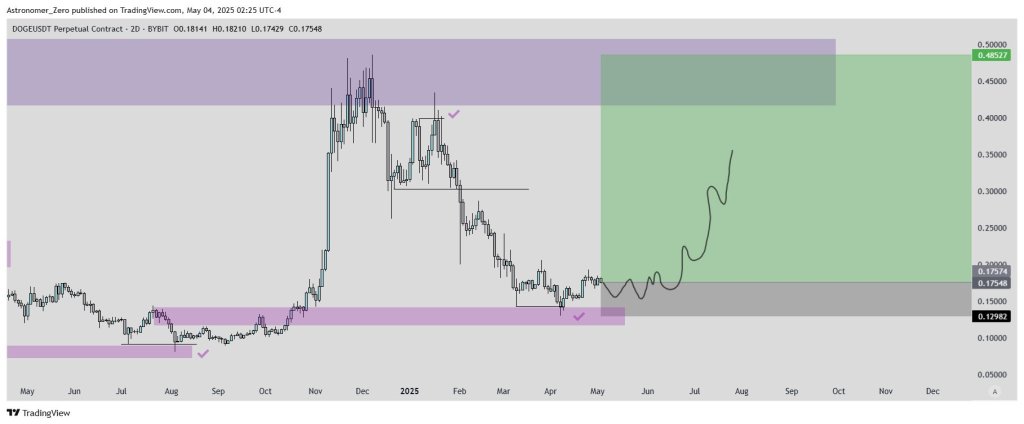

Dogecoin’s two-day candlestick chart has returned to the same accumulation shelf before the outbreak of five times last fall, with an independent market technician astronomer (@astronomer_zero) deeming the model “looks at reach and I’m long.” The strategist marked Bitcoin’s April low as “After on X” before the $69,000 outbreak, and Doge now returns the “6r+ deal” to the December supply wall.

Dogecoin bottom is

The updated chart shows that the price prints continuous wicks for the Lavender Demand Band start at $0.12 and up to $0.15,000. Every test of the floor has been absorbed so far, making a series of higher two-day closings. “Well, the Governor is only slightly lower, so if you want to go high, there is still a 6r+ deal.”

The black level of $0.18210 marks the first decisive recycling. Sunday’s meeting opened at $0.18141, rushing to $0.18210, priced at $0.17548, under the trigger, but it’s clear that the gray value area of the analyst’s risk box is defined. For traders who run and stay, the invalid distance is less than $0.12982, limiting the decline to about twelve cents while keeping the entire upside space on the liquidity of $0.40000-0.48527, shaded by Emerald Green. “If you want a determined reward risk, it makes sense for a long time, too,” the astronomer added.

Related Readings

Technically, the structure mimicked October 2024, when Doge carved a circular base for $0.10, ignited on rising numbers and rose eight weeks later at $0.48,527. Analysts remind readers: “The last time we left the range mentality was ‘October 24, we bought Mano on 10 C.” “It pulled out 5 times and then regained the current lows of IMO.”

The projection prediction outlined on the chart, the one-to-two-month sides inside the Gray Band were chopped to about $0.175, then the stairs advanced to as low as $0.30, and the December pivot was tested in the fall.

Related Readings

No hand-painted arrow pierces the ancient high school, emphasizing that the paper is not based on price discovery but is based solely on the mean reversal of the last weight supply node. “Given this is an altcoin, expectation may be over $0.5, so there are already very few risk fees,” he wrote. “They may still take time slower than BTC, but RR IMO will be higher.”

As always, confirmation will be performed or failed on tape. A two-day closure over $0.20000 will establish a higher time reversal and expose liquidity of $0.30, while a settlement under $0.12982 will invalidate the settings and reopen the 10-cent handle. Before this, astronomers’ call was based on the bottom of Bitcoin, first of all, Ethereum followed the premise, “one by one by one, through periodic timing, emotions and their respective pois lowered downward.” He believes that Dogecoin just ticks each box.

At press time, Doge’s trading price was $0.173.

Featured Images created with dall.e, Charts for TradingView.com