Dogecoin supply margin hits 77.9%, but XRP, BTC is far ahead

Data on the chain shows that 77.9% of all Dogecoin supply is currently profitable. Here’s how it stacks with Bitcoin and XRP.

Dogecoin compared with the remaining total supply profit

In a new post on X, the chain analysis company Santiment shares some of the top coins in the cryptocurrency industry, such as Bitcoin and Dogecoin, currently compared with the percentage of total supply of profit metrics.

As the name implies, “percentage of total profit supply” tells us that the percentage of total supply of digital assets is held in unrealized earnings.

This indicator looks at the last price increase by browsing the chain history of each token on the web. If the previous transaction price is less than the current spot value of any coin, it is assumed that the particular coin is now held in profit.

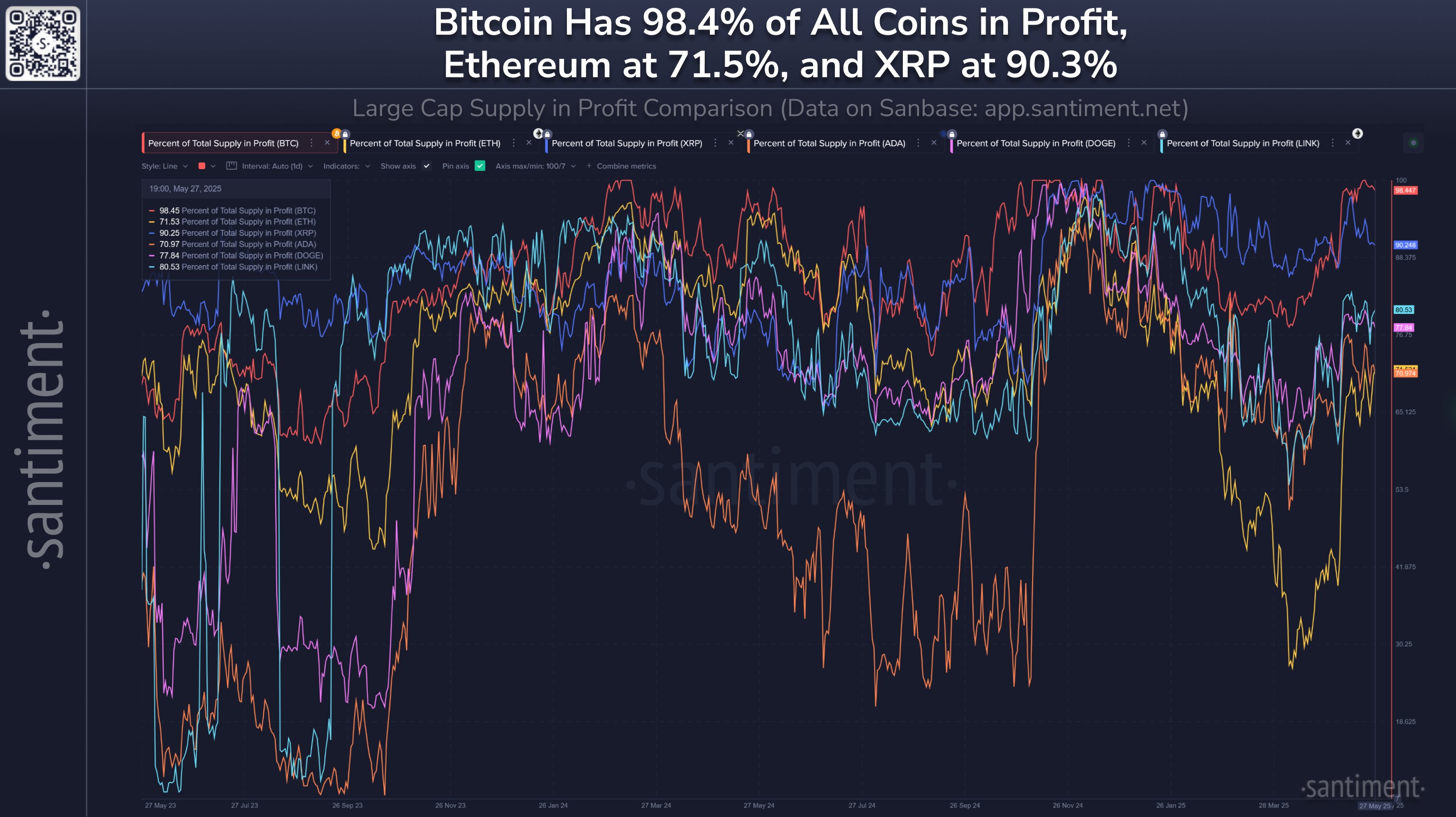

The percentage of total profit supply calculates all tokens that meet this condition and determines which portion of the total supply they make up for. Now, here is a chart showing how the number currently looks for six top coins: Bitcoin (BTC), Dogecoin (Doge), Ethereum (ETH), XRP (XRP), Cardano (ADA), and ChaineLink (link).

Looks like the metric's value has generally gone up across the sector recently | Source: Santiment on X

As shown in the above chart, all of these cryptocurrencies except XRP have witnessed a significant increase in the percentage of total profit supply over the past month.

As far as metrics are concerned, the king of the industry is Bitcoin, with 98.4% of its supply being green. BTC has been in an all-time high (ATH) exploration mode lately, so this extreme level is not surprising considering that 100% supply sets a new ATH in a flash.

Although XRP has not seen much growth in XRP lately, its balance of profit loss remains the second best among these assets, with more than 90% of the supply taking up some gains.

Chainlink and Dogecoin ranked third and fourth, with a percentage of total profit supply of 80.5% and 77.9% respectively. Ethereum, The second largest coin that tied the market caps performed relatively poorly on the indicators, with a value of 71.5% It is worth noting behind others. That said, from a growth potential perspective, ETH’s profitability may not be as bad as it seems.

Generally, profit investors are more likely to participate in sales, so the motivation for large-scale sell-offs to achieve profits may become possible whenever a significant part of the network is in green. This can naturally promote the formation of the top.

Naturally, this does not mean that Bitcoin has extremely high profitability and will definitely reach its peak in the near future. As long as the demand side is strong enough to absorb any profit, its gathering can continue. However, theoretically, the coins on the lower end, such as Ethereum, Cardano and Dog, can have more space to run if the conditions are aligned.

Door price

Dogecoin has been trapped in lateral movement recently because its price is still around $0.22.

The price of the coin appears to have been consolidating during the past few days | Source: DOGEUSDT on TradingView

Featured images from dall-e, santiment.net, charts from tradingview.com

Editing process For Bitcoin experts, focus on thorough research, accurate and impartial content. We adhere to strict procurement standards and each page is diligently evaluated by our top technical experts and experienced editorial team. This process ensures the integrity, relevance and value of our content to our readers.