Enhance all content indicators of Bitcoin to increase profits

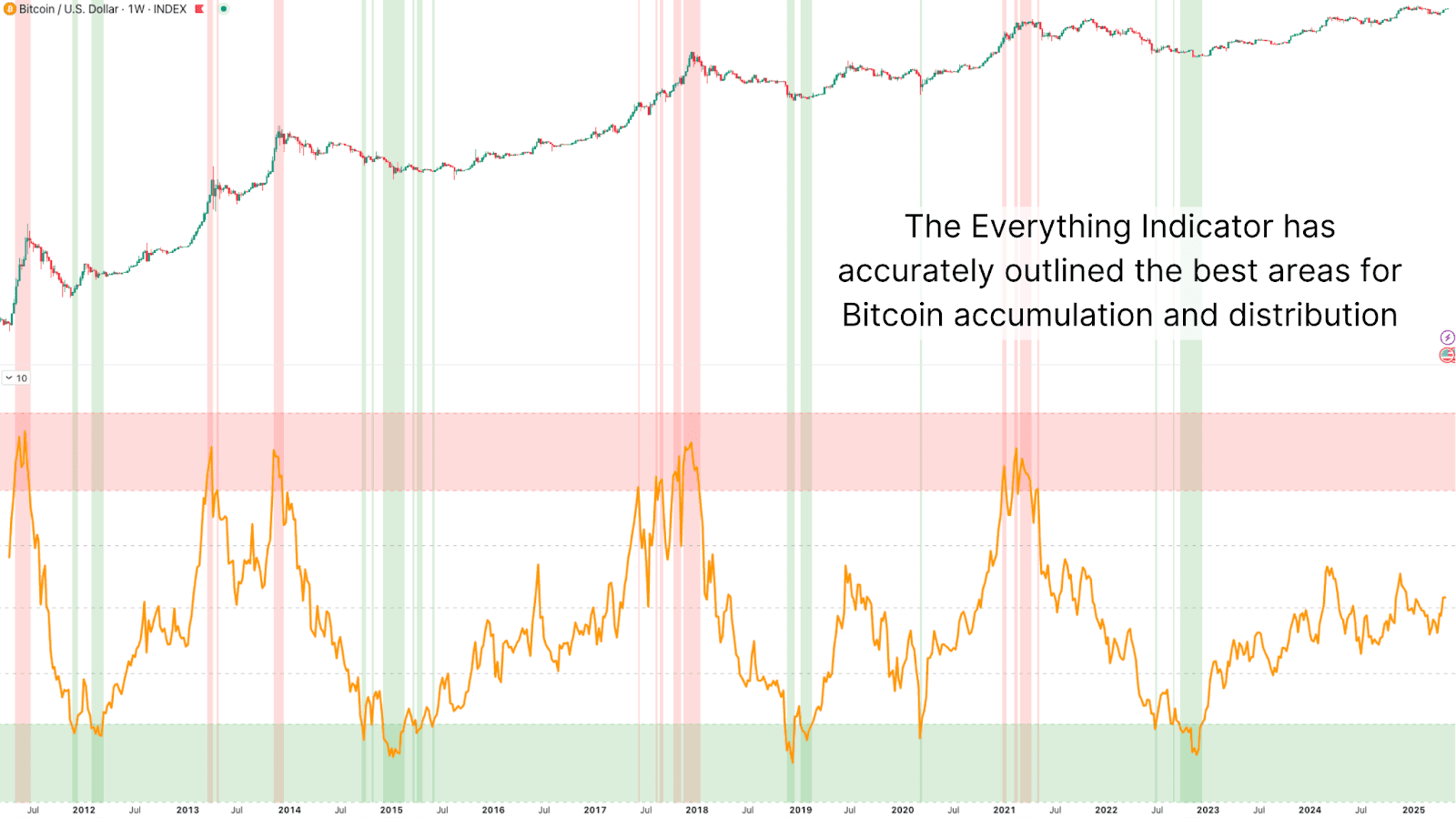

All Bitcoin metrics are designed to provide a comprehensive view of all major forces that affect BTC price actions, chains, macros, technologies and fundamentals. Since its creation, it has been very accurate at the top and bottom of the marking loop. But today, we have taken a step forward.

In this article, we will explore how to upgrade this already powerful tool with simple modifications to provide more frequent, actionable insights without compromising its core integrity. If you are looking for a high signaling way to get closer to the Bitcoin market more aggressively, then this may be the indicator you’ve been waiting for.

What are all the indicators of Bitcoin?

Bitcoin was originally built as a composite tool, and all content metrics were constructed from several unrelated signals:

These data points are collectively weighted rather than overfitting, creating a total score that tracks BTC market dynamics. Importantly, it does not rely on any single model or metric. Instead, it captures the convergence of multiple domains that together shape Bitcoin price movement. The backtesting showed that the indicator always highlighted the macro turning points of all major Bitcoin cycles, including the top of the cycle and the bottom of the surrender.

Rare but strong signals

Although accurate, all the original indicators are essentially long-term. The signal will only appear every few years, marking the main turning point in every bull and bear market. This is invaluable for investors looking to buy generation lows or scale macroscopically.

But for those who aim to manage risks with more active, strategic DCA, spin capital, and even in medium-term exports, it provides little day-to-day guidance. Solution? Increase signal resolution without sacrificing the macro integrity of the model.

Add a moving average

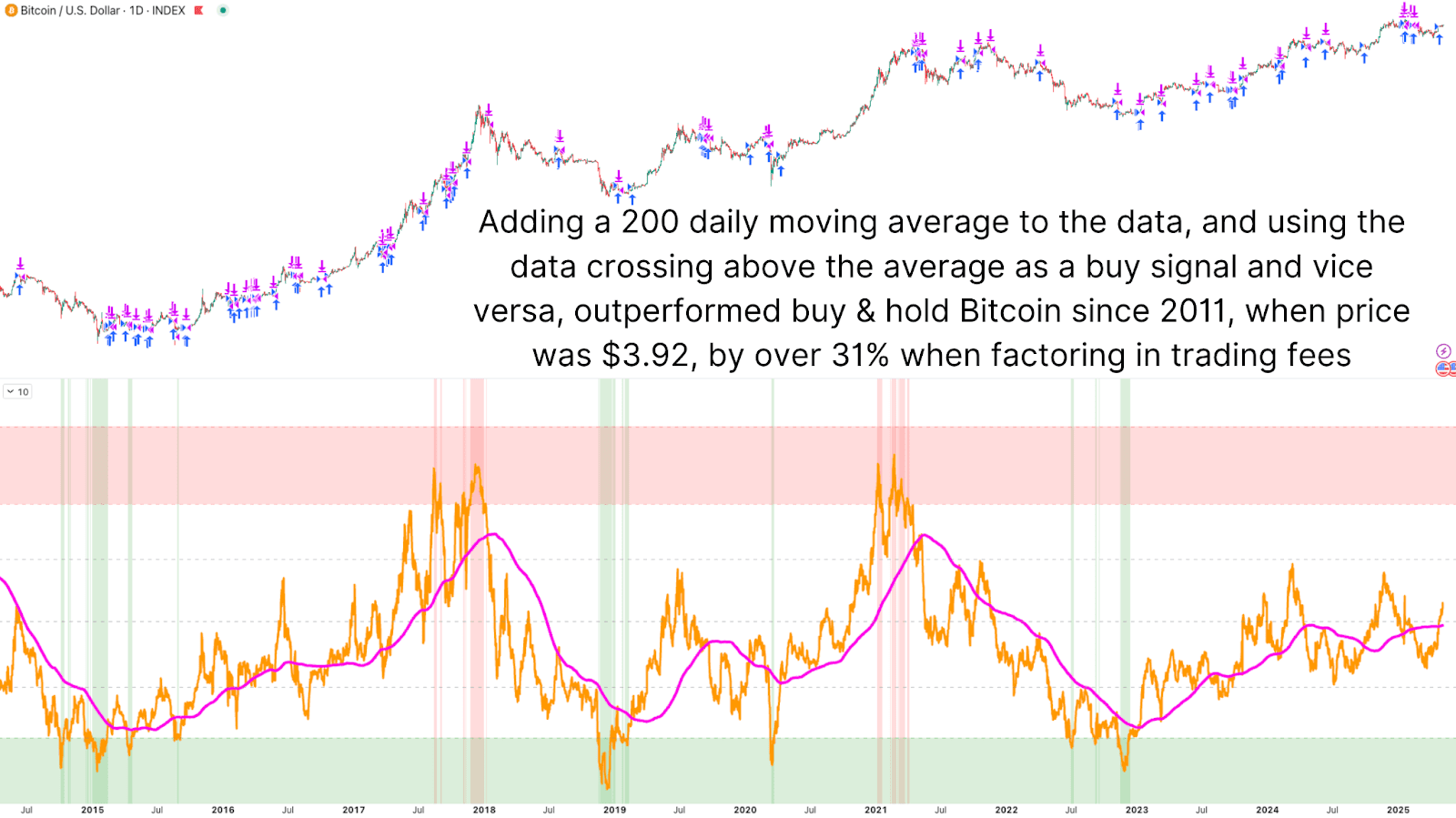

Improvements are very simple: apply the moving average to all metric scores and look for crossovers. Just like we do with our price-based strategies, we can think of indicators as signal lines and look for directional changes.

By default, a simple moving average of 200 cycles is applied. When all metrics exceed this MA, it indicates that most components, mobility, network health, emotion and technicians are trending together. These crossover signal signals are the start of bullish trends, providing early entries rather than just waiting for cycle lows. Instead, crossings below the moving average can be used as a relief or distribution signal, especially when previously or near previously identified overheating areas.

Even with conservative trading assumptions (fees increase and slip-over), the strategy’s performance is surprising. Bitcoin’s early backtests, when BTC trading was less than $4, showed that the crossover strategy had a return of more than 3.1 million, but its performance exceeded the effect of simple buying and holding.

Signal frequency increases

To accommodate more active investors, for example, we can further shorten the moving average to lower it to 20 periods. This provides hundreds of in and out signals while retaining the original logic of the indicator.

Even with short-term signals, the return remains strong, and the performance relative to holding BTC remains unchanged. This shows the flexibility of the tool. Now it can serve long-term investors seeking macro confirmation and active traders looking for more dynamic responses to market changes.

Reducing moving average cycles has key benefits, including earlier signals at market lows, more frequent accumulation guidance, regular exit prompts in overheating conditions, and increased opportunities to avoid prolonged declines.

in conclusion

All Bitcoin’s metrics now offer the best of both worlds: high convergence, a full range of market health views, and the flexibility to provide frequent actionable signals through simple moving average coverage through simple moving average coverage. Even using realistic trading friction, fees and slippage, the strategy outperforms BTC on multiple timetables, including from 2011 to 2011.

So if you already use the metrics suite of Bitcoin Magazine Pro, now may be the time to take a step further. Add an overlay. Adjust the moving average. in frequency band and filter layer. The more you adapt these tools to your own strategies, the more powerful and intuitive they will become!

For more in-depth research, technical metrics, real-time market alerts, and access to the growing community of analysts, visit Bitcoinmagazinepro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Be sure to do your own research before making any investment decisions.