Ethereum is “crazy underestimated” because accumulated addresses are constantly stacking

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

Morbi Pretium Leo et nisl aliquam Mollis. quisque arcu lorem, super quisque nec, ullamcorper eu odio.

esteartículo También Estádandousible enespañol.

According to a recent X post by crypto trader Coinvo, Ethereum (ETH) is “undervalued” at its current price. Despite underperforming prices in the past few years, the metrics on several chains seem to support Coinvo’s assessment as the addresses accumulated by ETH continue to stack digital assets.

Ethereum may be held soon

Although ETH has grown 8% in the past two weeks, it has dropped 43% over the past year, trading around $1,700 at the time of writing. Ethereum fell 63.6% from its all-time high school (ATH), in stark contrast to Bitcoin (BTC), which traded only 13.7% more than its ATH.

Related Readings

Compared with other major cryptocurrencies, Ethereum has relatively poor performance, raising questions about its long-term prospects. While Bitcoin benefits from its first step advantages and wider institutional adoption, Ethereum faces competition from rival smart contract platforms such as Solana (Sol), Sui), Sui and Polkadot (DOT).

Despite widespread negative sentiment, some analysts believe ETH may be on the verge of turnaround. For example, Coinvo claims that Ethereum is greatly undervalued and can be held at large scale.

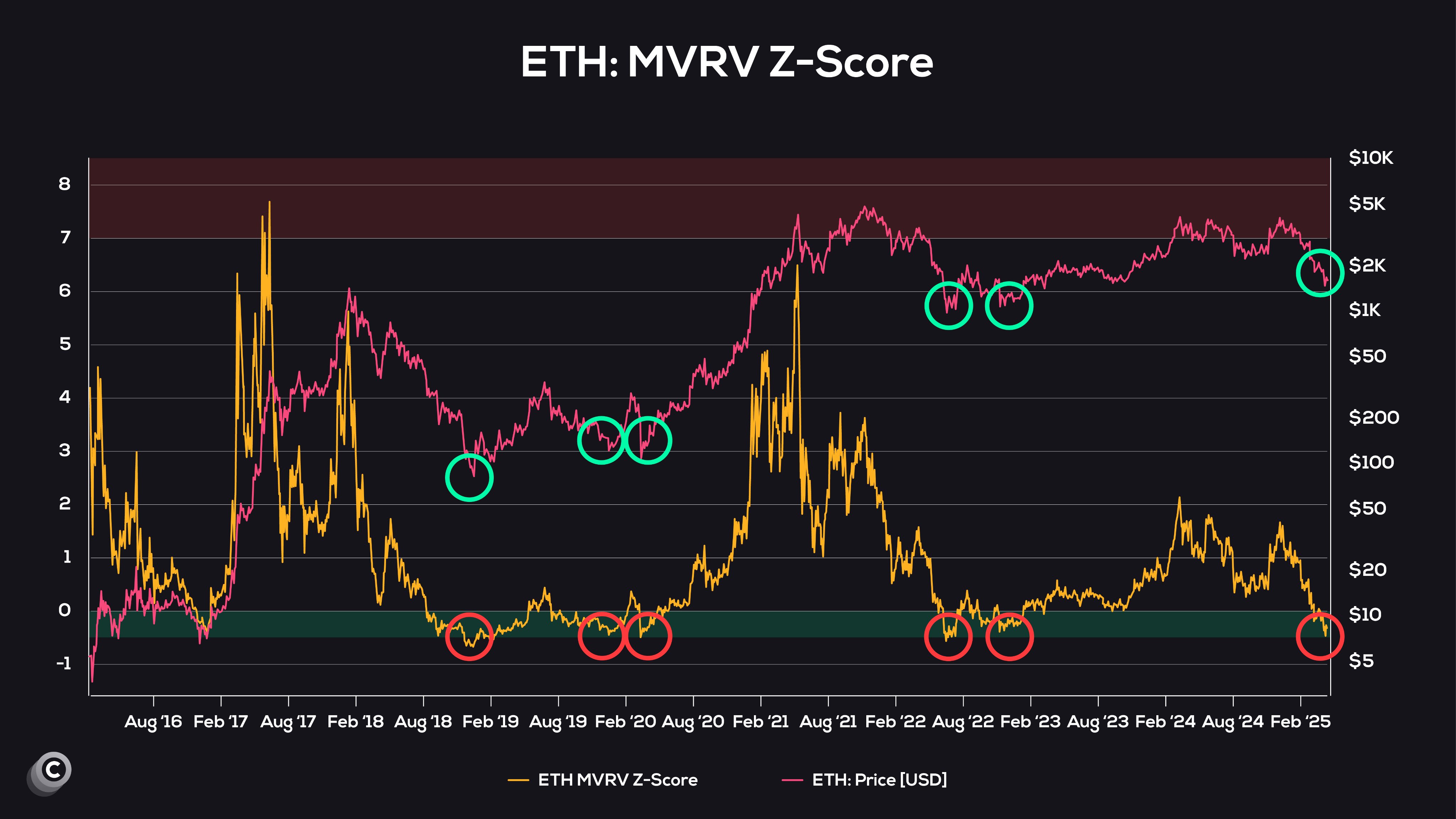

Traders shared the following chart that utilizes the market value of the Realization Value (MVRV) Z score – an indicator used to identify the top and bottom of the potential market. According to the chart, Ethereum’s MVRV Z score has now entered the green area (between 0 and -1) Market bottom possible Trend reversal.

Meanwhile, inflows into Ethereum accumulated addresses have soared to an all-time high. In the X post, analyst Cryptogoos shared a chart in 2025 showing records of ETH flowing into these addresses.

The massive inflow to accumulated addresses suggests that long-term investors are actively buying and holding ETH even during market downturns. This behavior often reflects growing confidence in the future value of Ethereum and suggests potential bullish sentiment beneath the surface.

In another article, Cryptogoos also stressed that Ethereum’s exchange reserves are at multi-year lows. Reduced reserves in exchanges indicate reduced sales pressures and tighter supply, which can enhance the scarcity narrative of ETH and drive price increases in the near term.

ETH holders are not “bullish” enough

The analyst cryptocurrency rovers pointed out have achieved similarities between ETH’s current price action and BTC’s 2021 trajectory. According to analysts, if Ethereum reflects Bitcoin’s past performance, it may be hoped to reach a new ATH in the coming months.

Related Readings

That is, the attention still exists Further decline If global macroeconomic conditions worsen in the looming reciprocity tariffs of U.S. President Donald Trump, it comes at the cost of ETH. At press time, ETH was trading at $1,754, down 2.1% in the past 24 hours.

Featured Images Created with Unsplash, Charts for X and TradingView.com