Good news and bad news

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

Morbi Pretium Leo et nisl aliquam Mollis. quisque arcu lorem, super quisque nec, ullamcorper eu odio.

esteartículo También Estádandousible enespañol.

Although there have been 24 hours Characterized by heavy abandonmentBitcoin still holds more than $100,000 levels, and as of this writing, Bitcoin has traded around $103,700. It is worth noting that the sign of fatigue seems to be Bitcoin has also begun to appearespecially in the past 48 hours.

While long-term indicators indicate a bullish continuation of Bitcoin’s price, short-term models indicate a collapse of bullish forces, especially as cryptocurrencies approach the critical $100,000 support zone.

Related Readings

The sentiment is conveyed by popular crypto analyst Willy Woo Bad news Based on Bitcoin’s current technology.

Good news: bullish long-term signals remain intact

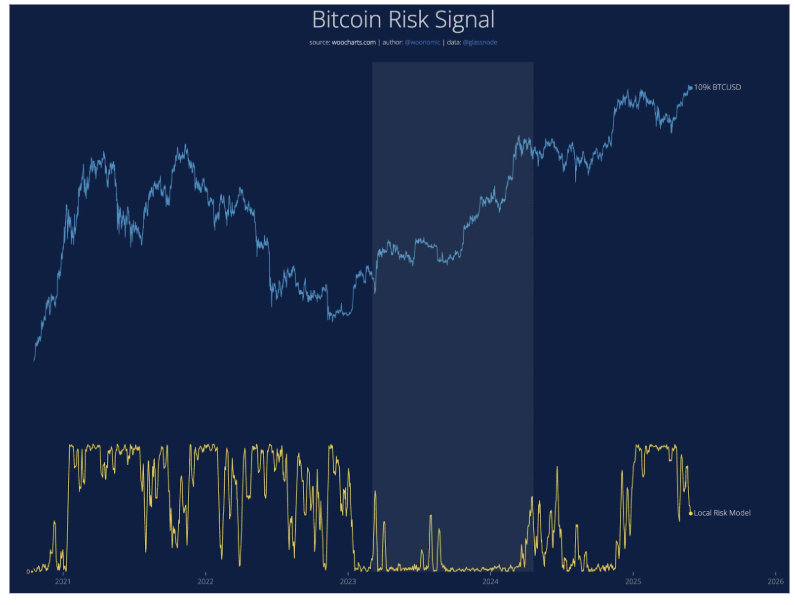

according to Woo is one of the strongest long-term signals, Bitcoin risk signals, and is currently trending downward. The decline suggests that buyer liquidity currently dominates the long-term environment, laying the foundation for another strong leg to move upward.

The lower the risk reading, the safer the risk of holding or accumulating Bitcoin, and the current decline in this signal shows a environment where long-term investors are at a lower risk.

Woo points out that this long-term setup is intact and that Bitcoin trading is much higher than the psychological six-digit marker, this momentum is still there Long-term favor for bulls.

When writing, as shown in the figure below, the local risk model is currently in a medium distance, falling from its peak level in early 2025 and is expected to continue the downward trend. Willy Woo noted in another analysis that the next big move could push it up $114,000 and trigger liquidation of short positions.

Bad news about Bitcoin price

Although long-term situations are still favorable, short-term models, including speculation and SOPR (output margin of expenditure) Indicators, be cautious. Using this metric, Woo points out The strength of the rally started to weaken from $75,000 to $112,000, especially in the capital inflows over the past three days.

Keep this in mind, Bitcoin’s price action this week is crucial. “If we don’t comply, then we will work during another merger.” Analysts said. If spot purchases are in the first week of June, especially after a long weekend when the U.S. market reopens, there will be a bearish opportunity.

The good and bad news can be summarized as follows: If the buying pressure is quickly opened, Bitcoin could be over $114,000 and heading towards the next major liquidity zone towards $118,000 to $120,000. Not pushing higher push possible Confirm bearish divergence And lay the foundation for another round of mergers.

Related Readings

At the time of writing, Bitcoin has fallen 1.5% and 3.9% at 103,700 in the past 24 hours and 7 days respectively.

Featured images from Unsplash, charts for TradingView