Bitcoin must recoup the crucial $106,000 resistance to avoid further collapse

Bitcoin has been making a huge market cool in the past week since reaching a full-day full-high period of over $111,000. Bitcoin has dropped 4.36% over the past seven days, forcing the price to be below $104,000, according to CoinMarketCap.

To build bullish momentum, a well-known crypto analyst with X username Daan Crypto said that the Prime Minister’s cryptocurrency must decisively exceed $106,000, representing a key price area in the current price structure.

Bitcoin price exceeds the scope of integration – is it leading?

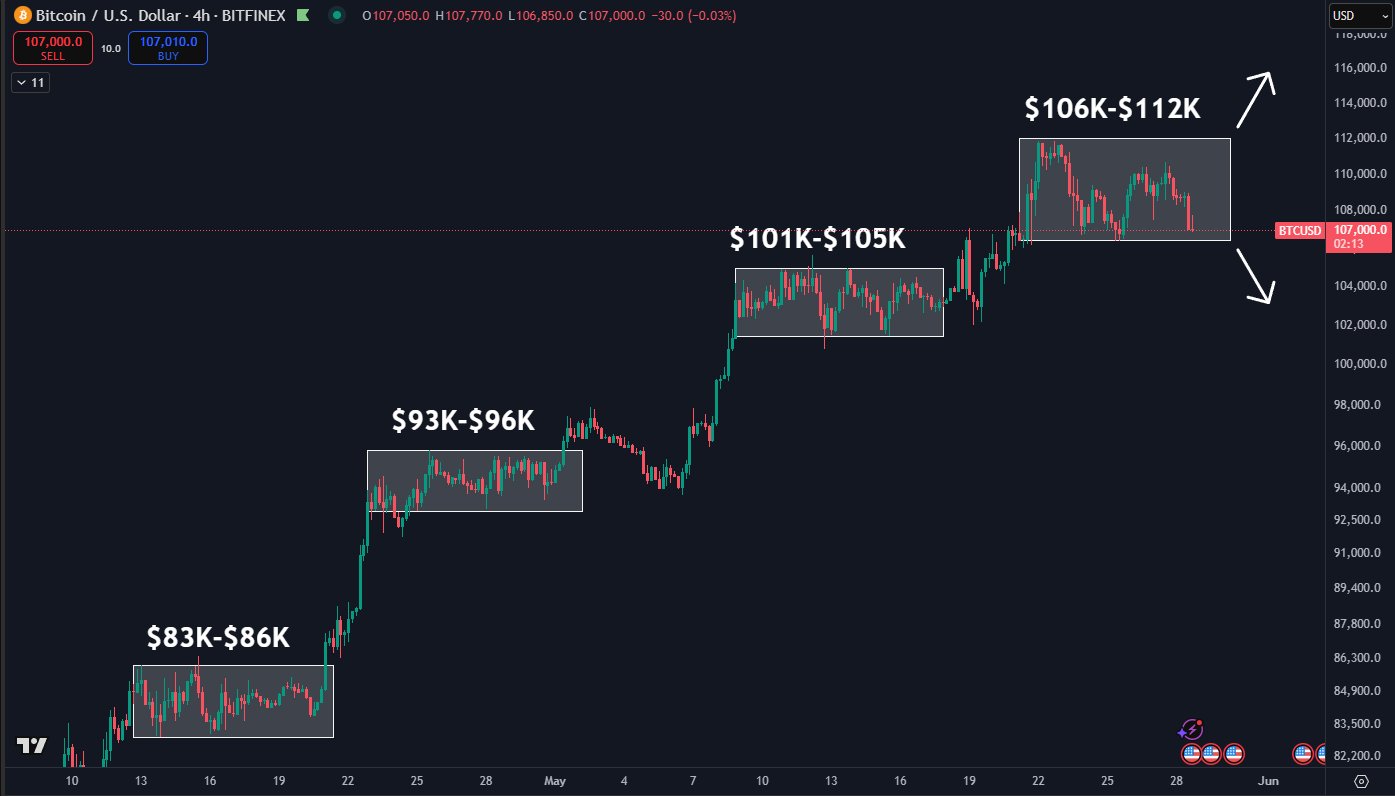

After the crypto bull market restarted in April, Bitcoin showed a specific price pattern with its iconic $10,000 price increase, then about 7-10 days within the merger range within a specific price range, followed by a rally.

After being the latest rise to $111,970 as the new ATH, the price of BTC appears to have settled in the action in the range, between $106,000-$112,000, preparing for another potential rise. However, there has been a recent negative reaction to factors including macroeconomic pressure, as reports suggest that U.S.-China trade negotiations have hit the wall, bringing prices below the merger zone as low as $103,867.

According to Daan Crypto in his May 30 X post, the Bitcoin Bull must recover more than the $106,000 price range to stop the current decline and determine the intention to maintain the current uptrend.

It is worth noting that a potential rejection at this price level will indicate that Bitcoin may have reached its highest level of $111,970 and will undergo further price corrections in the coming weeks. The potential for this bearish development is significantly high, especially given other factors, including negative inflows of Bitcoin field ETFs on May 29, the first in more than ten trading days.

Some market analysts believe that the potential of overwhelmed bearish pressures targets price targets around $100,000 to $102,000, while others believe that the Prime Minister’s cryptocurrency could lead to a significant price crash that aligns with the crypto market cycle.

Bitcoin Price Overview

At the time of writing, Bitcoin was trading at $103,539, reflecting 2.60% of the past day. Meanwhile, the daily trading volume of assets fell by 2.24%, indicating that the current decline in market sales pressure has dropped slightly.

More than 1.27 million people are currently declining due to Bitcoin’s retracement, according to blockchain analytics firm Sentora. However, there is strong evidence to support the market rebound if the price retests the $100,000 region.

Featured images from Pexels, charts for TradingView

Editing process For Bitcoin experts, focus on thorough research, accurate and impartial content. We adhere to strict procurement standards and each page is diligently evaluated by our top technical experts and experienced editorial team. This process ensures the integrity, relevance and value of our content to our readers.